As the municipal bond market continues to evolve, recent trends point towards a potentially lucrative horizon for investors. With primary issuance gaining momentum, coupled with a decline in U.S. Treasury yields and a positive performance in equities, the present landscape appears ripe for opportunity. Analysts’ insights and market data reveal important factors that are shaping the municipal bond environment.

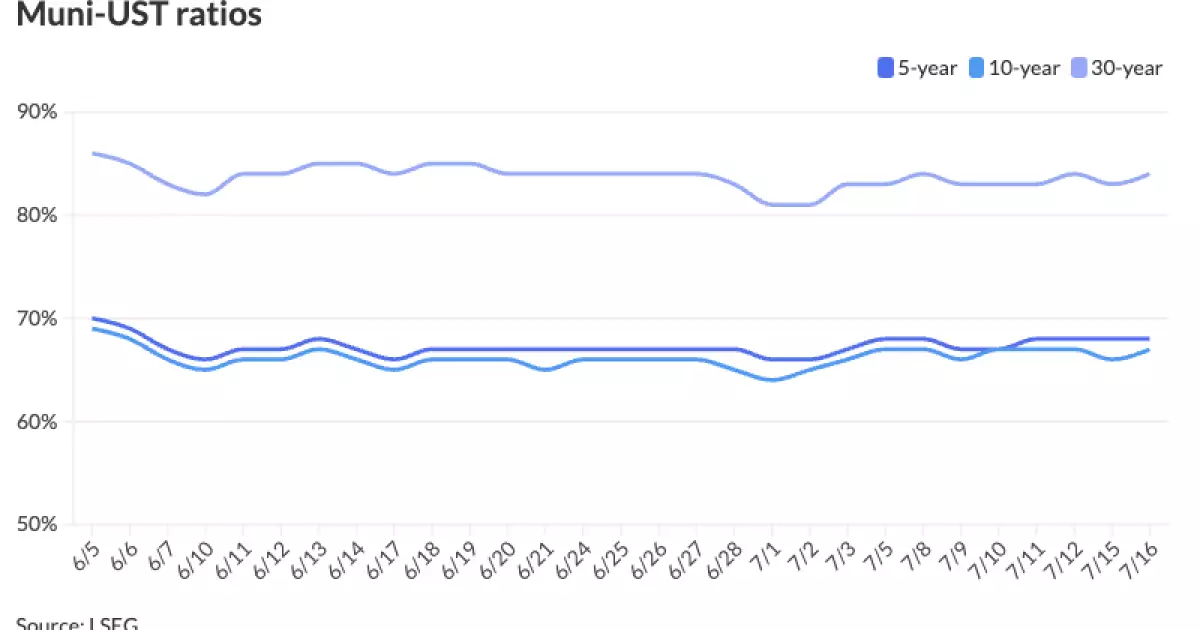

On Tuesday, the municipal bond market exhibited notable strength in secondary trading. This positive movement comes alongside an encouraging uptick in the primary market, which seems to echo broader economic trends. According to Refinitiv Municipal Market Data, the muni-to-Treasury ratios provide an intriguing glimpse into valuation dynamics. Ratios for two-year and three-year maturities stood at 65% and 66%, respectively, while longer maturities reflected increasing ratios, culminating with a 30-year muni-to-Treasury ratio of 84%. Such favorable ratios suggest that municipal bonds are becoming increasingly attractive compared to their Treasury counterparts.

Investment professional Matt Fabian from Municipal Market Analytics stressed that last week’s rally brought about an optimistic sentiment fueled by June’s consumer price index report. This development resulted in an improved likelihood of interest rate cuts by the Federal Reserve in September. However, he pointed out that the momentum of this rally has not translated into substantial movements for shorter maturities. Fabian advises that while they may appear overbought, the longer end of the curve shows signs of being exceptionally undersold, presenting immediate total return opportunities for discerning investors.

One significant factor driving current municipal market activity is the forthcoming tax-exempt reinvestment, projected to approach $40 billion in August—a notable increase from July’s figures. This substantial reinvestment is expected to breathe new life into the sector, encouraging retail investors to reinvigorate their portfolio allocations into municipals. The surge in trading volume last week, which reported nearly 300,000 recorded trades, reflects this renewed enthusiasm.

Dealers are also exhibiting increased optimism by allowing inventory levels to rise over the summer. This strategic build-up in inventories aims to accommodate upcoming issuances, as the market expects to see a steady increase in supply. With an estimated $10.7 billion in new issuance forecasted for this week alone, the atmosphere is charged with anticipation. The continual flush of capital into the municipal market is a testament to its endurance amid broader economic fluctuations.

Turning the spotlight to primary market activities, a diverse range of municipalities are gearing up for sizeable bond issuances set for this week. For instance, Miami-Dade County, Florida, has priced an impressive $921.86 million in aviation revenue refunding bonds, with tranches reflecting varying maturities and attractive yields for investors. Likewise, a noteworthy issuance from the Hospital Authority of Hall County and Gainesville, Georgia, showcases the demand for municipal financing as it offers over $248 million for health system projects, further validating investor confidence in the economic landscape.

Other exciting issuances include the New York City Transitional Finance Authority, which is preparing to price tax-secured subordinate bonds, and the University of California Regents, offering general revenue bonds for critical infrastructural investments. Such prominent issuances signal robust demand among investors, reinforcing the perspective that municipalities continue to operate as vital players in economic structural financing.

Despite the encouraging performance and heightened issuance, concerns regarding supply outpacing demand linger in the background. Analysts indicate that while increased supply this week should not hinder overall sector performance, the municipal bond market must work hard to maintain positive fund flow and stability.

Furthermore, mutual fund flows have shown inconsistency, though inflows into exchange-traded funds hint at a strategic positioning among investors awaiting a more enduring tax-exempt allocation. Dealers remain watchful as market conditions evolve and respond to these shifts.

The current municipal bond market situation illustrates a compelling blend of opportunities for investors willing to navigate its complexities. With newfound enthusiasm stemming from economic indicators, strengthened market analytics, and significant primary issuances, investors may find themselves well-placed to capitalize on the diverse benefits that municipalities offer in an increasingly uncertain economy. The coming weeks will be pivotal in assessing whether this positive momentum can be sustained and how it will ultimately shape the future of municipal investments.