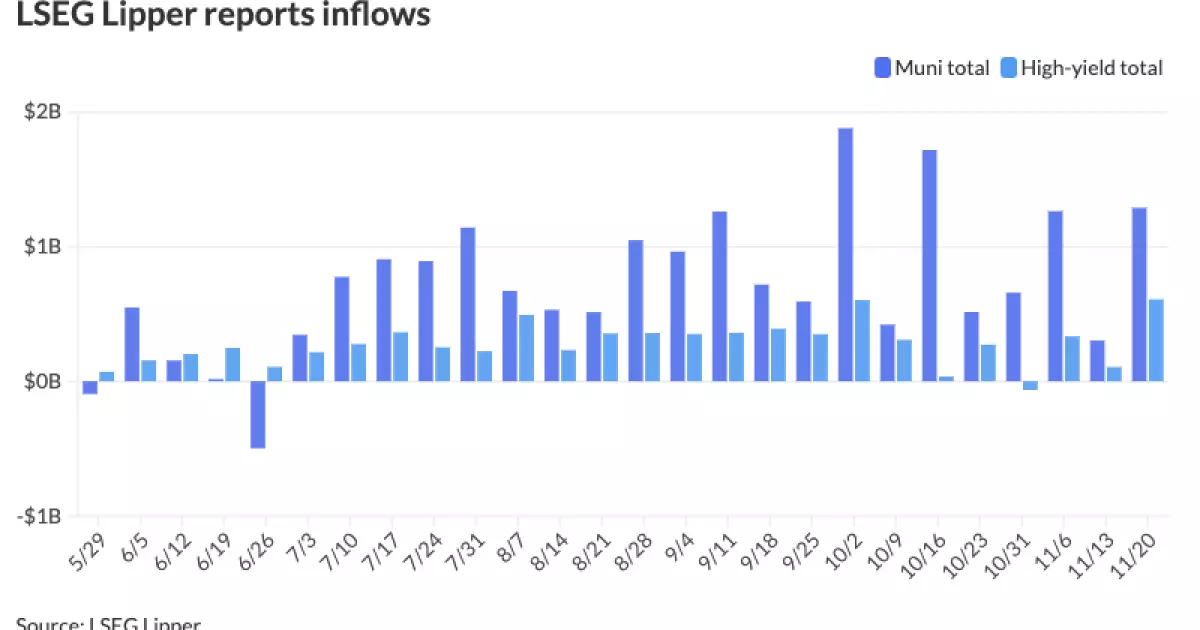

The municipal bond market has been experiencing notable shifts recently, with municipal bond mutual funds witnessing substantial inflows, marking a resilient phase for this investment sector. According to recent data, municipal funds attracted over $1 billion in inflows, specifically $1.288 billion for the week leading up to Wednesday. This represents a significant jump from the previous week’s inflows of $303.2 million, indicating a robust interest from investors. Notably, this surge follows a consistent 21 weeks of inflows, showcasing a persistent confidence in municipal bonds among investors.

Despite the positive trends in municipal bond funds, U.S. Treasury rates saw an uptick, complicating the landscape for bond investors. While most triple-A rated municipals held steady in yields, the dynamics of U.S. Treasury yields altered the bond landscape, with varying movements across different maturities. The municipal-to-U.S. Treasury yield ratios indicate investor sentiment, revealing how municipal bonds can still offer attractive options relative to tax-equivalent yields offered by Treasuries.

Analyzing the yield metrics, the two-year municipal-to-Treasury ratio stood at 60%, reflecting a favorable valuation for shorter maturities. As we progressed to longer maturities, the five-year and ten-year ratios saw slight improvements, landing at 62% and 66%, respectively, while the 30-year ratio held at 82%. Such ratios are critical for investors in understanding the comparative attractiveness of municipal bonds versus risk-free Treasury securities.

The market noted a sharpening contrast in inflows between high-yield and more stable municipal offerings. High-yield funds alone attracted $608.9 million, a significant upswing compared to $150.3 million from the week before. Such movements suggest a growing appetite for higher risk assets within this segment of the market, as investors seek to optimize their yield amidst fluctuating interest rates.

The primary issuance market has also shown dynamic activity, although it experienced a lighter calendar recently. Industry experts remarked upon the overwhelming demand for primary issuances, which have generally been well-received. Significant bond sales were recorded, including $520 million of taxable education revenue bonds from the Maricopa Industrial Development Authority and various health care revenue bonds by the Charlotte-Mecklenburg Hospital Authority. These developments underline the market’s appetite for new municipal issues, especially as investors continue to seek yield opportunities in an uncertain economic climate.

The competitive market similarly highlighted strong demand, exemplified by Dallas’s issuance of general obligation bonds totaling over $321 million, which saw competitive pricing across various maturity timelines. This kind of demand indicates not only investor confidence but also a robust appetite for diversified municipal investment options.

It is important to recognize that the holiday season, particularly Thanksgiving, will likely see a significant decline in market supply, with projections indicating a potential $5.58 billion in visible supply. Market participants anticipate that after the holiday, there could be a resurgence in issuance, accounting for 75% to 80% of total activity in the following weeks. This cyclical slowdown could present both challenges and opportunities, as the market adapts to seasonal rhythms.

Analysts suggest that while the municipal market has remained relatively stable post-election, there are fundamental factors yet to be resolved that will shape the investment landscape. With inflation monitoring and Federal Reserve monetary policies looming over the market, upcoming adjustments in rates could catalyze shifts in market behavior and investor sentiment.

Forecasts indicate potential rate cuts ranging from 50 to 100 basis points in the coming year, contingent on economic data and inflation trends. These anticipated changes could significantly impact inflow dynamics to municipal funds; typically, yield increases have been known to state investors’ appetite for munis. Moreover, the upcoming economic policy shifts tied to immigration and tariff regulations may further shape market perceptions and cash flow scenarios.

The current landscape of the municipal bond market presents a complex yet promising environment. As investors navigate the interplay of yields, inflows, and seasonal shifts, there lies an opportunity for prudently strategizing investments to maximize returns, particularly for those within higher tax brackets who stand to benefit significantly from the appeal of munis. Comprehensive monitoring of future Federal Reserve actions and economic legislation will be essential for all stakeholders in this evolving market.