The municipal bond market is in a state of duality, navigating through a recent surge in inflows while facing the ramifications of preceding outflows and evolving fiscal policies. Recent data reveals that municipal bond mutual funds welcomed inflows exceeding $1 billion on Thursday, marking it as the second highest influx recorded this year. Despite the turbulence in U.S. Treasuries, municipal bonds are showcasing an interesting pattern of resilience. However, the question stands: what are the implications of these trends in the broader financial landscape?

Inflation’s Influence on Municipal Bond Flows

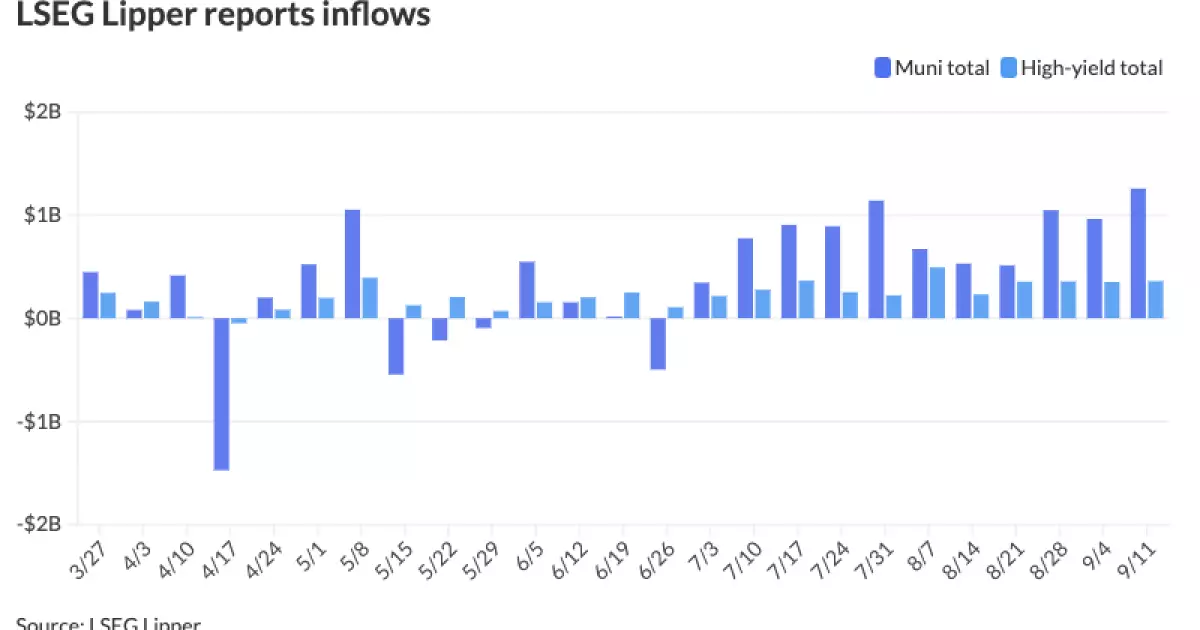

The latest figures from LSEG Lipper indicate that investors have poured approximately $1.258 billion into municipal bond funds, ranking this period just behind the $1.413 billion observed at the end of January, underscoring a consistent appetite for municipal investments. This marks the eleventh consecutive week of inflows, demonstrating a reinvigorated confidence among investors despite the past trend of significant outflows that witnessed a staggering $122 billion leaving the market from the onset of the Federal Reserve’s rate hiking cycle in early 2022 through 2023.

Investment strategies have pivoted towards municipal bonds due to the compelling yield offered compared to other fixed-income securities. The resilience in the high-yield sector, which captured $360.2 million this week alone, suggests a growing acknowledgment among investors of the favorable long-term prospects in municipal bonds.

Past Trends and Potential Growth

Looking back, historical trends indicate that municipal bonds tend to perform favorably during periods of capital inflow. Sam Weitzman from Western Asset Management highlighted that previous inflow cycles resulted in an average return of 12.4% prior to 2022, providing a robust backdrop for the current cycle. Yet today’s average performance, as dictated by the Bloomberg Municipal Bond Index, stands at a negative 2.0%, indicating that the markets may not yet be ready to revert to more favorable conditions seen in earlier years.

Weitzman’s comments raise pertinent questions about whether the current momentum in flows will manifest in improved returns as investors redefine their risk tolerance within the ever-evolving landscape. There remains room for potential growth, particularly as the Federal Reserve signals a more dovish monetary policy approach in the coming months.

The allure of municipal bonds comes primarily from their favorable tax-equivalent yields, especially in a climate where individuals are increasingly cost-conscious. Chris Proctor from SS&C ALPS Advisors acknowledged that the fundamental strength of municipal bonds is better than in preceding years, asserting that the current ratios of munis to Treasuries hover at appealing percentages. The two-year muni-to-Treasury ratio stands at 64%, offering a compelling choice for investors looking for alternatives to corporate bonds.

Despite the headwinds posed by rising supply in response to frontloaded issuance ahead of impending elections, the supply-demand dynamics have notably improved. Proctor’s remarks highlight that while yields are attractive, they also reflect a market adjusting to macroeconomic pressures, favorably positioning municipal bonds against corporate alternatives.

Although the municipality market shows remarkable tenacity, ongoing challenges persist, notably the influx of supply as issuers pivot towards capital markets to fund infrastructure projects. This need to finance critical initiatives is becoming increasingly important, particularly as federal support wanes. Larger deals pricing with increased concessions can attract both issuers and investors, reflecting positively on the relative yield attractiveness of municipal bonds.

Yet, there lies a potential pitfall: if supply continues to outpace demand, the robustness of pricing could be compromised, thereby jeopardizing the yield premiums that investors currently seek.

Market Dynamics and Future Projections

In light of recent developments, the municipal bond market is at a pivotal crossroads. With J.P. Morgan analysts anticipating a further cheapening of ratios, the outlook suggests that current levels of tax-exempt securities may offer value against their taxable counterparts in various maturities. This presents an opportunity for discerning investors to capitalize on municipal bonds, potentially mitigating risks associated with broader market volatility.

While the municipal bond market grapples with a complex interplay of inflows, outflows, and fiscal policies, the evidence suggests a resilient sector, providing appealing investment avenues. As market conditions continue to evolve, stakeholders must remain vigilant, analyzing both the macroeconomic factors and fiscal policies at play that could shape the future of municipal securities. With careful consideration and strategic positioning, investors could find themselves adequately equipped to navigate the intricacies of the municipal bond landscape in the months to come.