The ongoing discussion surrounding the State and Local Tax (SALT) deduction cap is emblematic of a broader struggle in American tax policy—one that intertwines regionalism with fiscal responsibility. The recent House proposal to increase the SALT deduction cap from $10,000 to $40,000 might seem like a political concession aimed at healing rifts within the GOP, particularly for representatives hailing from high-tax states. However, this proposal ultimately raises more questions than it answers and could perilously destabilize an already complicated tax regime.

A Misguided Bargain

At the heart of the issue lies an apparent disconnect between what the proposal intends to achieve and the practical implications of its enactment. The House bill is framed as a means to provide relief to taxpayers grappling with exorbitant local taxes, but the lack of interest from Senate Republicans, notably those from states like South Dakota and Idaho, underscores a vital point: not all tax policies should be evaluated through the lens of regional preferences. The notion that raising the SALT cap serves as a bargaining chip for bipartisan support is misleading. Rather than uniting lawmakers, it may widen the chasm between state interests and a cohesive national policy.

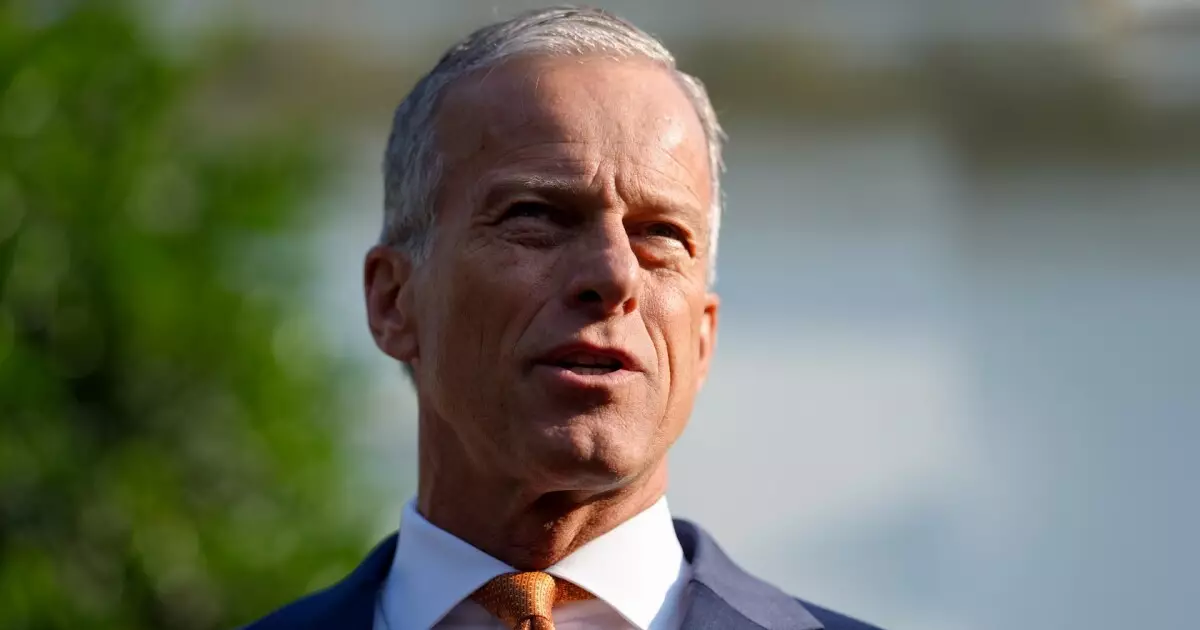

Senate Majority Leader John Thune’s dismissal of the SALT issue demonstrates that many lawmakers see it as a distortion of fiscal priorities—diverting attention away from more pressing economic accountability measures. Forcing a bill through that inflates tax deductions while simultaneously stoking federal deficits strikes me as irresponsible. It suggests a disinterest in sustainable governance and a failure to recognize the long-term economic ramifications of such a move.

Miscalculated Costs and Consequences

The financial implications cannot be overstated. Tax Foundation Director of Policy Analysis Garrett Watson highlighted the troubling reality of the proposed SALT deduction raising the national budget deficit by a staggering $2.6 trillion over ten years. Such figures should ring alarm bells for every fiscally-conscientious American. The idea that we can perpetually grind up our deficit while showering wealthier residents with tax cuts is not only shortsighted but sets a troubling precedent for future governance.

The expectation that taxpayers’ burdens can be eased in this manner without accountability appears naive at best. The proposal could overextend financial alleviation at the expense of responsible budgeting, limiting the government’s ability to invest in critical infrastructure and social programs. The misalignment of incentives can further fragment an already challenged budgetary process, derailing plans for balanced spending and fiscal integrity.

Unintended Wrinkles in Tax Policy

As the SALT cap controversy plays out, it also brings to light the complexities of alternative strategies, such as pass-through entities (PTEs), which are often utilized as workarounds to offset the original SALT cap. Excessive reliance on these mechanisms could ultimately lead to the dilution of sound tax policy. Experts anticipate that if the House’s updated SALT proposal were to pass the Senate, PTEs might begin to lose their relevance, leading to unforeseen shifts in how local tax policies are structured.

In essence, an appeal to lift the SALT cap as a remedy only complicates the larger discussion. Instead of crafting coherent tax policy, legislators appear trapped in a cycle of patchwork fixes. This slippery slope risks sacrificing the principles of a transparent and equitable tax system for transient political gain.

The Case for Smart Tax Solutions

What the SALT debate underscores is the vital need for fundamental reforms that prioritise fiscal prudence and equitable distribution of resources. Rather than merely throwing more money at a problem that may appear localized, we should be considering comprehensive tax reforms that offer sustainable solutions benefiting all Americans, regardless of their state’s tax landscape.

By re-evaluating our approach to state and local taxation, lawmakers can create policies that honor both local autonomy and national interests—a balance that seems increasingly elusive in the current climate. Tax policy should aim to simplify the system while ensuring a fair contribution from all taxpayers, allowing for a trajectory toward fiscal stability rather than reactive, politically expedient measures. In the end, we should be cautious of any proposal that dances around the grim realities of accountability and responsibility, potentially leaving taxpayers to bear the brunt of reckless financial maneuvering.