As the municipal bond market settles into a steady rhythm, cautious optimism prevails. Recent data indicate stability leading up to pivotal decisions from the Federal Open Market Committee (FOMC), as U.S. Treasury yields show little movement. This steady performance, coupled with a mild uptick in equity markets, suggests that investors are bracing for significant policy shifts. Insights from experts at BlackRock highlight the potential for enhanced volatility in this sector due to the unpredictability surrounding the Trump administration’s economic policies. The emphasis on deregulation may foster economic growth; however, the introduction of new tariffs could dampen this momentum while marginally increasing inflation.

The imminent FOMC meeting brings heightened interest regarding interest rates, particularly in light of the prevailing inflation and positive growth data. Market analysts, including Municipal Market Analytics’ Matt Fabian, predict that another rate cut seems unlikely in the short term. They further clarify that the momentum from earlier cuts will begin to taper this year, with no anticipated hikes. This sentiment is reinforced by a sustained inability to meet the Fed’s 2% inflation target amidst ongoing economic resilience. BlackRock’s strategists argue that a steepening of the Treasury yield curve is plausible, with front-end rates likely to decrease as the Fed navigates its early-year activities.

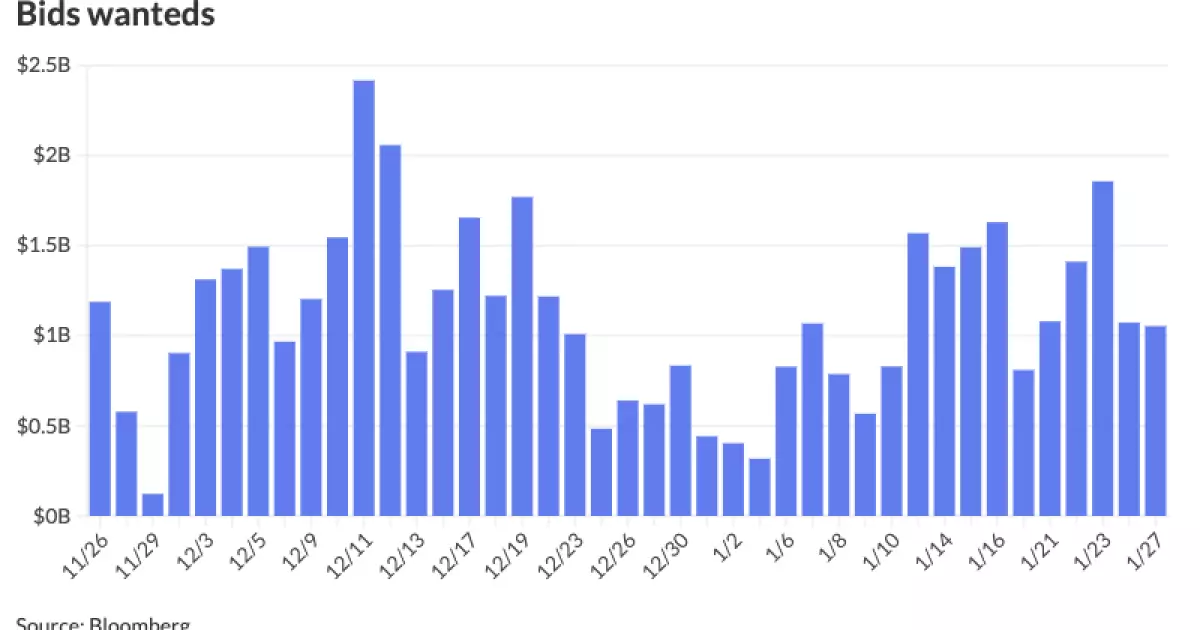

While the municipal bond landscape appears stable in the near term, several underlying factors are steering investor behavior. A notable factor is the consistent demand from retail investors, driven primarily by attractive yields and stable credit conditions. Recent trading volumes showcase a dynamic marketplace; even amidst a lull in specific trading days, activity surpassed $70 billion. Such resilience underscores a confluence of favorable income prospects and the growing influence of low-cost retail investment platforms. Analysts forecast continued strong demand as investors remain keen on capturing value in municipal bonds, particularly given the considerable cash reserves waiting on the sidelines for more favorable investment opportunities.

Looking forward, the demand forecast is subject to potential interruptions stemming from anticipated shifts in tax policy. Changes, such as modifications to the state and local tax deduction cap, may lessen the need for tax shelter in high-tax jurisdictions, potentially dampening demand therein. Similarly, a reduction in the corporate tax rate could induce a decrease in institutional interest in municipal bonds. This analysis highlights the intricate interplay between tax policy and market dynamics, indicating that legislative changes could spearhead significant shifts in market sentiment and buying patterns.

The current ratios of municipal bonds compared to U.S. Treasuries reflect ongoing market conditions. Reporting from Municipal Market Data reveals stable ratios across various maturities, with two-year and five-year municipal bonds at 64% in comparison to Treasuries. This consistency is pivotal, contributing to the ongoing attractiveness of municipal bonds relative to other fixed-income investments. Additionally, the primary market is witnessing substantial activity. Major institutional players are actively pricing considerable offerings, such as revenue bonds from the Oklahoma Turnpike Authority and the Columbus Regional Airport Authority, denoting robust investor interest across multiple segments of the market.

The upcoming week is lined with significant structured offerings, enhancing the projections for the municipal bond market. Temple University’s revenue refunding bonds are on the horizon, and the anticipated Colorado State Intercept Program-insured bonds from Mesa County Valley School District No. 51 point to sustained institutional engagement. Furthermore, competitive offerings from educational institutions and local governments reflect an ongoing commitment to financing public resources through municipal bonds. These movements indicate that the market remains agile and receptive to new opportunities, positioning itself effectively to weather external economic pressures.

As we survey the municipal bond market, a nuanced picture emerges of stability interwoven with potential volatility. While external factors such as federal monetary policy and taxation present uncertainties, the market’s resilience is underscored by strong retail demand, solid trading activity, and ongoing significant offerings. The year ahead will be critical as investors adapt to the evolving landscape, balancing between opportunities and prevailing risks. Clarity from upcoming policy decisions and market trends will be essential in navigating this intricate financial arena.