Nvidia (NVDA) has shattered all records, establishing itself as the first company to reach a staggering $4 trillion market capitalization. This towering valuation isn’t just a testament to Nvidia’s technological prowess but a reflection of investor enthusiasm that has propelled its stock into the stratosphere. Once on the brink of slipping below $2 trillion during the tumultuous “Liberation Day” lows—an intraday decline to $86.62—Nvidia now outstrips giants like Apple and Microsoft, which previously held the crown with $3 trillion valuations. Such a rapid ascent in less than two years is extraordinary, and it underscores the shifting landscape of modern tech dominance.

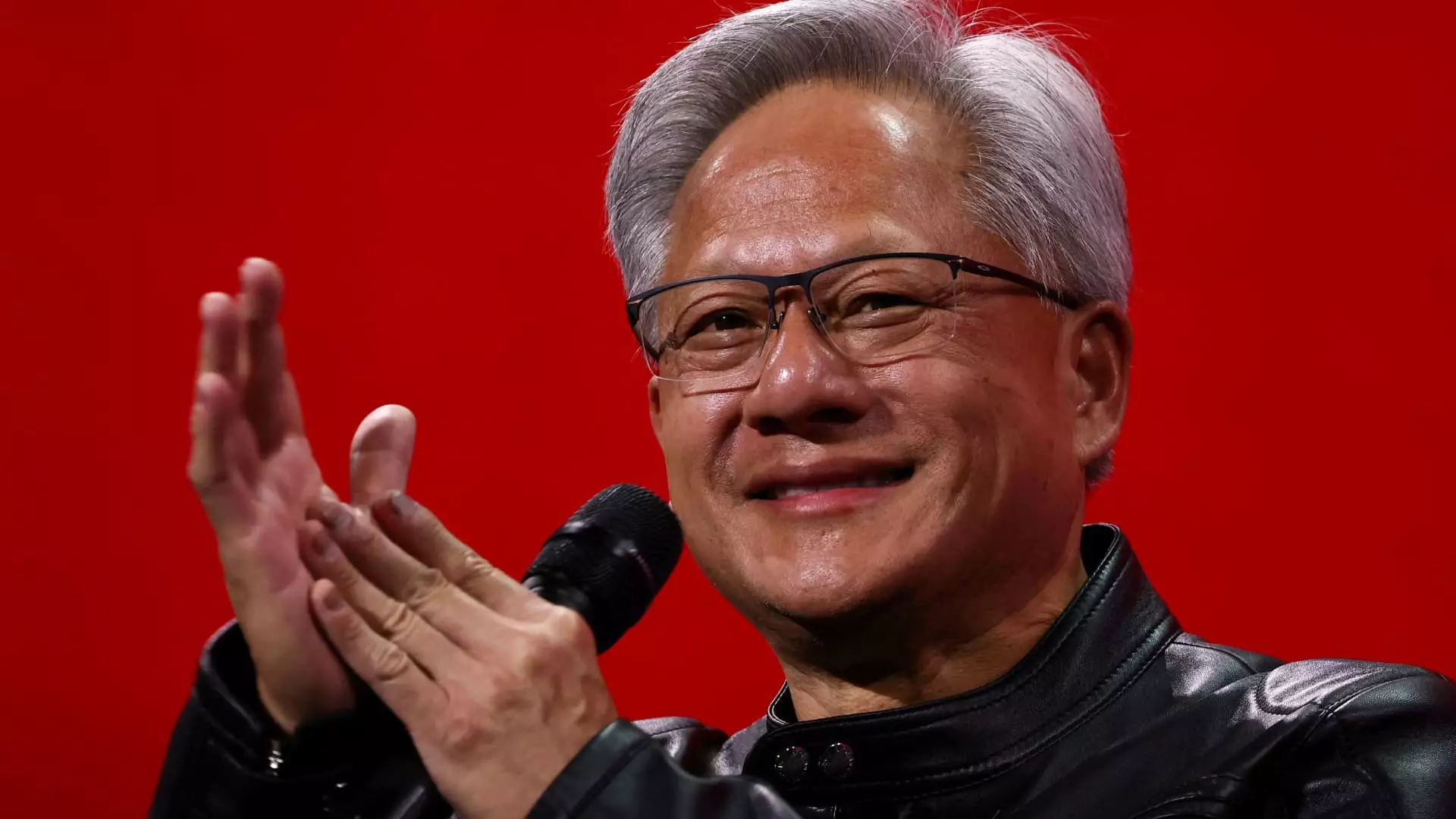

This ascent is not incidental. Nvidia, under Jensen Huang’s leadership, has strategically positioned itself at the core of the AI revolution. Its transformative innovation over three decades culminated in a swift two-year journey from a trillion-dollar-plus business to a $4 trillion colossus. For a company that once seemed to rely heavily on hardware breakthroughs, Nvidia has adeptly capitalized on AI, cloud computing, and emerging data-driven technologies, redefining what a semiconductor company can achieve.

Is This Growth Sustainable or a Market Mirage?

While it’s tempting to chase the exuberance of Nvidia’s valuation, a pragmatic investor must question whether such a rapid surge is sustainable. Market history suggests that soaring valuations often precede corrections. The phrase “pigs get fat, hogs get slaughtered” resonates here; it’s a warning that greed could lead to catastrophic losses if one becomes overly aggressive in holding onto assets that have already run too far.

Despite Nvidia’s robust fundamentals and market position, the risk of a retracement looms. The AI frenzy has created a bubble of sorts—an environment ripe for corrections. Markets are inherently unpredictable, and valuations driven by hype or momentum can quickly deflate if underlying demand wanes or if broader economic factors shift. Nvidia’s current dominance may be unparalleled now, but it’s crucial to temper optimism with caution and recognize that even the most compelling stories can encounter turbulence.

Strategic Positioning Amidst Market Euphoria

For those who have benefited from Nvidia’s meteoric rise, locking in gains appears to be a prudent move. The author advocates using options—specifically, a risk reversal—to hedge against potential downside while maintaining upside exposure. By selling a near-term call and simultaneously purchasing a put, investors can lock in certain profits and protect themselves against a sudden drop in Nvidia’s stock price.

This strategy exemplifies a balanced approach—being neither fully committed to riding the stock’s wave nor abandoning ship entirely. The logic here hinges on the notion that, after such an exponential rise, the market may experience a pause or correction. Investors should consider their risk tolerance carefully, especially if they were not already long Nvidia before the surge. Naked calls or overly aggressive positions could be dangerous, potentially exposing investors to unlimited losses if the stock continues to climb unexpectedly.

The specific trade highlighted involves selling a $170 2025 call while buying a $150 put, resulting in a credit that provides some cushion if Nvidia stages a pullback. Such a move is a testament to the importance of risk management in a period characterized by euphoria—acknowledging that, even in an environment of optimism, prudent safeguards are essential.

The Broader Political and Economic Context

In a centrist economic-light, market-oriented perspective, Nvidia’s rise can be seen as a reflection of technological innovation driven by well-managed corporate strategies. It’s an example of how competition, free markets, and technological progress can produce extraordinary results. However, it also exposes the fragility of overvalued assets in a speculative environment. Market regulators, investors, and policymakers must remain vigilant to prevent a bubble from bursting, which could have ripple effects beyond the tech sector.

While Nvidia’s innovative capabilities are laudable, reliance on short-term momentum can jeopardize long-term stability. A center-right liberal approach would emphasize balanced regulation to prevent market excesses while fostering innovation. The current Nvidia episode reveals both the strengths and vulnerabilities inherent in capitalism’s unrestrained phases of growth—an intricate dance that requires continuous oversight and disciplined investing.

By critically assessing Nvidia’s ascent, it’s clear that the company’s remarkable achievements are intertwined with risk. Investors must navigate this landscape with caution, balancing the allure of substantial gains against the peril of a potential correction. Strategic, well-hedged moves like options positionings can mitigate some risks—yet ultimately, the market’s fate will depend on broader economic currents, industry dynamics, and investor sentiment.