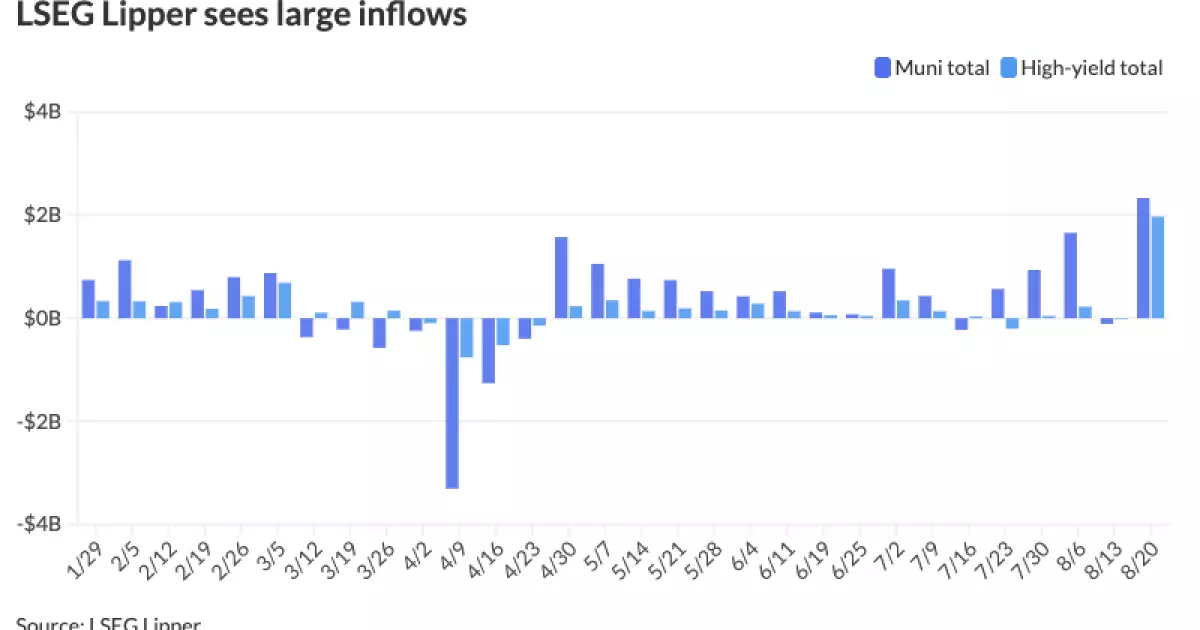

In the labyrinth of the municipal bond market, recent data depict a surprising surge in investor confidence—mutual fund inflows exceeding $2 billion mark an encouraging tide, yet beneath this surface lies a web of uncertainty and conflicting signals. While at first glance, the inflow suggests a bullish sentiment, a deeper examination reveals that this could be less a sign of enduring stability and more a symptom of strategic repositioning in an environment riddled with geopolitical and macroeconomic tensions.

Investors have pivoted toward municipals, with high-yield funds seeing a remarkable influx of nearly $2 billion, a stark turnaround from prior outflows. Such a shift hints at a desire for higher returns in a low-yield environment, yet it also raises red flags about risk appetite. The fact that most of this capital is driven by a handful of large ETFs signifies a concentration of power—financial institutions and sophisticated investors may be leveraging these inflows to reassert dominance over the market, rather than a genuine belief in municipal creditworthiness.

This inflow’s composition hints at the raw political and economic tension underpinning the market. Large reallocation into high-yield ETFs could be a hedge against future upheavals—an insurance policy—rather than a straightforward vote of confidence. As these funds often carry significant risk, their surge suggests that market participants might be preparing for turbulence rather than tranquility, hinting at a fragile equilibrium rather than sustainable growth.

The False Security of Broad Technical Indicators

Parallel to the inflows, technical signals from the market paint a picture of cautious optimism but also expose vulnerabilities. The declining balances in muni money markets—reaching their lowest since April—serve as subtle warning signs. While yields on floating instruments elevate slightly, indicating marginally improved income prospects, these are not necessarily signs of resilience. They could well be precursors to liquidity tightening, especially given the looming September redemptions totaling approximately $17 billion.

The market’s apparent steadiness, with consistent trade volumes hovering around $9.5 billion daily, might seem reassuring. Yet, beneath this calm, tactical maneuvers and technical constraints reveal a landscape where institutional players remain reticent—hesitant to ramp up supply, wary of the uncertain monetary policy outlook. The apparent steadiness could just be frictional—an equilibrium that is more fragile than it appears.

The key question is whether this stability is genuine or a carefully constructed façade. The seemingly robust technical indicators—such as stable yield curves and unchanged AAA scales—might be misleading. An overreliance on these static signals risks underestimating the brewing storm, especially as the market’s backbone, the technical infrastructure, becomes increasingly tenuous with dwindling liquidity.

The Political Winds Blowing Through Market Dynamics

Amid all these financial details, the central theme remains political: the impending Federal Reserve rate decision, scheduled for September, will act as a catalyst—or a destabilizer. Softening CPI data have fueled speculation about a potential rate cut, but the timing and scale are hotly contested. This ambiguity is the crux of market uncertainty.

Those in power, including policymakers and large institutional investors, face a delicate balancing act. On one hand, a rate cut might invigorate the municipal market, encouraging further inflows and stability; on the other, it risks igniting inflationary pressures and worsening fiscal imbalances. The September meeting is more than a mere policy fade; it symbolizes a contest of influence—between inflation fighters, growth advocates, and the long-term sustainability of public finance.

From a center-right perspective, the cautious approach aligns with a belief in fiscal responsibility and measured interventions. Over-reliance on monetary easing can just as easily inflate the market’s bubble as it can stimulate growth. The political terrain suggests that external pressures—fiscal deficits, state-level budget challenges, and the need for sustainable development—must temper any short-term enthusiasm about rate cuts and liquidity injections.

The ongoing debate over future rate adjustments underscores a critical issue: the market’s long-term health hinges on prudent policy, not knee-jerk reactions. The political responsibility, particularly for a centrist view, should be to balance growth without excessive reliance on monetary stimulus, acknowledging that markets are inherently politicized arenas where short-term gains can obscure dangerous vulnerabilities.

The Power Struggles Behind the Market Narrative

In essence, the recent market movements are part of a larger power struggle—one where different factions vie for control: policymakers, institutional investors, retail market participants, and political leaders each pushing their agendas. The inflows into municipals, largely driven by a handful of ETFs and mutual funds, reflect not just market choices but strategic positioning by those with the most influence and information.

Big players are capitalizing on the current environment—reallocating wealth into assets they perceive as safe or potentially profitable in uncertain times. Yet, this concentration of inflows into select vehicles risks creating bubbles, especially if the political and economic environment shifts unexpectedly. Policymakers, aware of this, often hesitate to intervene aggressively because of the risk of inflating these bubbles further.

Meanwhile, the smaller investors and public officials caught in this web often depend on these market signals to plan for essential infrastructure and public services. Their confidence, often based on superficial indicators like yield spreads and trade volumes, is precarious at best. The political responsibility should be to ensure transparency and prudence, recognizing that market signals are molded as much by political decisions as by economic fundamentals.

The true game here is not just about immediate cash flows or technical yields. It is about who manipulates the narrative—whether authorities, large financial institutions, or market speculators—and how this shapes the future of municipal finance. This battle for influence influences the level of risk taxpayers ultimately shoulder, underscores the need for centrist policies that balance growth with fiscal conservatism, and reveals the fragility hidden behind seemingly stable market facades.