The municipal bond market exhibited notable steadiness on Monday, even as U.S. Treasuries showed signs of slight weakening. The equity markets reflected a mixed performance, highlighting the divergent trends affecting various asset classes. According to Refinitiv Municipal Market Data, ratios between municipal bonds and Treasury yields were relatively stable during the afternoon. The two-year muni-to-Treasury ratio sat at 62%, reflecting investor confidence in shorter maturities, while the longer maturities, particularly the 30-year bonds, remained more attractive at a ratio of 87%. This suggests a nuanced approach among investors as they adjust their strategies based on the evolving economic landscape.

A Positive Shift in August Returns

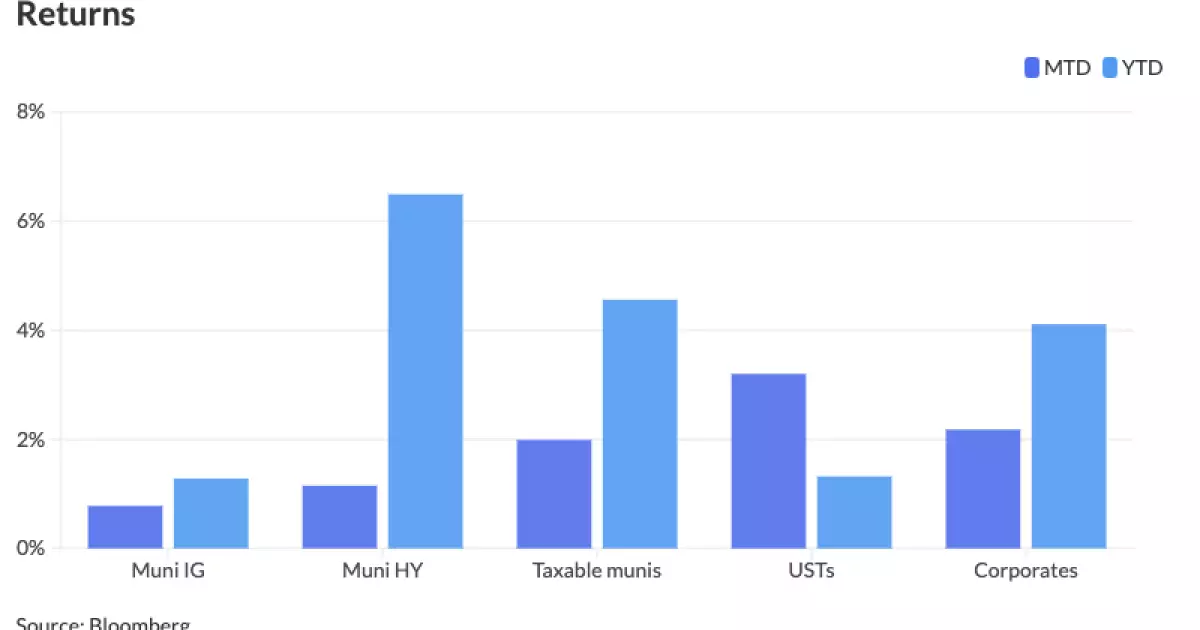

August has proven to be a contrasting month compared to last year, with taxable municipal bonds registering a gain of 0.78% this month, inevitably boosting year-to-date returns to 1.28%. Jason Wong, a vice president of municipals at AmeriVet Securities, describes this trend as a “stark reversal” from the losses experienced in August of the previous year when municipal bonds were beleaguered by a 1.79% drop—largely due to the Federal Reserve’s aggressive rate hike strategy aimed at combating inflation. This year’s performance, particularly in August, is bolstered by recent shifts in monetary policy and market expectations, suggesting that investor sentiment may be beginning to recover, albeit cautiously.

Yield Movements and Anticipated Adjustments

Analyzing yield movements reveals that, while municipal bond yields have experienced an average increase of 26 basis points across the curve, the more recent trends indicate a slight easing. The 10-year notes, important for gauging medium-term borrower sentiment, have seen yields rise by approximately 36 basis points within August. Notably, there has been a small retreat this month, with yields decreasing by an average of 2.5 basis points for 10-year munis. Factors contributing to this dynamic may be attributed to remarks from Fed Chair Jerome Powell, who suggested that it might be time for the central bank to consider rate cuts. Following these statements, both Treasury yields and stock prices experienced a downward trajectory, reinforcing optimistic sentiments within the municipal bond sphere.

This week, municipal issuance volume appears to be relatively average at $8.9 billion, particularly leading up to the Labor Day holiday, an indicator of typical summer market behavior. However, the forward calendar shows promise, with expectations for above-average issuance in the coming weeks. Chris Brigati, senior vice president at SWBC, noted a “summer slowdown,” yet there exists an undercurrent of activity and interest, especially in new issuances. A significant number of sizable deals are imminent, including a $1.1 billion bond from the North Texas Tollway Authority set to price soon, indicating a robust pipeline that may pique investor interest.

Performance of Key Maturities

Investors have seen varying levels of yield performance across maturities. In the most recent trading session, AAA scales showed minimal fluctuation, with the one-year at 2.51% and remaining stable into two-year notes at 2.45%. Longer duration bonds, like the 10-year and 30-year, exhibited yields of 2.69% and 3.57%, respectively. Yield adjustments are also reflected in ICE and Bloomberg BVAL data, where slight increases in yields were noted along specific points on the curve. Such stability or slight downticks in yields for medium maturation bonds often suggest underlying investor confidence in the market’s trajectory, aligning with broader economic signals.

With the continued presence of economic uncertainty and the potential for adjustments in monetary policy, it is crucial for municipal bond investors to remain vigilant. The interplay between treasury yields and municipal performance can offer insights into investor sentiment and strategic positioning. The impending bond issuance, coupled with anticipated yield adjustments in response to economic commentary from the Fed, enhances the landscape for active managers and investors alike.

As market conditions evolve, attention to fundamental indicators, as well as tactical adjustments based on macroeconomic forecasts, will be essential for navigating the municipal bond space effectively. Overall, while challenges persist, the municipal bond market is showing resilience and adaptability, reflecting a potential recovery phase that could bolster investor confidence in the months to come.