The municipal bond market has recently experienced a subtle downward trend in yields, marking its fourth consecutive day of declines. This trend comes in conjunction with rising U.S. Treasury yields, which have climbed notably. Over the past sessions, municipal yields have decreased by up to three basis points, influenced by market conditions that seem to reflet a temporary divergence between municipal bonds and Treasury securities. Notably, the two-year U.S. Treasury yield has breached the 4% threshold for the first time since late August, further emphasizing the tightening conditions in the bond market.

This movement in yields can be illustrative of shifting investor sentiment and underlying macroeconomic factors. As the municipal-to-Treasury yield ratios fluctuate, investors must adapt their strategies accordingly to optimize their portfolios. The ratios currently reveal that the two-year muni-to-Treasury ratio rests at a modest 61%, with varying figures across other maturities, hinting at the complexities investors face when determining the value of municipal bonds compared to their Treasury counterparts.

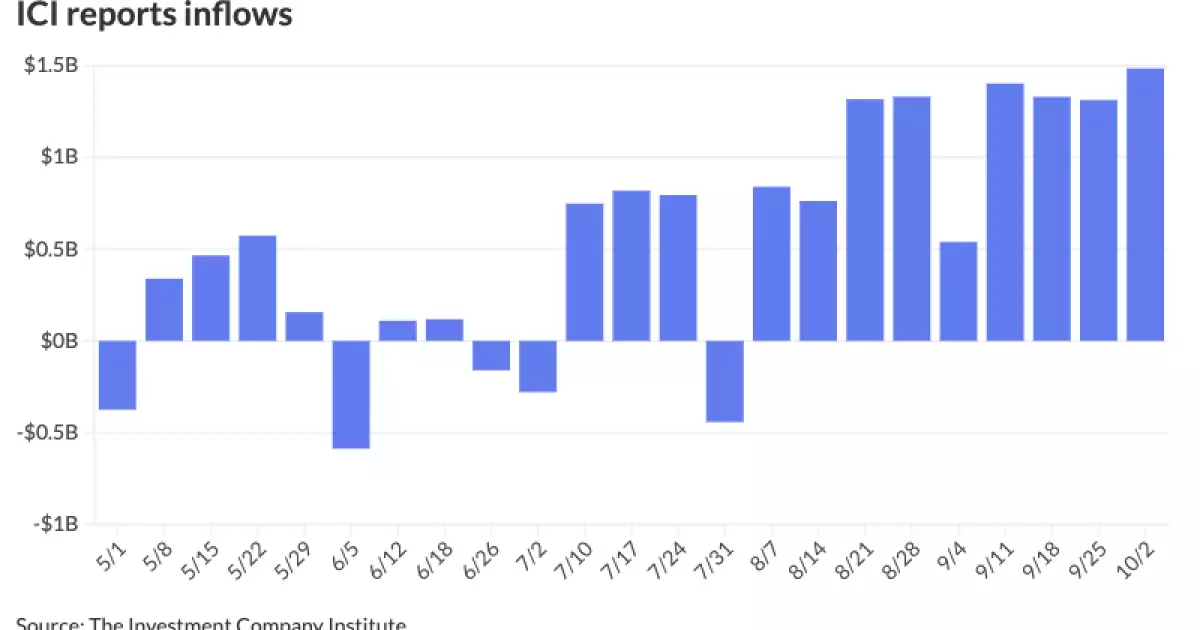

Recent data indicates a reassuring trend for municipal bonds, as the Investment Company Institute reported inflows into municipal bond mutual funds reaching approximately $1.484 billion for the week ending October 2. This increase follows a prior week of $1.312 billion and underscores a strong passion for municipal securities among investors. The sustained interest is particularly notable as it marks the ninth consecutive week of inflows, with four of those weeks seeing inflows surpassing the $1 billion mark.

This consistent demand is pivotal, especially as it reflects an increasing risk appetite among investors. Additionally, as exchange-traded funds (ETFs) witnessed inflows of $810 million—their highest since before the summer—there appears to be a capital shift favoring municipal securities. This trend may be attributed to attractive relative valuations and the need for stable returns in a volatile market, especially with monetary policy signals from the Federal Reserve leading to increased caution among investors seeking safety.

With broader economic conditions in mind, analysts suggest that while the current supply of municipal bonds remains robust, comprising over $10 billion on a weekly basis outside holiday periods, the outlook remains uncertain leading up to the presidential election. According to Jeff Lipton, a noted market strategist, both the acceleration of issuing bonds and the associated refinancing activities are pivotal in shaping short-term market dynamics.

As political events favor heightened issuance activities, analysts speculate that supply may taper off temporarily as the market absorbs these adjustments. The upcoming election can motivate issuers to front-load their deals, adding to the supply of tax-exempt instruments available for investors. Hence, while robust demand might continue due to October’s reinvestment needs and burgeoning interest in tax-efficient investments, a demand-supply imbalance seems plausible in the short term as cautious investors consider their options.

In realigning strategies, Daryl Clements highlights that while supply is digestible, relative valuations have increased, suggesting a more selective investment approach may be prudent for many buyers. Retail and institutional investors alike are advised to assess their portfolios through the lens of relative value, particularly as taxable-equivalent yield calculations become more relevant in a tightening rate environment.

With the present technical backdrop showing some resilience, the anticipation of opportunities in the near term emerges as ratios begin to adjust. The mixed performance observed across various maturities presents both challenges and opportunities. The upcoming week may yield greater clarity for investors, especially as primary issues such as Connecticut’s $935 million general obligation bonds begin pricing.

This backdrop allows for thoughtful engagement from both retail and institutional buyers, who may soon find advantageous entry points in an otherwise competitive landscape. Given the interplay between governmental issuance and market dynamics, creating an informed strategy will be pivotal as market conditions evolve.

As the municipal bond market realigns amid fluctuating yields and supply fluctuations, investors must remain vigilant and adaptive. The changing landscape signals a need for refined strategies that consider both relative value assessments and macroeconomic influences. While signs of resilience remain, particularly from strong inflows and demand, the pressing backdrop of the upcoming presidential election complicates short-term forecasts. Adapting to these market nuances will be essential for investors aiming to navigate the complexities of the municipal bond market effectively. As we look forward past the current quarter, the lessons learned from this period of volatility may well inform investment strategies into 2024 and beyond.