As 2025 progresses, the municipal bond market—long viewed as a bedrock of conservative investment—finds itself wrestling with structural burdens that many investors either underappreciate or dismiss outright. Despite a seemingly stable backdrop marked by record equity highs and rising Treasury yields, tax-exempt municipals have markedly underperformed. This underperformance reflects deeper underlying vulnerabilities driven principally by a surge in supply, which risks destabilizing a sector fundamental to infrastructure financing and local governance. The commentary from market strategists lays bare a complex dynamic: issuance is swelling to historic levels even as investor enthusiasm for municipal bonds wanes, and this tension reveals much about broader fiscal and economic fault lines.

The Overhang of Unprecedented Supply

The municipal bond market’s current predicament stems primarily from a record pace of new issuance, with June 2025 expected to smash monthly issuance records by exceeding $50 billion. With total annual issuance forecasts climbing from $520 billion to $580 billion, the supply shock is impossible to ignore. To a lay observer, a booming issuance might indicate vibrant government investment or fiscal health; yet, this is misleading. The flood of new maturities and coupon payments looming on the horizon threatens to swamp demand and erode bond prices. The classical economic principle of supply and demand here plays out brutally: more bonds hitting the market mean yields must rise to attract buyers, driving down prices—especially when competing against an improving Treasury market. This trend undermines the notion of municipal bonds as safe, income-generating assets, particularly amidst inflationary pressures and rising interest rates.

A Market Forced Into Yield Competitiveness

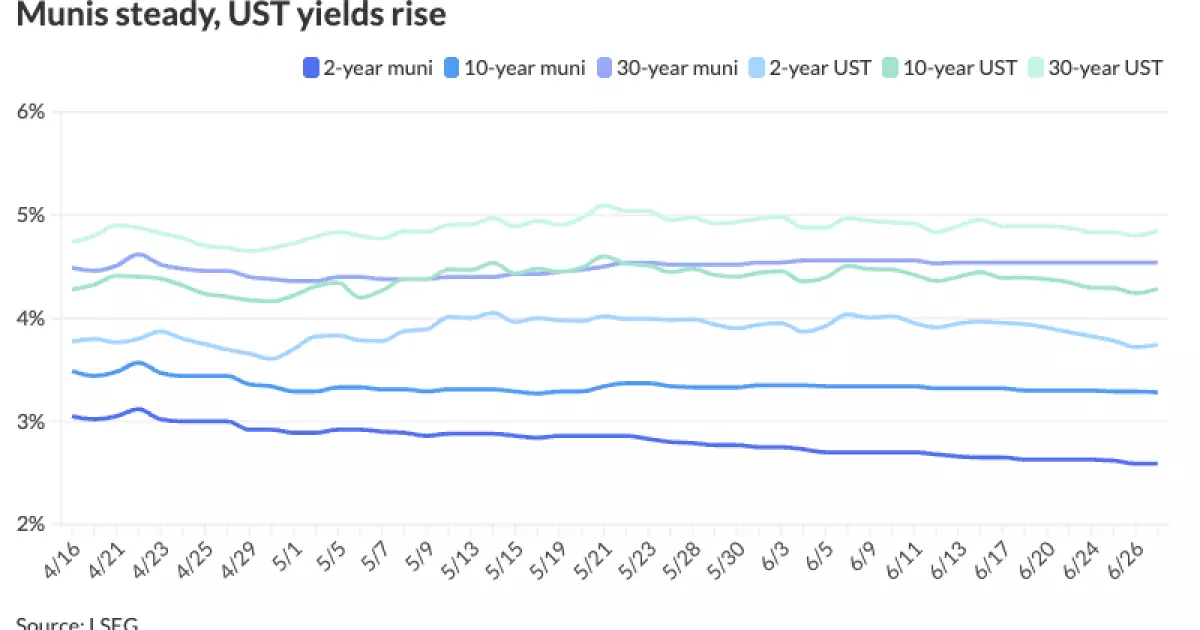

One striking development is the rising ratios of municipal bond yields relative to U.S. Treasuries. For instance, the 10-year muni-to-Treasury ratio nudged upwards to 77%, and the 30-year touched 94%. While some may cheer higher yields, this shift signals municipal bonds selling off relative to the benchmark for risk-free assets: Treasuries. Normally, federal tax exemption affords municipals a comfortable valuation premium, but that advantage is under siege as the market adjusts to oversupply. The increased ratios mean municipal investors are demanding more yield to assume greater risk or illiquidity— a warning sign that confidence in muni credits or market liquidity is waning. This is compounded by a rally in Treasury prices, highlighting a relative loss of allure for municipals.

Technicals and the Illusion of Seasonal Strength

Historical data suggests tax-exempt municipals tend to firm in July and August, buoyed by a seasonal confluence of redemptions and coupon payments that soak up supply. However, relying on these cyclical patterns feels like a fragile crutch in 2025’s environment. Barclays and BofA strategists cautiously note that while second-half issuance might decline somewhat, it will remain elevated, and redemptions may not keep pace. This imbalance risks setting the stage for renewed pressure heading into the fall months, a period which could see further weakness. The municipal market’s reliance on seasonal technicals in this context masks a sobering reality: fundamental demand drivers are tenuous, and any prolonged supply overhang can induce investor fatigue, stress liquidity, and create price dislocations.

The Myth of Safe, Steady Returns in 2025

It is telling that municipals remain the only fixed income asset class sporting negative total returns year-to-date despite their conservative reputation. This fact not only defies investor expectations but challenges the assumption that municipal bonds are immune to broader interest rate and credit risk volatility. Rather, 2025 reveals a harsh truth: even traditionally “safe” sectors are vulnerable when market mechanics shift. Underperforming municipals also feed a dangerous narrative for retail and institutional investors inclined to overweight them as a safe harbor. The market’s softness could spur capital flight to Treasuries or other assets, leading to a self-reinforcing decline in muni prices and liquidity.

Political and Fiscal Implications: Tax Exemptions Under Siege?

From a center-right liberal vantage point, the municipal bond market’s troubles underscore a growing fiscal reckoning for local and state governments. Profligate issuance, often justified as necessary to fund infrastructure and social programs, inherently carries risks that have now materialized in tighter market conditions and higher borrowing costs. Tax-exempt status is a costly subsidy funded by the federal government and ultimately taxpayers. If the market signals that such bonds demand higher yields, politicians must confront the true budgetary trade-offs involved. Blindly expanding debt without clear growth or efficiency gains heightens fiscal fragility, undermines market solvency, and threatens the cherished “triple-A” standards of many issuers. Financial discipline and reform are overdue if taxpayers are to avoid footing the bill for failed borrowing strategies.

Why Investors Must Demand More Discipline and Transparency

Given the inherent risks revealed, investors and policymakers alike should demand greater prudence. Investors must scrutinize supply trends, issuer creditworthiness, and valuation metrics rather than complacently relying on federal guarantees or tax incentives. Meanwhile, state and local governments should recalibrate issuance strategies, prioritize genuine capital needs, and pursue structural reforms to improve fiscal health. Without such measures, the ongoing issuance surge risks converting what has been a steady asset class into a minefield of credit risk and volatility. Investors who recognize this growing fragility—and position their portfolios accordingly—stand to benefit, while those clinging stubbornly to outdated bullish assumptions are likely to suffer avoidable losses in an evolving market landscape.