The municipal bond market has recently showcased a remarkable resilience, indicating a characteristic strength amidst increasing economic uncertainties. As we end the first half of 2023, we find a variety of contributing factors playing into the current condition of this market sector. The yields of U.S. Treasuries, which serve as a benchmark for many asset classes, have seen significant fluctuations. This situation has served as fertile ground for municipalities, allowing them to nurture gains that might just yield a fruitful result in the long run.

The current environment suggests that the municipal bond market is experiencing a relative revitalization. While still grappling with year-to-date losses, municipal bonds appear to be stepping back from the brink of significant underperformance that plagued the early months of 2023. JB Golden, an executive director and portfolio manager at Advisors Asset Management, notes that gains of 0.45% in municipal bonds contrast with the 0.89% rise in U.S. Treasuries—showing that investors’ preferences may indeed be shifting. This shift could signal a renewed interest in municipal securities, spurred by their increasing attractiveness as an investment choice.

Yield Ratios: A Positive Sign for Munis

Examining the market ratios, we observe that municipalities are faring reasonably well against Treasuries across various maturities. With ratios hovering around 70% for two-year and five-year bonds and achieving a notable 94% for the 30-year, it’s evident that investor interest remains strong. This relative strength against Treasuries could highlight a growing confidence in municipal bonds, suggesting that financial variables supporting this asset class could lead to favorable pricing dynamics going forward.

Moreover, the improvement in the broader landscape comes amidst prevailing uncertainties, particularly those related to interest rate hikes from the Federal Reserve. The volatility on the long end of the yield curve has also contributed significantly to municipal performance, hinting that volatility can sometimes create unexpected opportunities. The market seems to be leveraging this unpredictability as a tailwind rather than a headwind.

Political Influence: The Strains on State Funding

Politics continue to play a pivotal role in shaping the trajectory of the municipal bond market. The discussions surrounding the federal government’s decreasing support for state and local initiatives mean that municipalities increasingly find themselves reliant on bond issuance to fund critical projects. The 16% increase in new issuance year-over-year is a compelling statistic, indicating that municipalities are not just reacting but actively engaging in financial strategizing.

However, while some view increased issuance as a potential crisis, it could instead be interpreted as a pragmatic response to a changing landscape. The historical context of high issuance sending alarms during stable economic phases seems to be falling on deaf ears as the municipality’s appetite for new debt remains unabated. As Golden points out, many factors are intersecting here—political clarity, economic stability, and investor sentiment—that suggest the market is finding its footing.

The Role of Reinvestment Demand

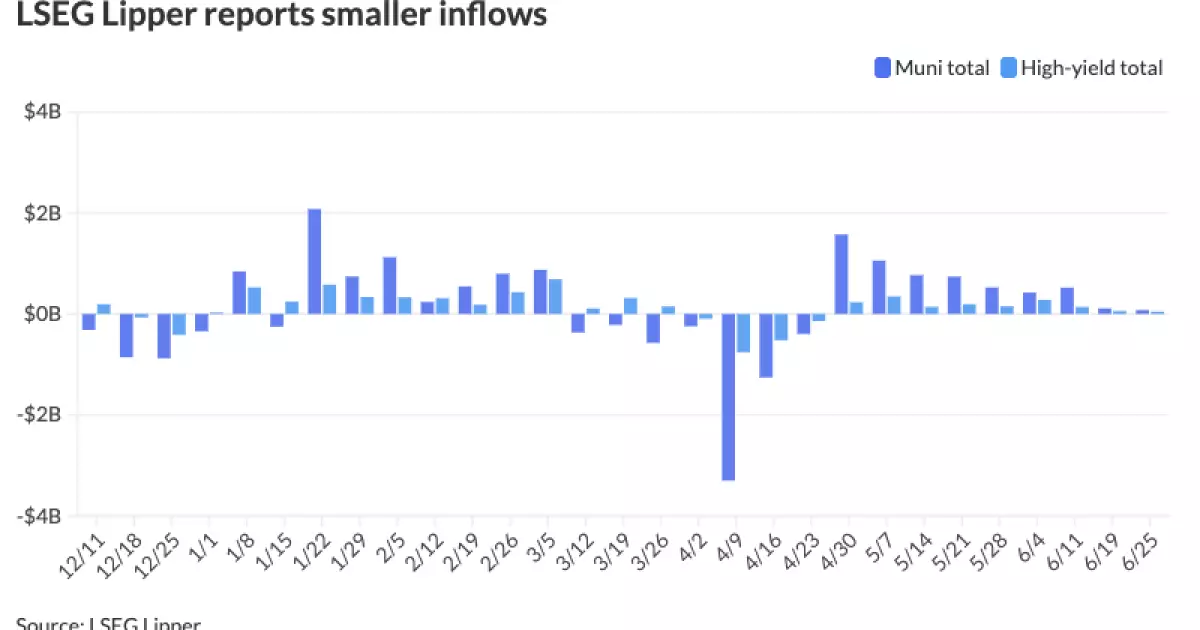

A thorough examination would be incomplete without addressing the effects of reinvestment demand, which has become a crucial player in the current environment. The municipal market successfully absorbed an impressive $50 billion in new issues last May, further asserting investor confidence. The trend of hefty inflows into municipal bond funds only strengthens this narrative. Notably, high-yield funds reported significant inflows, showcasing a robust appetite for riskier assets within the realm of municipal securities.

In a time when economic indicators are remaining somewhat mixed, the influx of capital into municipal bonds asserts that investors are looking for security without sacrificing yield. When coupled with the expected heavy reinvestment periods coming up in the months ahead, the municipal market may indeed be prepping itself for a strong performance in the latter half of 2023.

Valuation Trends and Future Expectations

Valuations are now more appealing than they have been in previous periods, allegedly reaching historically attractive levels. For the first time this year, the alignment of valuations and demand within the municipal market could mark a substantial pivot point. As headwinds begin to shift into tailwinds, it raises new questions about the broader economic context and the potential for sustainable growth in municipalities.

The possible easing of the political climate regarding infrastructure and social spending could also enhance the appeal of municipal bonds. As lending standards potentially relax and cities begin to undertake essential projects, the demand for municipal bonds could grow exponentially. Such an outcome would bear significant implications not just on investors but on economic stability and local governance in years to come.

In essence, the municipal bond market stands at a pivotal juncture, characterized by emerging opportunities birthed from a complex blend of economic and political dynamics. The potential for growth beckons as municipalities adapt to these conditions, leaving investors and analysts alike pondering the implications for future investments.