On a recent Thursday, the municipal bond market faced notable pressure as U.S. Treasury securities reported losses driven by geopolitical tensions alongside mixed readings from macroeconomic data. With an important employment data release on the horizon, investors remained cautious, leading to a decline in equity markets nearing the day’s end. Despite these pressures, the latest trends in municipal bond inflows and issuance indicated a continued robust market for tax-exempt securities, showing a remarkable potential for resilience.

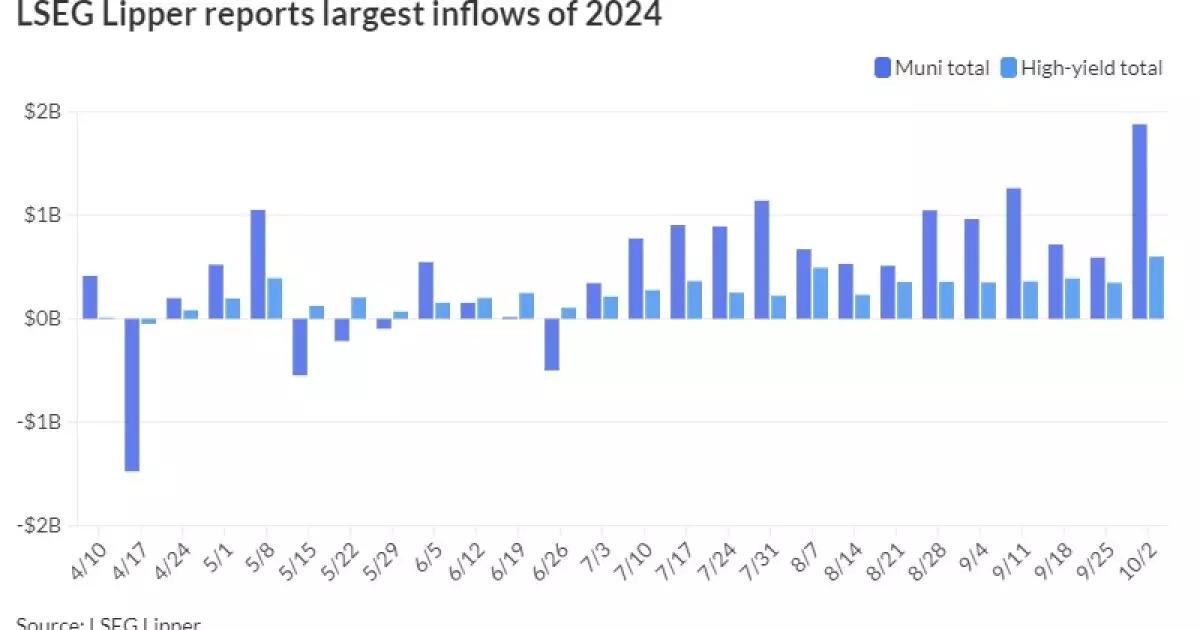

Recent data from LSEG highlighted significant inflows into municipal bond mutual funds, with the figure approaching $1.9 billion for the week, marking the 14th consecutive week of positive inflows. This consistent performance showcased an impressive indicator of investor confidence and appetite for municipal debt. The rise in inflows was particularly pronounced compared to the preceding week’s $592.1 million, suggesting a sharp upswing in investor interest and engagement within this segment of the bond market.

In particular, the high-yield sector within municipal funds performed well, witnessing inflows of approximately $602.3 million. This was a considerable jump from the $349.3 million observed in the previous week. The predominant interest in long-term options was voiced by J.P. Morgan’s strategists, who acknowledged that inflows were notably concentrated in longer-dated securities, reflecting a constructive outlook among investors.

The municipal yield curves demonstrated minor adjustments in response to the market’s dynamics. Triple-A rated bonds experienced slight reductions in yield, while the municipal market as a whole managed to outperform U.S. Treasury yields amid a day characterized by rising yields in government securities, which shifted between five to eight basis points. The municipal-to-U.S. Treasury yield ratios showed a tendency to adjust downward following these developments.

Zoning in on specific maturity periods, the two-year municipal to Treasury ratio was observed at 61%, climbing to 62% for three-year bonds and peaking at 83% for thirty-year securities. Such movements illustrate the market’s recognition of the attractiveness of municipal debt amid escalating Treasury yields.

On the issuance front, significant transactions unfolded in the primary market on Thursday. Notably, J.P. Morgan Securities facilitated the pricing of a substantial $265.075 million water system junior lien revenue bond offering for the city of San Antonio, reflecting solid borrower credit ratings (Aa1/AA+/AA). The bonds were structured with various maturities, offering yields ranging from 2.43% for short-term maturities to 3.64% extending to 2047.

Additionally, Alexandria, Virginia, also took advantage of favorable conditions by selling $114.555 million worth of general obligation capital improvement bonds. These offerings were well-received by the market, further underscoring the readiness of investors to engage with municipal debt, irrespective of intermittent market pressures.

With the market poised for a significant labor report, the recent data on private payrolls, which revealed an uptick in employment, pointed towards favorable trends but left room for caution among investors. Signs of a more dynamic labor market, as delineated by the strong performance of private payrolls in September, suggested a potential for upside risks ahead of the employment report. Analysts noted that this might lead to speculation regarding the Federal Reserve’s monetary policy stance and its implications for future rate adjustments.

Even as the municipal market navigates these complexities, its basic fundamentals—the consistent inflows, robust demand, and lower issuance yields—exhibit a healthy landscape, indicating that the sector’s resilience amid pressures is unwavering.

The municipal bond market’s ability to draw continued investor support amidst fluctuating economic conditions is a testament to its inherent stability. As we approach milestone economic indicators and navigate current geopolitical unrest, the persistence of inflows into this sector fortifies the outlook for municipal bonds moving forward. The balance of risk and opportunity remains pivotal as participants engage with the evolving landscape, trading strategies and adapting to economic signals that will ultimately inform market trajectories. This is a market to watch closely as it unfolds in the weeks ahead.