The municipal bond market is experiencing a vibrant yet tumultuous phase, characterized by shifting U.S. Treasury yields, changing equity landscapes, and an impending smaller new-issue calendar. As investors seek refuge from market fluctuations, it is essential to dissect the underlying trends and projections that will shape the municipal bond landscape in the coming weeks.

Recent developments in the municipal bond market have mirrored broader fluctuations in the U.S. Treasury market. The release of a robust employment report in January seems to have disrupted a Treasury rally that had previously gained momentum. Strategists at Bank of America emphasize that the emphasis on upcoming consumer price index (CPI) reports is causing “bear steepening” in the Treasury curve. This means the yields on longer-term securities are rising faster than those on shorter-term ones, a turn of events that will likely cultivate a range-bound environment for municipal investors as they brace for potential inflationary pressures.

Barclays strategist Mikhail Foux elucidates that heightened rate volatility is complicating municipal trading. The abrupt shifts in Treasury yields exert considerable influence, as investors attempt to decipher the ramifications of inflation releases and tariff alters. With skepticism reigning amidst these changes, BofA’s strategists warn that market conditions could remain “quite challenging” for participants, especially until there is tangible evidence of cooling inflation forces.

Looking ahead, the municipal issuance schedule presents an estimated $5.5 billion influx next week, partially hamstrung by a holiday-shortened timeframe. Despite this dip, the overall supply for February is anticipated to stay healthy, with visible supply figures hovering around $10.42 billion. The issuance is expected to include substantive segments from major players such as Miami-Dade County, which is projected to launch a substantial $526 million airport revenue bond offering, alongside other significant issues across various jurisdictions.

The resurgence in refunding volumes, particularly in the backdrop of the recent market rally preceding the CPI announcement, indicates a renewed interest among investors looking to capitalize on favorable market conditions. From mid-January to early February, the decline in 10-year municipal yields by approximately 35 basis points has drawn in an impressive $4.2 billion in refunding activities, reflecting a vibrant market pulse.

The interplay between supply and demand remains a focal point in the municipal bond sector. Analysts at Bank of America suggest that the robust volume of redemptions and coupon payments will likely overshadow new issuance in the near term. This trend should lend support to municipal pricing as inflows into mutual funds largely trend positive. With investors continuously seeking refuge in municipal bonds, the market is navigating a delicate equilibrium between healthy issuance rates and persistent demand.

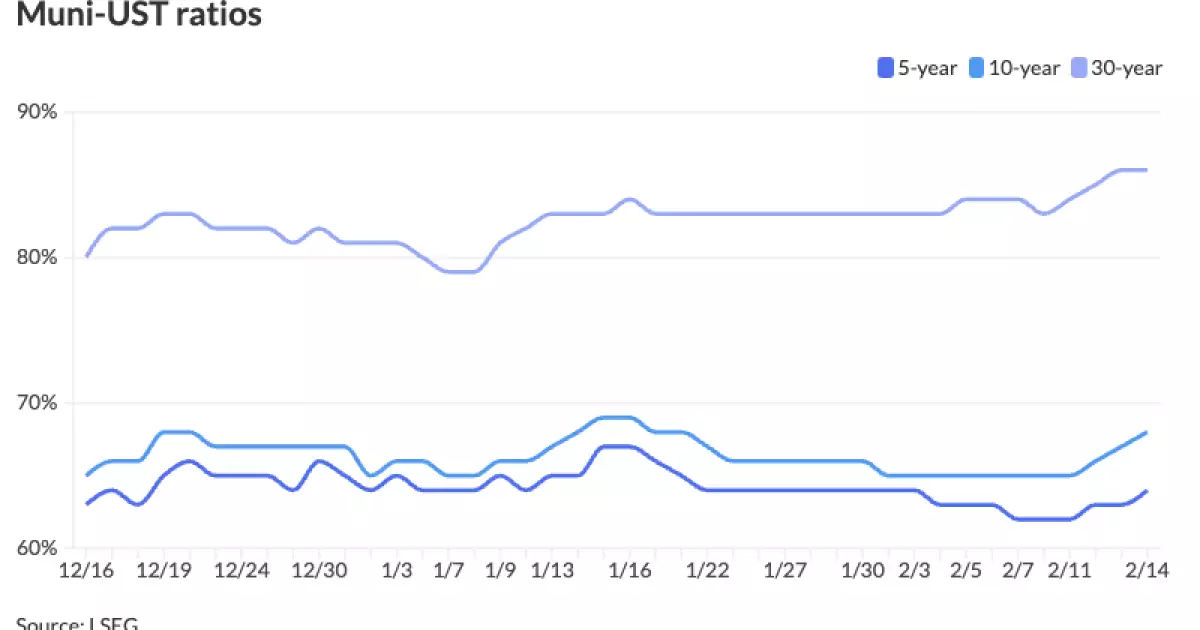

Moreover, BofA’s recent observations on the comparative pricing of municipal bonds against their Treasury counterparts highlights a slight cheapening in municipals, with the two-year and three-year municipal to UST yield ratios resting at 63% and 64%, respectively. This metric serves as a barometer for investors focused on assessing the relative value of municipal assets.

A notable feature of the current market landscape is the “steepening” observed in the AAA muni yield curve. This trend indicates that investors are exhibiting greater caution regarding duration risk, reflecting a shift in sentiment towards more defensive asset allocations. The widening spread between short-term and long-term yields—the 1s10s AAA slope at 37 basis points—signals a growing wariness from investors aiming to navigate impending economic uncertainties. Last year, this slope was deeply inverted, illustrating a stark departure from past market behavior.

The upcoming primary issuance calendar showcases a variety of competitive deals expected from several key municipalities across the nation. Guilford County’s competitive auction of GO school bonds for $570 million could serve as a critical test of market appetite, along with other significant issuers including Texas Tech University and Florida’s Miami-Dade County.

The municipal bond market stands at a crossroads, presenting both opportunities and challenges amid fluctuating interest rates and evolving economic indicators. Investors are advised to remain vigilant, carefully analyzing the interplay of monetary policy, inflationary trends, and issuance rates. As we move further into February, understanding these dynamics will be crucial for making informed strategic decision-making in what promises to be an intricate and potentially rewarding environment for municipal bond investors. As always, a balanced approach, with an eye on both risk management and market timing, will be essential for navigating this complex financial landscape.