The start of 2025 has signaled a shift in the municipal bond market as investors strategically deploy reinvestment funds. This uptick contrasts sharply with a previous week’s trend where municipal bond mutual funds faced substantial outflows. Despite some challenges, the entry into the new year has highlighted the resilience of high-yield munis, which concluded the previous year with positive inflows contrary to the overall trend in municipal funds.

The closing of 2024 was marked by volatility in U.S. Treasury (UST) yields, impacting investor sentiments. While the municipal market saw some movement to the upside, U.S. Treasuries ended the trading session mixed. As investors cautiously navigated these waters, the relatively stable demand for high-yield munis is worth noting.

Recent data paints a nuanced picture of yield dynamics. According to ICE Data Services, the two-year municipal bond to UST ratio sat at 66% by Thursday’s market close. Interestingly, the 10-year municipal yield opened the year above 3.00%, an occurrence not seen since 2010. This signifies a change in investor expectations, perhaps anticipating shifts in Federal Reserve policy or broader economic conditions.

Analysts, including Kim Olsan of NewSquare Capital, underscored this potential volatility. “December’s yield downturn saw a dramatic increase of 30 basis points, marking yields at their highest for the year,” Olsan highlighted. This suggests a period of adjustment for investors as they recalibrate their portfolios in response to evolving economic conditions.

Despite a challenging December, the full-year performance of municipal bonds still boasted a respectable return of +1.05% for 2024, as reported by Bloomberg indices. Comparatively, USTs posted a mere +0.58%, with U.S. Corporates slightly ahead at +2.13%. It is essential to dissect these figures further for insight into the sub-sectors of municipal investing.

DeGroot from J.P. Morgan emphasized a stark contrast in performance among different sectors within the investment-grade muni index. The riskier categories, particularly those tied to infrastructure development and BBB-rated bonds, outperformed baseline expectations. However, long-dated bonds faced significant pressure, particularly in December, resulting in a 2.4% loss for long-duration indexes against a backdrop of overall market resilience.

As we dissect the latest dynamics of the market, high-yield municipal bonds emerged as a refuge for investors. With 2024 closing at a -1.66% return for high-yield munis in December, a silver lining appeared with a full-year return of 6.32%. This recovery showcases high-yield bonds’ potential to safeguard investor capital amid market turbulence.

The sector’s ability to attract inflows despite broader outflows in municipal funds signals ongoing investor confidence. Olsan’s observation regarding consistent inflows within the high-yield sector demonstrates that these products are increasingly recognized for their risk-adjusted returns relative to their peers.

As the focus shifts to potential economic landscapes for 2025, it’s crucial to recognize how stable economic conditions can influence revenue streams for municipal projects, which remains paramount for sustaining investor confidence. Interestingly, a further decrease in UST rates could pave the way for refinancing opportunities in the municipal sector—a trend known as advance refunding.

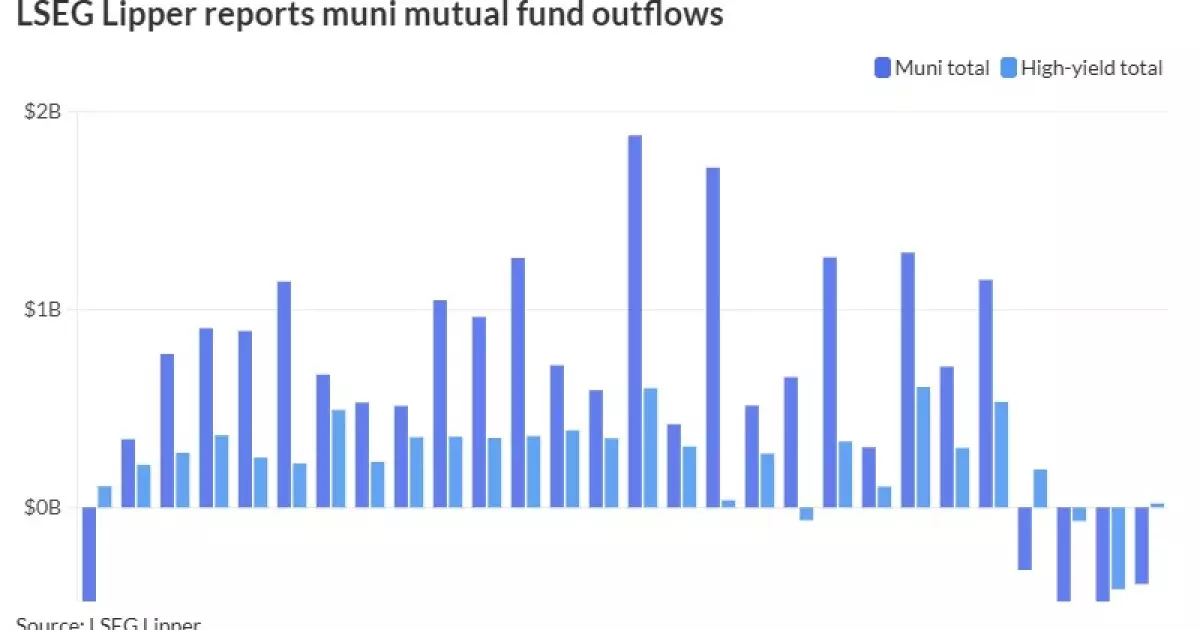

Building on this note, LSEG Lipper reported significant adjustments in fund flows, with municipal funds experiencing noteworthy outflows as investors recalibrated amid rising UST rates. This reaction underscores the interconnectedness of municipal and Treasury yields, influencing investor psychology and market trajectories going forward.

As we embark on a new year of investing, the municipal bond sector finds itself at a crossroads, shaped by both prevailing conditions and investor actions. The noticeable movement in yields, diverging performance among various segments, and the robust nature of high-yield munis showcase a complex yet promising landscape.

Investors are urged to remain vigilant as they assess potential avenues for growth and stability in their portfolios. The groundwork laid at the beginning of 2025 will undoubtedly influence broader municipal performance and investment strategies. As this market evolves, understanding the interplay between economic factors and municipal bonds will be crucial for navigating future opportunities and challenges.