The financial markets are in constant flux, driven by various factors including economic indicators, business earnings, and notably, political events. Recently, the results of a significant election in the United States – one that saw a sweeping victory for former President Donald Trump and changes to the Republican stronghold in the Senate – have profoundly impacted the municipal bond market. The resultant shifts in interest rates and investor sentiment shed light on the complex relationship between politics and financial markets.

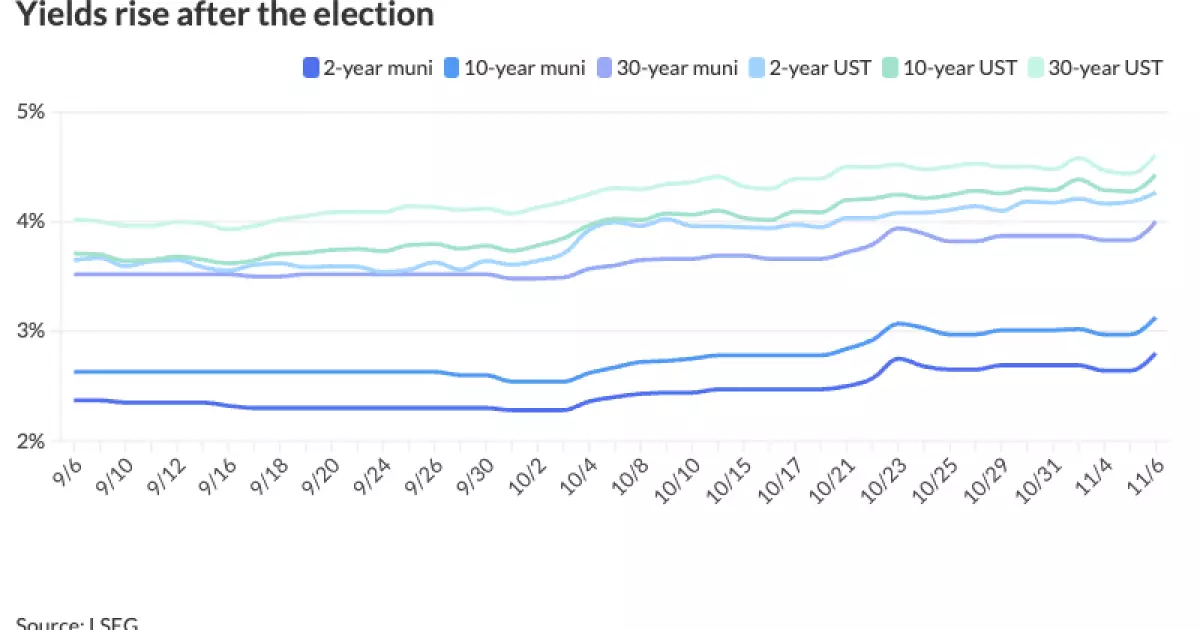

In the wake of Trump’s electoral victory, municipal bonds experienced a notable sell-off. This downturn echoed trends seen in U.S. Treasuries, where rising yields indicated a willingness among investors to embrace higher risk in a “risk-on” trade scenario. The yield curves for triple-A municipal bonds surged by 11 to 17 basis points, showing significant losses particularly among longer-term obligations. Such movements illustrate a market grappling with the implications of new fiscal policies anticipated under a Republican leadership framework.

Peter Block, managing director of credit strategy at Ramirez, emphasized the unpredictability of the election’s outcome despite prevailing expectations of a Trump victory. This phenomenon captures the emotional element of market reactions — investors may anticipate certain outcomes, but the certainty that accompanies those outcomes triggers immediate adjustments in asset values. The dynamics of the fixed income market, particularly municipal bonds, are heavily influenced by these sentiments.

The recent surge in yields shows a significant relationship between market anticipation of fiscal policy changes and the overall economic outlook. Analysts from BMO Capital Markets noted that expectations for growth accompany expectations for higher yields and inflation. Financial markets are beginning to show signs of adaptation; with increased government borrowing to cover large deficits, the supply of U.S. Treasuries is expected to remain elevated, further pressuring yields upward.

Notably, the ratios of municipal bond yields to those of USTs have shifted, indicative of changing risk appetites among investors. For instance, the two-year municipal to UST ratio stabilized at around 66% on Wednesday, suggesting that investors are beginning to re-evaluate the relative safety and yield of municipal bonds against U.S. government securities amidst anticipated changes in fiscal policy.

In the context of broader economic trends, the potential for substantial federal deficits under Trump’s administration looms large. Opinions vary, with some analysts expressing concerns that expansive fiscal policies could lead to reduced economic growth. James Pruskowski, chief investment officer at 16Rock Asset Management, pointed out that financial market uncertainty creates opportunities; hence, market movements could be influenced by the dual factors of inflation expectations and supply constraints.

Furthermore, there’s speculation about how the Federal Reserve will adapt its monetary policy in response to these shifting dynamics. With predictions of potential interest rate cuts in the near future, strategic positions become crucial for both municipal and treasury bond investors. The prospect of a 25 basis point cut in the immediate term seems to underline the Fed’s inclination towards maintaining its data-driven approach in the face of evolving market conditions.

Despite the anticipation of rate cuts, market strategists warn against complacency. Tighter monetary policies could emerge in response to inflationary pressures anticipated from tax cuts — a scenario that reflects the complexity of monetary policy tools in tackling supply-induced inflation. As economic activities continue to normalize, the stakes become higher for decision-making in the monetary realm, especially considering Trump’s focus on tariffs early into his second term.

Morgan Stanley analysts forecast that the implications of trade and tariff strategies will likely begin to dominate discussions in the markets once again. The trade variables in play suggest that threats to growth are manifold—paying attention to market behavior is essential as strategic tariff implementations could leave lasting impacts on investment landscapes.

The market’s reaction to the recent political landscapes reflects deeper underlying currents that investors must navigate carefully. Municipal bonds, once seen as stabilizers, are now responding dynamically to fiscal policy changes and economic forecasts. As uncertainties remain concerning future Fed actions and GOP fiscal strategies, a keen eye on market signals — spanning yields, bond ratios, and equity performances — becomes paramount. The intricate dance between politics and finance will undoubtedly shape the landscape of municipal bonds moving forward, demanding resilience and adaptability from investors.