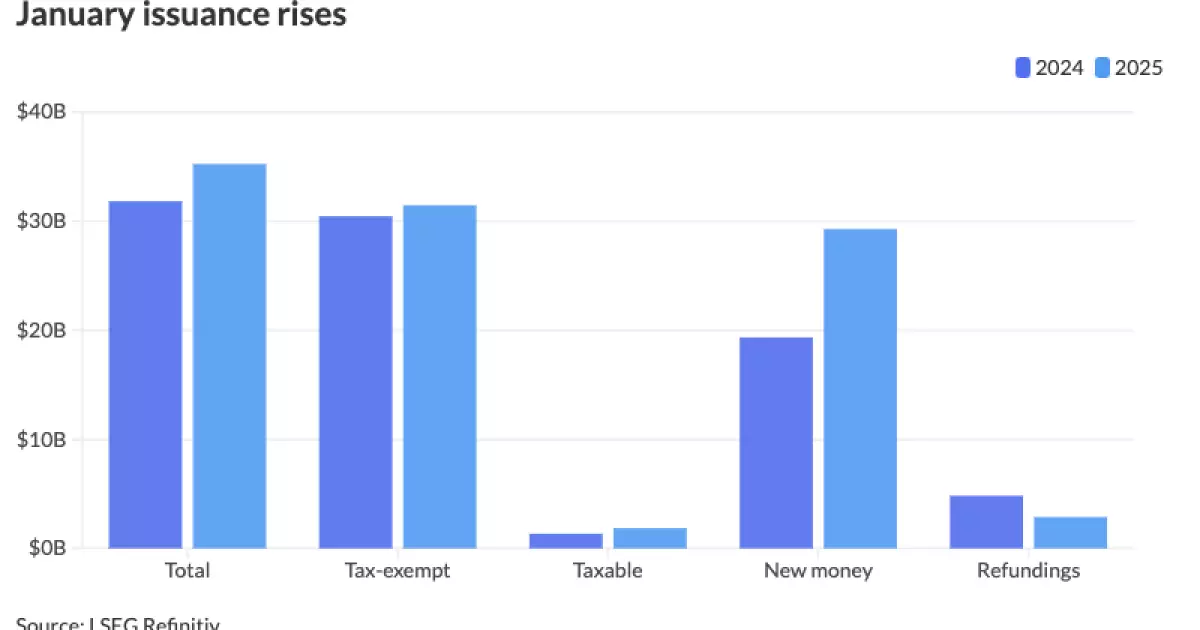

The start of 2025 showcased a notable surge in municipal bond issuance, driven by a complex interplay of economic indicators and strategic decision-making among issuers. As various forces coalesced around policy uncertainties and anticipated legislative changes, bond issuers capitalized on the market’s momentum in January. With total issuance rising to $35.243 billion from $31.817 billion in the previous year, this uptick highlights underlying trends and potential future trajectories for the municipal bond market.

The increase in bond issuance can largely be attributed to a pressing desire amongst issuers to navigate heightened market volatility. As pointed out by Alice Cheng, a credit analyst at Janney, many were keen to act before the onset of potentially disruptive fiscal and monetary policy alterations proposed by the new administration. The Federal Open Market Committee’s decisions further complicated the landscape, with the Federal Reserve maintaining interest rates but experiencing external pressures to lower them. This tension generated an atmosphere where issuers felt compelled to be proactive.

Cheng’s insights underline a significant theme in this context: the fear among issuers regarding the potential rescission of funds allocated through the Infrastructure Investment and Jobs Act. With the specter of these funds being “clawed back,” many opted to mobilize their resources and issue bonds rather than defer their plans in an environment colored by uncertainty. This inclination to act—despite less-than-ideal interest rate conditions—indicates a strategic pivot by issuers towards immediacy in their financial planning.

In this landscape, tax policy also emerged as a pivotal factor influencing municipal bond issuance. The apprehensions surrounding potential changes to tax exemptions—particularly those affecting healthcare and private educational institutions—served to further incentivize issuers. James Pruskowski, chief investment officer at 16Rock Asset Management, echoed this viewpoint, anticipating that front-loading issuance in an uncertain tax environment is not unexpected.

The confluence of high interest rates and substantial inflow into mutual funds and ETFs created an opportunity for issuers to capitalize on pent-up demand. Pruskowski highlighted that delays from the previous year, particularly during periods of elevated volatility, contributed to a backlog of projects that were now being addressed. Such a scenario posits that January’s vigorous activity may be indicative of a broader trend for 2025.

As financial aid from the COVID-19 era continues to diminish, municipalities are increasingly turning to the bond market to fulfill their capital funding needs. Cheng reaffirmed that January presented a conducive window for issuers to take the leap into the market amidst this changing landscape, with emerging patterns hinting at a sustained surge in issuance for the year ahead.

Mikhail Foux, a strategist at Barclays, anticipates that January’s robust supply signals a vigorous market pipeline continuing into 2025. This activity is a remarkable departure from the traditionally slow start of the year and suggests a potentially transformative period for municipal bond issuers.

With municipal bond issuance exceeding $500 billion in 2024, the onus remains on tapping into projects that had previously slowed down. Public finance expert Rob Dailey laid out the emerging importance of federal funds as stimulants for project developments. State and local governments are now leveraging federal dollars to explore additional projects across the infrastructure landscape, such as affordable housing and transportation systems, positioning the bond market for sustained demand over ensuing years.

January stats reveal that tax-exempt issuance accounted for $31.45 billion across 428 issues—marking a modest yearly increase—while taxable issuance surged significantly. New-money offerings indicated an impressive rise of 51.4%, signifying a marked shift in issuer sentiment towards seeking fresh capital for upcoming initiatives. Meanwhile, a reduction in refundings—down 40.4%—indicated a strategic emphasis on growing capital rather than refinancing existing obligations.

State-wise, California led the pack with issuance amounting to $6.371 billion, reflecting a year-over-year increase, while Texas and Florida also showed impressive growths. However, Massachusetts saw a significant decline, an anomaly in an otherwise upward-trending issuance landscape.

January 2025’s issuance activity is not merely a fleeting uptick but rather a potential harbinger of trends that could define the municipal bond market moving forward. The desire to act amidst uncertainty, tax policies’ shaping of issuance strategy, and emerging project funding needs all suggest that a robust municipal bond market could persist through 2025 and beyond. As issuers continue to seek strategic alignment with fiscal dynamics, the interplay of governmental influence, market demand, and regional factors will be critical in shaping the future trajectory of municipal financing.