Chicago is experiencing a critical juncture in its financial management as Kroll Bond Rating Agency (KBRA) has recently placed the city’s A general obligation bond rating on a Watch Downgrade status. This decision aligns with the City Council’s impending vote on a contentious $300 million property tax increase—an initiative embedded in Mayor Brandon Johnson’s proposed 2025 budget. With a staggering projected corporate fund shortfall of $982.4 million for the coming year, the city’s financial outlook appears more precarious than ever.

KBRA’s decision to implement a rating watch is no minor concern. It points to a convergence of significant fiscal challenges that Chicago faces moving forward. The agency’s concerns revolve around several critical factors: the reliance on temporary financial solutions, the overwhelming pension payment obligations that may impede other essential spending, and an over-dependence on economically sensitive revenue streams. This situation is exacerbated by the delayed commencement of the budgeting process, especially in the context of such a monumental financial shortfall.

Another layer of complexity is added by the city’s plans to issue up to $1.5 billion in new debt before the year’s end. While KBRA has affirmed an A rating for Chicago’s general obligation bonds, the establishment of this watch indicates an urgent need for reassurance regarding the city’s financial planning and management. As KBRA stated, it expects to reach a resolution on the rating watch by early January, contingent on the City Council’s effectiveness in passing a budget that successfully addresses the structural deficit while avoiding an over-reliance on non-recurring revenues.

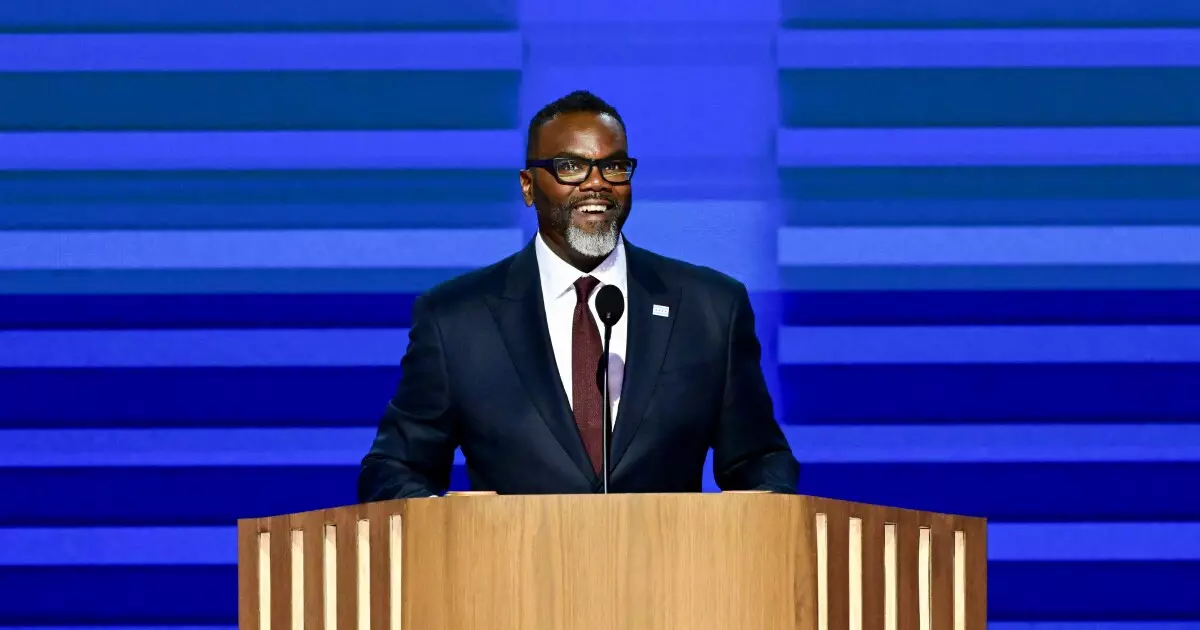

The proposed budget is a reflection of the complexities within Chicago’s fiscal policy. Mayor Johnson attempted to bridge the looming shortfall by positioning his budget as a blend of structural fixes and one-time revenue sources. Specifically, the allocation comprises 80% structural remedies and 20% temporary financial inflows. The inclusion of the property tax increase represents a significant pivot from Johnson’s previous campaign commitments, which proposed to approach budget balancing through alternative methods.

Experts, including those from the Civic Federation of Chicago, signal a cautious approach toward the proposed property tax hikes, advocating for such measures to be a last resort. However, contrasting opinions exist among rating agencies, with Fitch Ratings and S&P Global endorsing the tax increase as a means to address the city’s substantial budget deficits. Meanwhile, 29 of the 50 alderpersons have expressed their intentions for a special vote on the proposal, reflecting a division in opinion that could hamper consensus on budgetary solutions.

As the financial landscape continues to evolve, the city must work rapidly to reach an agreement between Mayor Johnson’s administration and the City Council. The complexities associated with the property tax increase have led to speculation that the proposed hike may see a “significant” reduction in favor of reallocated federal stimulus funds and other new revenue streams. This shift highlights the pressing need for alternative solutions to equilibrate the budget by the deadline of December 31, 2024.

Linda Vanderperre, senior director at KBRA, noted that any revised proposals must be carefully examined to gauge their effectiveness in addressing the city’s structural deficit. The anticipated outcomes hinge heavily on maintaining compliance with established financial and debt policies, particularly regarding the city’s budget stabilization fund that was enacted in FY2016. Given the inherent volatility in Chicago’s revenue collection, alternative funding routes must be pursued urgently to ensure fiscal sustainability for the future.

In addition to immediate budgetary concerns, Chicago faces the ongoing challenge of addressing its pension liabilities—issues that threaten long-term financial health. KBRA’s analysis emphasizes the dangers of relying on short-term fixes, warning that they may exacerbate systemic financial imbalances and escalate costs in the coming years. Consequently, Chicago’s financial strategy must evolve to include diversified and sustainable revenue sources to meet rising fixed costs related to pensions and debt servicing.

Renegotiating the city’s $1.5 billion refinancing plan for its existing debt could yield savings in the short term. However, these savings must be insightfully integrated into a larger, more sustainable financial strategy lest they merely serve to mask deeper systemic issues that will resurface down the road. Balancing immediate fiscal pressures while adhering to long-term commitments will be a formidable challenge for Chicago’s policymakers in the months ahead.

The complexities of Chicago’s fiscal landscape illustrate the delicate balance between necessary immediate actions and the strategic long-term health of the city. The divergence in responses to proposed tax increases, along with the pressing pension obligations, underlines the critical nature of transparent and inclusive financial strategies. Chicago now stands at a crossroads, tasked with not just stabilizing its current budgetary situation, but with laying down a sustainable pathway that accommodates not only economic realities but also the expectations of its residents. As the city gears up to tackle these impending hurdles, the forthcoming months will be pivotal in retuning its financial approach to ensure fiscal resilience and integrity.