As we approach pivotal events like elections and Federal Open Market Committee (FOMC) meetings, the financial markets are brimming with uncertainty. Investors are remaining cautious and waiting for clearer signals before making significant moves. This moment is critical as it can shape both short-term market reactions and long-term economic policies. Importantly, the outcome of the upcoming election and the direction of the Fed’s monetary policy will likely trigger considerable volatility in the months ahead.

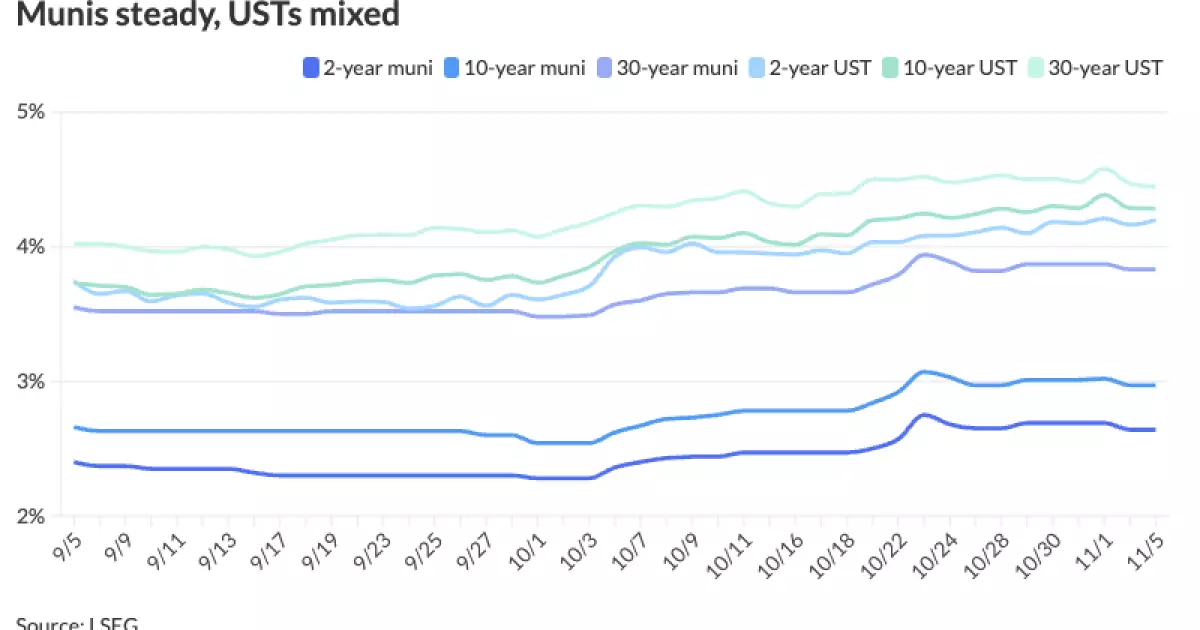

In the current climate, the performance of U.S. Treasuries reflects a blend of sentiments. Some participants in the municipal market remain steady, choosing to tread lightly while expecting significant developments in the near future. The anticipation of a potential rate cut by the Fed is prevalent, yet it is married to forecasts about the election’s outcome. Market analysts speculate about how the results will influence economic landscapes.

Erik Weisman, chief economist and portfolio manager at MFS Investment Management, emphasizes the divergent market reactions anticipated from different election outcomes. If former President Trump secures a victory, it is likely to be perceived as a move toward a more inflation-prone climate. Conversely, a triumph for Vice President Harris is expected to reflect a continuation of current policies, avoiding dramatic economic shifts. This creates a scenario where investors are wary of how these political turns will affect municipal bonds, especially given the potential alterations in tax structures and measures.

Throughout the discourse around the elections, the underlying message is the impact of political outcomes on tax-exempt municipal bonds. Notably, J.P. Morgan strategists provide insight into the implications of various electoral scenarios. For instance, a unified Republican government might influence lower corporate taxes, impacting the demand for tax-exempt bonds detrimentally. Conversely, a liberal approach championed by the Democrats could potentially heighten tax burdens on corporations, improving the appeal of municipal bonds.

Interestingly, betting markets speculate on the probability of a Republican sweep, noting a significant likelihood of unified GOP control. Despite varying opinions about these outcomes’ feasibility, the consensus resonates with the assertion that a divided Congress could stifle transformative legislation, complicating the renewal of expiring provisions from the Tax Cuts and Jobs Act.

As political dynamics evolve, the bond market’s trajectory is likely to reflect its responsiveness to burgeoning inflationary pressures. Analysts indicate that Trump’s proposed trade policies, particularly increased tariffs, could exert downward pressure on fixed incomes. Specifically, the suggestion that a Trump administration would negatively impact bond market stability is supported by the potential of rising inflation come 2025.

Industry experts like Andrzej Skiba from RBC Global Asset Management argue that the interplay between inflation and the Fed’s interest rate decisions will remain critical. As rates are likely to rise with higher tariffs, Skiba warns of a perilous sequence where the Fed might be constrained in its ability to cut rates despite signs of an economic slowdown. The intensity of these inflationary pressures forms the crux of discussions around Fed’s monetary policy, drawing attention to how closely inflationary movements are being monitored.

The debate surrounding national debt also plays a significant role in shaping investor sentiment. As Bryce Doty of Sit Investment Associates suggests, the government faces a delicate balancing act in terms of managing interest rates against burgeoning debt levels. The implications of high deficits mean that irrespective of who takes office, the handling of fiscal health will be paramount.

While Doty posits that Trump’s economic policies may yield productive growth, the reality for the bond market remains precarious. The Fed’s policy trajectory appears to be aiming for moderation—likely opting for a modest rate cut to navigate the vigorous economic landscape shaped by impending election outcomes and associated fiscal policy.

As the financial landscape braces for the uncertainties of the election and Fed’s upcoming decisions, the prudent approach is one of caution for investors. With mixed signals from both Treasuries and equities, the road ahead is laden with potential volatility. The overarching narrative centers around the potential for a new fiscal reality, influenced by both local political climates and broader economic paradigms. Navigating this landscape requires vigilance and adaptability, as the consequences of upcoming events are sure to echo through the market for the foreseeable future.