The municipal bond market is often viewed as a bellwether for broader economic trends due to its sensitivity to government fiscal health and local economic conditions. In August 2023, several factors are contributing to noteworthy shifts within the municipal bond sector. This article delves into the latest developments regarding yield ratios, inflows, issuance, and general market sentiment, ultimately attempting to offer a clear framework for understanding the current landscape.

Recent market reports highlight a slight firming in short-term municipal bonds, indicating a positive sentiment among investors. The backdrop to this development is characterized by ongoing inflows into muni mutual funds alongside a relatively quieter primary market. Notably, the yield ratios for various maturities have been noteworthy. For instance, the two-year to Treasury ratio was pegged at 64%, while longer maturities such as the 30-year reached as high as 83%. This spread suggests an attractive risk-reward ratio, particularly for investors who might have been apprehensive about overexposure to U.S. Treasuries, where yields have recently trended upwards.

The importance of these ratios cannot be overstated; they influence investment decisions significantly. As investors compare the tax-exempt nature of municipal bonds to taxable Treasuries, these figures serve as critical indicators of relative value, allowing institutional and retail investors alike to gauge market competitiveness.

Inflows and Investment Sentiment

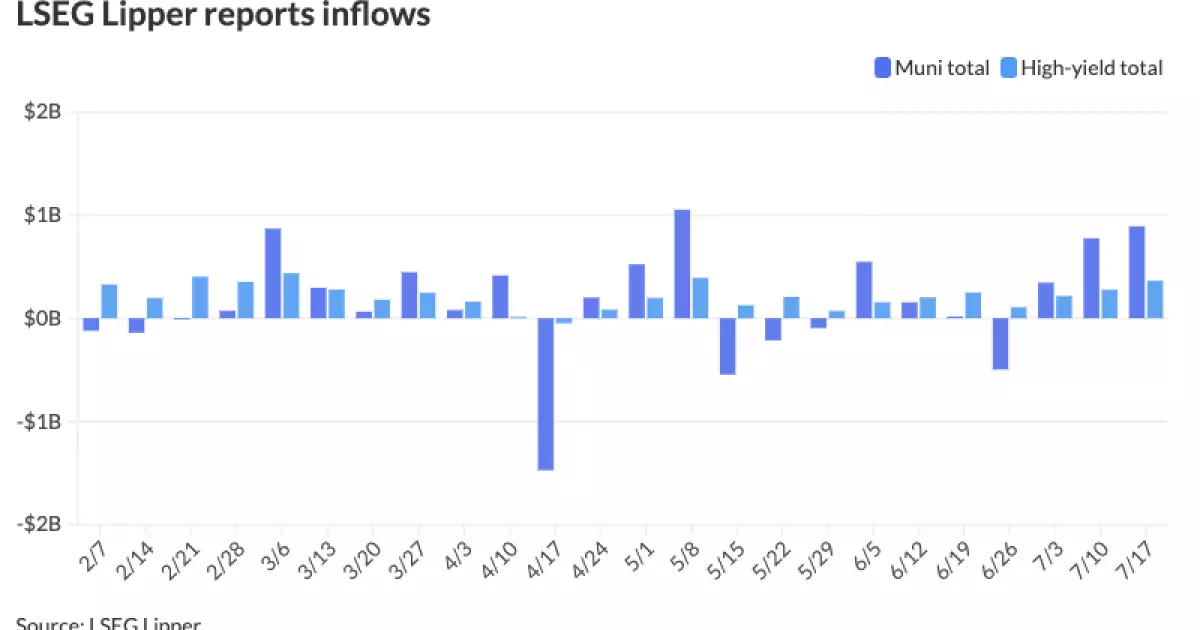

Municipal bond mutual funds have seen substantial inflows, with net additions reaching nearly $891.4 million in the past week alone. This contrasts with the $775.3 million recorded in the previous week, reflective of a burgeoning confidence among investors. High-yield funds have exhibited even greater momentum, with inflows totaling $364.4 million.

Market strategists argue that this renewed interest stems from favorable credit fundamentals, which currently reflect strong underlying economic conditions despite the creeping signs of economic slowing. Conservative budgeting practices, underpinned by historically high reserves, provide a safety net that reassures investors. The optimism surrounding this asset class reflects a broader trend where the municipal bond sector continues to attract a significant amount of capital, particularly as investors navigate a volatile equities market.

The seasonality of the municipal bond market plays a crucial role in shaping investor expectations. It’s widely understood that July typically emerges as one of the strongest months for muni performance, and the current conditions appear to be setting the stage for another significant uptick.

Analysts clarify that the typical summer blend of elevated reinvestment flows—coupled with a reduction in new issuance—fuels this pattern. As incoming funds from maturing bonds are reinvested, the demand for municipals could crescendo. Additionally, the belief that interest rates usually favor municipal bonds during summer reinforces a compelling case for prospective buyers.

Furthermore, the anticipation of large deals also factors into market dynamics. High-quality issuance in 2024 has already established a steady amount, and forthcoming large-scale offerings create a sense of urgency among buyers. The Texas Transportation Commission, for instance, is primed to issue $1.7 billion in bonds, with several other major municipalities gearing up for significant transactions in the coming weeks.

Despite the generally positive backdrop, it is essential to maintain a cautionary stance as external economic conditions are subject to rapid change. Analysts highlight the flattening of the yield curve, which may signal a tightening of potential gains in the long term. A pivotal concern for investors is the economic repercussions of the upcoming November elections, which could introduce volatility and uncertainty into market dynamics.

Furthermore, while market fundamentals appear robust, there is a growing awareness that rapid spreads compression could limit further price appreciation. Investors keeping a close eye on this sector should be wary of potential headline risks that can trigger sudden market reactions.

As the current landscape of the municipal bond market continues to evolve, it finds itself in a complex interaction of positive trends buoyed by inflows and cautious caveats signaled by economic uncertainties. By monitoring yield ratios, inflows, and issuance patterns, stakeholders can better navigate the intricacies of this sector. While current indicators support a bullish outlook, it remains essential to remain vigilant as external factors may dictate future market performance. The interplay of these dynamics will determine whether the municipal bond market can sustain the momentum it has built thus far, providing investors a worthwhile arena for strategic investment.