The robust economic data released recently from the U.S. payrolls sector has created significant ripples across the financial landscape, prompting traders and economists alike to reevaluate their expectations for future interest rates. The most recent jobs report indicated a far stronger growth in employment than analysts had predicted, which in turn led to a sell-off in U.S. Treasuries. Such movements in the financial markets serve as a barometer for assessing investor confidence and the broader economic climate.

The immediate consequence of the sizzling payroll figures was a notable upsurge in Treasury yields. Following the report, Wall Street saw a reallocation of expectations concerning Federal Reserve rate cuts, as evidenced by increases in short-term Treasury yields. The expectation was that instead of the more aggressive 50 basis-point cuts feared in the wake of past economic instability, a more modest reduction of 25 basis points was now deemed plausible for the upcoming months.

Lara Castleton, the U.S. Head of Portfolio Construction and Strategy at Janus Henderson Investors, remarked on the pronounced influence of the payroll numbers, suggesting they provide reinforcement to theories advocating for a “soft landing” of economic conditions. This newfound robustness in labor statistics supports narratives surrounding the Federal Reserve’s motives behind rate adjustments—primarily to balance rates more appropriately with the current economic activity rather than spurring rampant inflation.

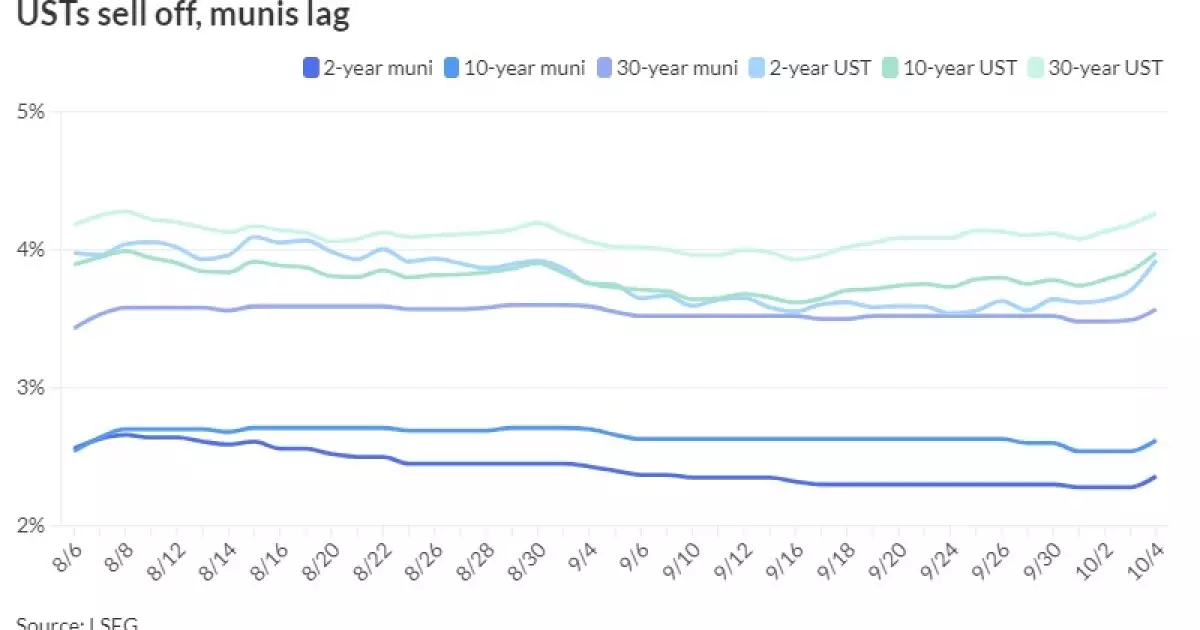

The municipal bond market was not immune to the shifting tides of the U.S. Treasury performance. Triple-A rated municipal bonds also experienced yield increases, albeit they demonstrated a tendency to outperform their taxable counterparts. The implications of these rising yields were evident in the revised municipal-to-Treasury ratios, which underwent considerable adjustments as market dynamics evolved.

For instance, recently reported municipal ratios declined, reflecting a tightening of spreads given the sharper moves in taxable securities. Such correlations signal potential vulnerabilities for municipal bonds, especially in light of a projected $10 billion influx of new issuance expected in early October. The sheer volume of supply could pose challenges for tax-exempt securities, particularly if the marketplace begins reacting more cautiously.

Brokers and financial analysts are now contemplating the ramifications of a heavy issuance pipeline coinciding with an uptick in yields. Mikhail Foux, Managing Director and Head of Municipal Research and Strategy at Barclays, articulated concerns that the combination of increasing supply and market dynamics might prompt investors to retreat momentarily from municipal investments. Such movements could reverse the recent positive market atmosphere, requiring close tracking of impending issuance trends.

As the market digests the implications of the jobs report, the adjustments in investor outlook could significantly influence future economic policies and investment strategies. Analysts predict that the evolving market conditions may lead to further intricacies in determining how the Federal Reserve will respond in its upcoming meetings, specifically concerning rate adjustments.

Approaching the first full week of October, investors will be presented with substantial new issuance opportunities. Leading the pack is a colossal $1.5 billion taxable general obligation bond offering from New York City, complemented by Connecticut’s $935 million general obligation bond offering. Such notable issuances are expected to draw significant market attention and interest, presenting a key thematic focal point for municipal investors.

Subsequently, a competitive deal from New York State, amounting to $521.75 million of general revenue refunding bonds, is scheduled for sale. These sizable deals offer a barometer for the wider market’s receptiveness to new municipal entries and will undoubtedly influence pricing dynamics moving forward.

The intersections of labor market performance, Treasury yields, and municipal bond dynamics present a multifaceted landscape for investors. As the market contemplates the repercussions of recent economic data, the overarching trends provide both challenges and opportunities. Investors must remain agile to adapt to the shifts in interest rate expectations and market sentiments, preparing to navigate potential volatility in the weeks ahead. Through close monitoring of employment indicators and Federal Reserve policies, stakeholders can better position themselves in an evolving financial environment reflective of a resilient, yet unpredictable economy.