As the municipal bond market navigates the post-holiday landscape, recent trends indicate a stabilizing environment with evolving opportunities. After witnessing a brief rally in U.S. Treasury (UST) yields in mid-January, the municipal market has shown resilience, though not without its challenges. UST yields fell slightly on Friday, prompting some analysts to re-evaluate the attractiveness of municipal securities in light of current market dynamics.

Market strategist Mikhail Foux from Barclays highlighted that the outperformance of tax-exempt bonds was especially noticeable despite a backlog of new issuances. This hints at a market sentiment that is cautiously optimistic despite anticipated supply pressures over the next couple of years. Investors are becoming increasingly vigilant as a potential cap on tax-exemption benefits looms on the horizon, an issue that is likely to keep issuers engaged in the initial months of 2023.

The current environment showcases a notable dichotomy in the municipal bond space. The Bond Buyer’s visible supply sits at a significant $9.631 billion, with expectations that new issuance will not diminish in the near term. Municipal bonds, in general, have started the week on a cheaper note, especially when juxtaposed against recent performance metrics. However, this cheapness has been short-lived, as momentum built within the market quickly rectified ratios.

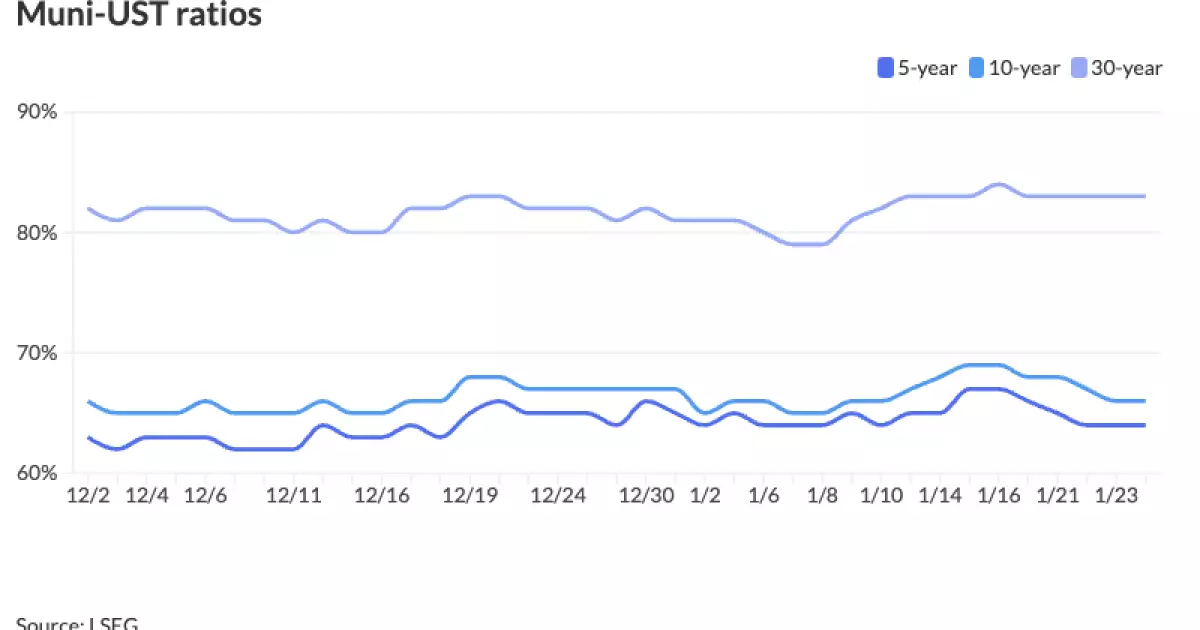

Foux observed that the tax-exempt market had slipped into “unattractive territory” again after an initial performance surge against USTs. Over the past few months, municipal-UST ratios have fluctuated within tight ranges, making it difficult to find robust investment opportunities. The two-year to UST ratio hovered around 64%, with five-year and ten-year ratios matching this sentiment at similar percentages. Although these ratios suggest potential room for gains, Foux argues it remains challenging to advocate for municipals given the current levels.

Despite the constraints, Foux pointed out a significant opportunity: California municipal bonds, which have displayed volatility in light of recent wildfires. The California index has substantially lagged behind its investment-grade counterparts, underperforming by about seven basis points since natural disasters intensified in the area. The disruption marked by these adverse events led to a reevaluation of California’s debt profiles.

Yet within this context lies potential recovery. While credits from the Los Angeles Department of Water and Power (LADWP) remain under scrutiny, several California bonds have become attractive to discerning investors. The situation illustrates again how regional factors can drastically impact local municipal bond performance, often creating opportunities amidst adversity.

Future Outlook and Market Strategy

Looking ahead, Foux’s team at Barclays is adopting a more neutral stance after a brief spike in positivity concerning the market’s trajectory. They suggest that anticipating a minor pullback could present a more favorable entry point for investors looking to capture value within the municipal sector. Consequently, the current investing climate conveys a duality—marked by cautious optimism but tempered by market realities.

In concert with upcoming issues, analysts anticipate a softening of issuance as market participants digest existing supply. Next week is projected to witness a drop in new issuance to roughly $5.151 billion, as the Oklahoma Turnpike Authority and Columbus Regional Airport Authority lead the way with significant bond deals. Investors are encouraged to observe these upcoming events closely, as broader municipal trends often hinge on the immediate supply-demand-relationships established during these key periods.

The municipal bond market in early 2023 reflects a complex blend of stability alongside cautious reassessment. With changing dynamics in UST yields, projected bond supplies, and the tangible effects of local economic challenges, market participants must be vigilant. While opportunities, particularly in California credits, emerge amidst adversity, any signs of a market pullback would designate a critical period for investment strategies. It remains essential for investors to remain informed and agile, ready to adapt to the imminent shifts within this evolving landscape.