The municipal bond market is currently displaying signs of softness, yet it continues to show resilience compared to the more significant downturn in U.S. Treasuries. Investors remain focused on the primary market, where an impressive volume of new issues is being successfully launched, thereby reflecting a robust appetite for municipal offerings. As this market undergoes these fluctuations, it is essential to analyze its dynamics and draw insights into what the future might hold for municipal bonds.

The Current State of the Market

On a recent Wednesday, the municipal bond market experienced a slight decline, with yield curves for Triple-A bonds exhibiting relatively unchanged to weaker results ranging from one to four basis points. The declines were notably less severe than those seen in U.S. Treasury yields, indicating that investors are still somewhat favorably disposed towards municipal bonds. According to data from Refinitiv Municipal Market Data, the ratios of two-year to 30-year municipal bonds to their Treasury counterparts adjusted downwards, which might reflect a shifting sentiment or condition in the investment landscape.

This downward adjustment in ratios highlights the ongoing interplay between the municipal and Treasury markets. Investors are closely monitoring changes in interest rates, and although the municipal market has slightly weakened, it still manages to draw investor interest as a comparatively safer option, fueled by healthy liquidity levels.

Strong Demand Driving Market Activity

A significant factor contributing to the current state of the municipal market is the abundant liquidity available to investors. With over $6 trillion parked in money market funds and nearly $2.5 trillion in certificates of deposit, there exists a massive reservoir of capital in search of attractive returns. Julio Bonilla, a fixed-income portfolio manager at Schroders, notes that a considerable amount of cash has been kept on the sidelines, creating potential for strong inflows into municipal bonds, particularly as interest rates gradually decline.

The underlying momentum for these inflows is further supported by the non-competitive nature of current equity valuations, which are viewed as relatively expensive. In this context, municipal bonds present a compelling opportunity for investors looking to optimize their portfolios, especially when considering the tax-adjusted returns on these assets.

The recent pricing of several large new issues showcases the strength of demand in the municipal bond sector. For instance, Columbia University recently entered the market with a notable $500 million offering that included a combination of taxable corporate bonds and revenue bonds. This issuance demonstrated tight spreads, suggesting that even amidst market volatility, investors are prepared to back quality issuers.

Additionally, various state and local agencies have successfully priced their offerings. The Kentucky State Property and Buildings Commission and Massachusetts have issued multi-million-dollar revenue bonds with competitive yields, attracting investor attention. The uptake of these bonds illustrates the continued confidence some municipal issuers enjoy in their creditworthiness, facilitating effective fundraising even when overall market conditions are less than favorable.

The Impact of Federal Reserve Policies

As investors evaluate municipal bonds, it is crucial to consider the influence of the Federal Reserve’s monetary policies. Each incremental adjustment to the Fed Funds rate has the potential to reshape investment strategies. Investors may indeed respond to rate cuts by shifting from shorter-term instruments into longer-term municipal bonds, eager to lock in favorable yields before they potentially decrease further.

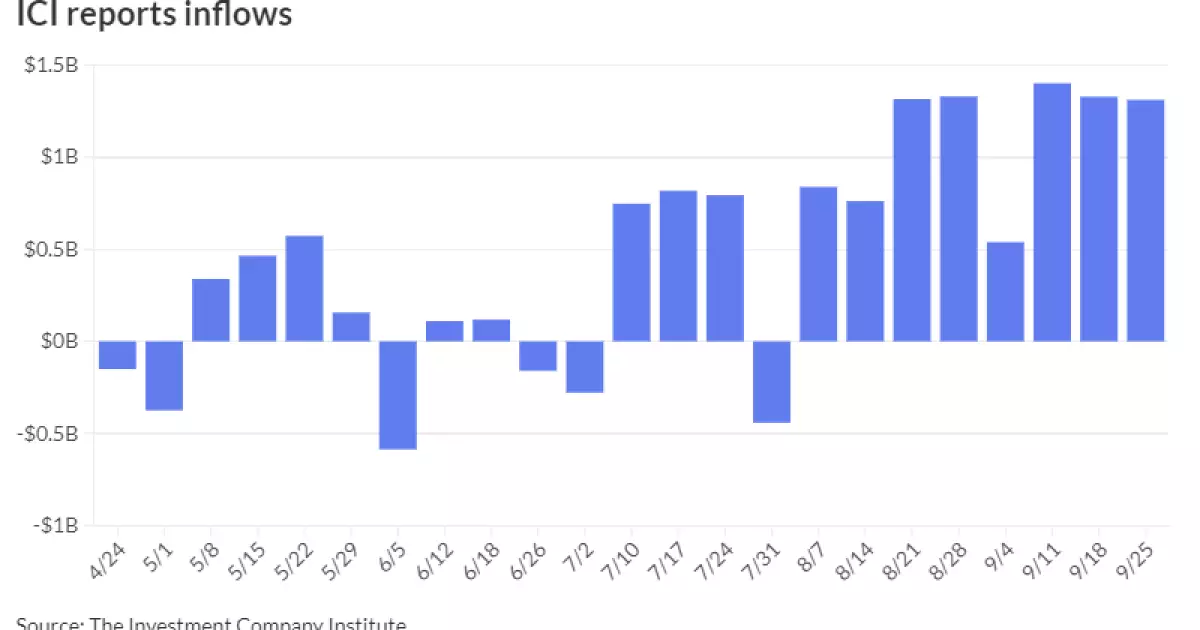

Market analysts, including Matt Fabian of Municipal Market Analytics, have observed the ongoing trend of significant inflows into municipal bond mutual funds and exchange-traded funds. The reported inflows of over $1.3 billion indicate a sustained investor interest that may continue as the year progresses. Encouragingly, such liquidity suggests that if the market experiences a rally, we might even witness record levels of issuance in 2024 as issuers capitalize on favorable conditions.

Although the current landscape poses uncertainties due to weaker Treasury performance and fluctuating yields, the resilience of the municipal market remains promising. The structural cash reserves available to investors, when coupled with attractive tax considerations, create a unique opportunity for municipal bonds.

However, industry participants must remain cautious as the backdrop of shifting policies and evolving economic indicators can influence market behavior. The robust demand from retail investors can only support the market to a degree, and macroeconomic factors must be continually assessed.

While the municipal bond market shows signs of softness amidst broader economic challenges, strong demand and liquidity provide a solid foundation. As we look ahead, maintaining vigilance over Fed movements and market dynamics will be crucial for stakeholders aiming to navigate this complex environment effectively.