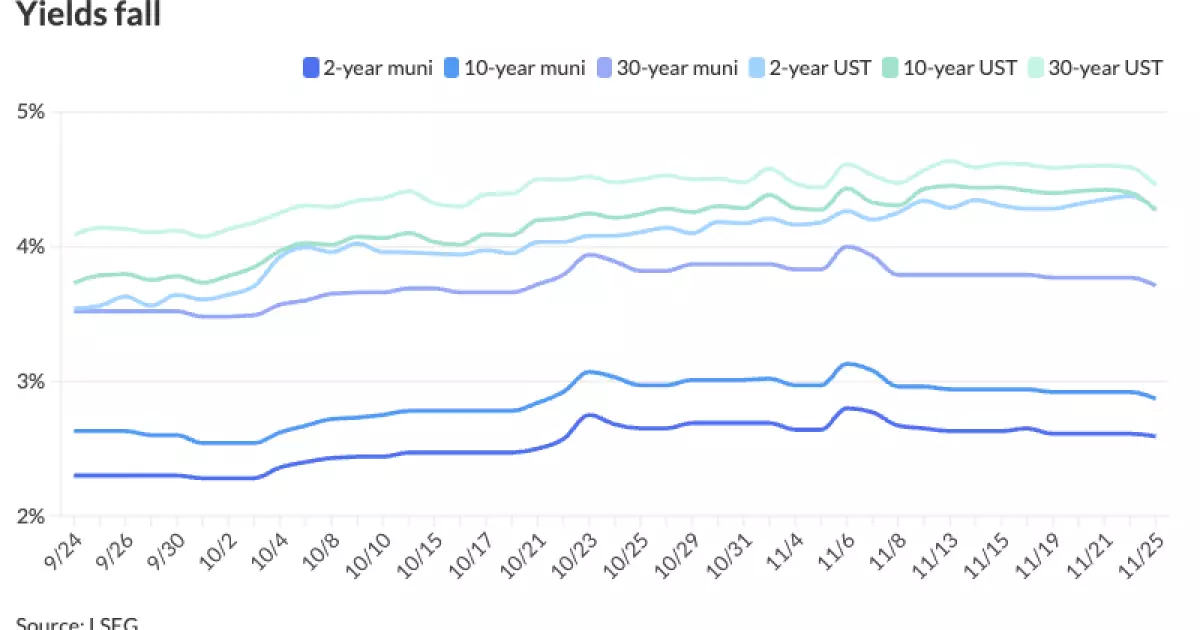

The municipal bond market has experienced a noteworthy transformation in recent weeks, marked by a rally that has shifted investor sentiment and altered the landscape. Following U.S. Treasury movements, municipal yields experienced a decrease that could suggest a burgeoning confidence among market participants. The appointment of Scott Bessent as U.S. Treasury Secretary has not only provided a point of optimism but has also fostered a sense of stability amid potential turbulence in the financial sector. The overall mood indicates a broad-based belief that Bessent’s entry into this pivotal role is a stabilizing force within President-elect Donald Trump’s administration, reflecting favorably on future fiscal policies.

As investors navigate through the possibilities introduced by new leadership, UBS strategists highlight the dual nature of current economic risks, notably inflation and rising interest rates. They suggest that these factors could inhibit the aggressive policy maneuvers previously expected from the incoming administration. This tempered outlook might lead to a reduction in inflationary pressures, which could ultimately be beneficial for fixed-income markets, including the muni space. On balance, while there is concern about potential volatility, the expectation is for U.S. Treasury yields to stabilize in the subsequent years, allowing the muni market to capitalize on this stability.

The performance metrics of the municipal bond market indicate a resurgence, especially in contrast to the preceding months. Daryl Clements from AllianceBernstein points out that strong demand for tax-exempt income has been driving munis’ relative success. Since the start of November, munis have been on an upward trajectory, recovering from losses suffered in October. This turnaround reflects a 0.88% gain, boosting year-to-date returns to 1.69%. High-yield munis, in particular, are thriving, with returns nearing 7%, showcasing the appeal of riskier assets in the current climate.

Another crucial factor is the tightening of after-tax spreads, a development that enhances the attractiveness of munis compared to their taxable counterparts. Conversely, the taxable segment has struggled, yielding negative returns for the month thus far, which accentuates the resilience of municipal bonds amidst broader market challenges.

The numerical landscape reflects a compelling story for investors looking at the relative valuation of municipal bonds against U.S. Treasuries. By assessing various maturity timelines, the two-year municipal-to-Treasury ratio stands at 61%, while the 30-year ratio is even more pronounced at 83%. These figures suggest that municipal bonds, particularly long-dated ones, are trading at heightened levels, thus raising questions about attractive entry points for potential investors. It’s essential to recognize, however, that while munis are currently perceived as expensive, their performance may justify the premium, especially in the context of a shifting interest rate environment.

Despite the prevailing economic concerns, inflows into the muni market continue to demonstrate robust investor appetite. In November, munis have absorbed over $1.2 billion, signaling strong demand, particularly for longer-dated and high-yield options. This contrasts with shorter-duration funds, which have faced asset losses as preferences shift among investors. The nuances in trading activities further highlight this trend, with a marked increase in purchases of 10- to 20-year bonds outpacing recent averages.

Looking ahead, the supply radar indicates a lean week, with only $1.4 billion anticipated. Though the market’s supply is set to dwindle as the year progresses, preliminary signals indicate the potential for recovery in the issuance landscape towards the start of December. Notable upcoming deals, such as significant transactions from the Greater Orlando Aviation Authority and other state agencies, may provide additional opportunities for investors seeking to diversify their portfolios in this classic fixed-income arena.

The revival of the municipal bond market amidst a backdrop of changing political dynamics is a testament to its resilience and attractiveness for income-seeking investors. As the landscape continues to evolve with increased demand and favorable performance metrics, munis present a compelling case for consideration. By keeping an eye on macroeconomic indicators and the ongoing developments in fiscal policy, investors can make informed decisions that leverage the strengths of the muni market amidst a broader economic context. The coming weeks will be crucial for defining the future trajectory of these bonds and their role within diversified investment strategies.