The municipal bond market has seen a noteworthy activity over the past few days, demonstrating resilience even in the face of broader economic fluctuations. As municipal mutual funds registered substantial inflows amidst a busy primary market characterized by significant bond issues, it’s crucial to analyze the factors driving these trends, particularly against the backdrop of ongoing shifts in U.S. Treasury yields and equities.

On a recent Thursday, municipal bonds exhibited relative stability, with little change recorded in their valuation. In stark contrast, U.S. Treasuries experienced declines, particularly in the long-term segment, while equity markets closed on a positive note. This juxtaposition underscores an intriguing dynamic within fixed income markets, where municipals can maintain steadiness despite adverse movements in a larger financial context.

The ratio of municipal bonds to Treasuries on that Thursday revealed that the two-year municipalities stood at 62%, aligning closely with three and five-year benchmarks. However, the 30-year municipals reflected a more promising ratio at 83%, suggesting that longer maturities are attracting more investor interest. Such trends are pivotal, as they signal market confidence in municipal bonds relative to other fixed-income securities.

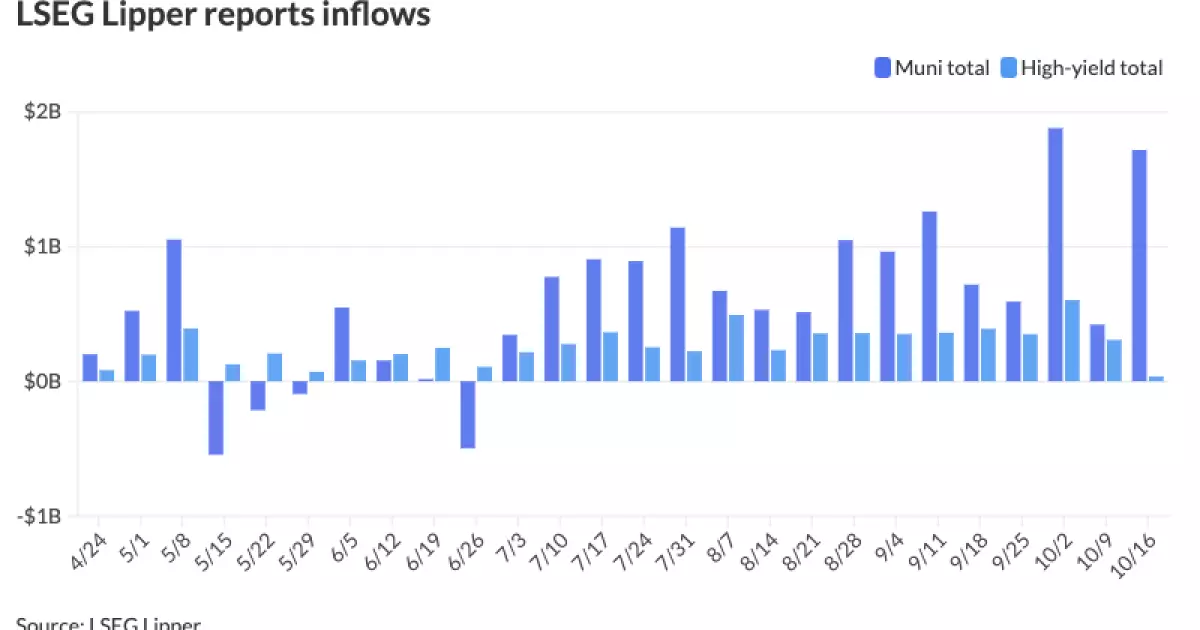

Investor inflows have been a hallmark of the municipal bond market lately. This week, LSEG Lipper data revealed that municipal bond mutual funds attracted an impressive $1.718 billion for the week ending Wednesday, a notable uptick compared to previous weeks. This marks an astounding streak of 16 consecutive weeks of inflows—a clear indicator of investor confidence.

High-yield municipal funds experienced a slight pullback, with inflows dipping from $308.3 million to $36.1 million. Despite this reduction, the overall trend in the municipal space remains distinctly positive. Fixed-income portfolio manager Brad Libby highlights that such persistent inflows typically correlate with lowering rates and subsequent positive returns. Thus, the current momentum aligns with historical patterns observed during previous Federal Reserve easing cycles.

An increase in supply has also defined the municipal market landscape, with analysts noting a significant backlog of deals requiring resolution. Factors contributing to this backlog include market disruptions occasioned by the COVID-19 pandemic and increased interest rates that delayed issuances until market conditions stabilized.

Kim Olsan from NewSquare Capital notes the projected net supply surplus as forward supply is expected to reach around $20 billion, juxtaposed with calls and maturities that sit about $2 billion lower. Consequently, the market is primed for heightened buyer interest, particularly for lower-rated bonds that have consistently seen oversubscription lately. Libby further states that A-rated credits are attracting considerable attention, whereas higher-rated bonds may require concessions that deviate from their historical trading levels to engage buyers effectively.

Primary Market Activity

The primary market over the recent days has recorded substantial dealings, indicative of renewed issuer enthusiasm to bring projects to fruition. Among the significant transactions, Pennsylvania executed a $1.6 billion General Obligation (GO) sale, while New Jersey’s Transportation Trust Fund Authority capitalized on market appetite by upsizing its transportation bond offering to $3.2 billion.

Similarly, Chicago’s O’Hare International Airport also priced a significant $1.6 billion bond, which indicates robust market traction. These multi-billion-dollar transactions are expected to perform well, illustrating strong demand amidst the wealth of available options.

Pricing details reflect a divergence in yields, with Pennsylvania’s issuance of 5s due in 2034 achieving a higher yield than a similar offering from December, solidifying the sense of evolving market conditions. The dynamics in yield pricing, particularly for deals of various categories—ranging from tax-exempt transportation system bonds to AMT refunding bonds—reveal a market in transition, responding acutely to investor sentiment and anticipation of future returns.

As the municipal bond market navigates an era marked by investor optimism and strong inflows, participants must remain vigilant to the ongoing fluctuations in U.S. Treasuries and equities. The interplay of supply, demand, and evolving economic conditions will undoubtedly shape the trajectory of municipal bonds moving forward. Investors’ increasing preference for municipal bonds could very well lead to sustained growth in this sector, particularly as issuers continue to clear backlogs and capitalize on favorable market conditions. Thus, understanding these nuanced dynamics is crucial for stakeholders aiming to harness potential opportunities within the municipal bond landscape.