In the dynamic landscape of music publishing, Reservoir Media has carved a distinct niche by operating a multifaceted organization that encompasses music publishing, recorded music, management, and rights management, particularly in the Middle East. This article delves into the company’s structure, financial performance, and market positioning, critically analyzing its operational model and shareholder dynamics to gain insights into its future prospects.

Reservoir Media is primarily segmented into music publishing and recorded music. The music publishing division is engaged in acquiring interests in extensive music catalogs, generating income through royalties. This segment is crucial as it not only works to build a rich catalog that includes works from iconic artists such as Joni Mitchell and John Denver, but it also focuses on signing promising songwriters to expand its repository. The recorded music arm, on the other hand, centers on acquiring sound recording catalogs and promoting new talent, which helps to sustain a diverse catalog for consumers and contributes to the company’s revenue stream.

The extensive catalog maintained by Reservoir Media consists of over 150,000 copyrights and 36,000 master recordings, demonstrating its role as a significant player in the music rights management space. This vast collection includes compositions from distinguished artists like The Isley Brothers and Hoagy Carmichael, ensuring that the catalog retains cultural resonance and commercial viability.

Financially, Reservoir Media has displayed impressive growth trends, especially since its public debut in July 2021, after merging with SPAC Roth CH Acquisition II. The company’s revenue growth, with gross profit growing from $47.39 million in its first earnings report to nearly $89.38 million, signifies a robust operational framework. Additionally, earnings before interest, taxes, depreciation, and amortization (EBITDA) showed an upward trend, enhancing investor confidence.

A significant factor for this growth trajectory stems from the booming subscription streaming industry, which has seen a positive growth rate of 11.2% in 2023, reflecting consumers’ evolving preferences toward digital music consumption. Reservoir Media capitalizes on this trend, with streaming and downloads accounting for over half of its total revenue. This alignment with market trends suggests the company is well-positioned to benefit from the ongoing digital transformation in music consumption.

However, amidst these promising financial indicators, Reservoir Media faces challenges related to its stock performance. Since its IPO, the company has experienced a 22.24% drop in share price, raising questions about market perception. While substantial engagement with shareholders is essential, the current valuation appears misaligned with the company’s growth metrics.

Strategic Activism and Shareholder Dynamics

The investment firm Irenic Capital has emerged as a notable activist shareholder, holding an 8.14% stake in Reservoir Media. Founded by experienced portfolio managers, Irenic’s approach focuses on strategic review processes and operational enhancements. Their engagement with Reservoir Media includes urging the formation of a special committee to oversee strategic reviews, positioning the company for potential reconsiderations of its operational model.

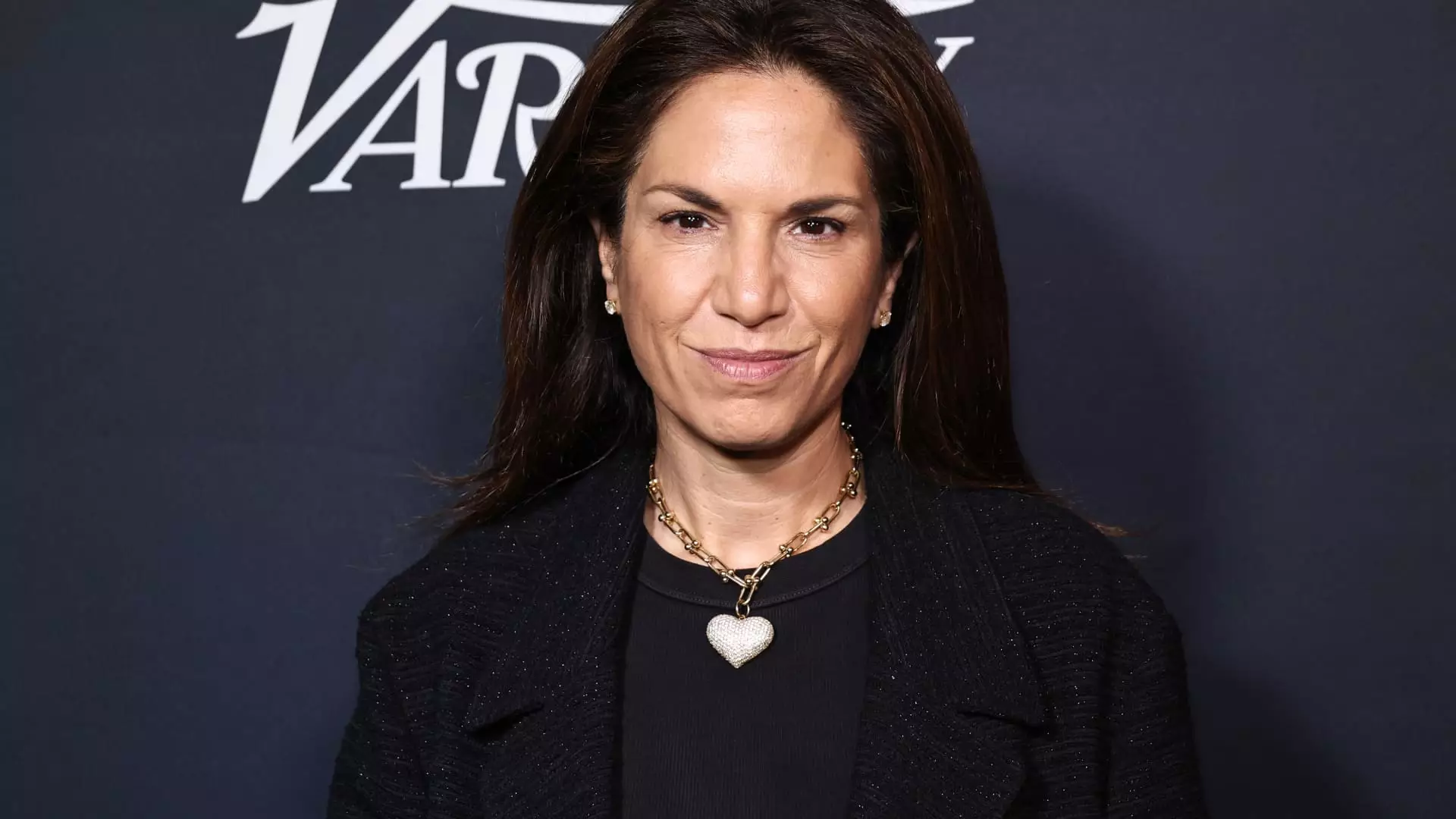

Irenic’s interests reflect a broader trend in corporate governance, where investors advocate for management changes or strategic pivots to unlock shareholder value. Nonetheless, their perspective on “sell the company” activism poses a critical lens that may not necessarily align with the long-term growth plans articulated by Reservoir’s management team, particularly under CEO Golnar Khosrowshahi’s leadership.

Given the nature of Reservoir Media’s business—a collector of royalties rather than a typical operating company—the potential for asset consolidation through acquisitions remains a focal point. With a substantial ownership stake held by the Khosrowshahi family and partnerships with firms like Richmond Hill Investments, the company’s governance framework suggests a collaborative approach rather than confrontational activism.

As Reservoir Media navigates the complexities of the music and investment landscape, several opportunities and challenges lie ahead. The increasing digitalization of music distribution presents avenues for revenue growth, particularly as streaming platforms evolve and consumer preferences shift. Moreover, as the company seeks to expand its catalog further, exploring partnerships and innovative content delivery models may solidify its market position.

Conversely, the company needs to address the concerns of declining share prices and ensure transparent communication with shareholders. The dual pressure from activist investors and market performance necessitates a focused strategy that harmonizes corporate governance with operational excellence.

Reservoir Media stands at a critical juncture in its evolution as an independent music royalty company. With a strong catalog, solid revenue streams, and active shareholder engagement, the future holds promise—but realizing that potential will require a delicate balance of innovation, strategic decision-making, and effective governance in an ever-evolving industry.