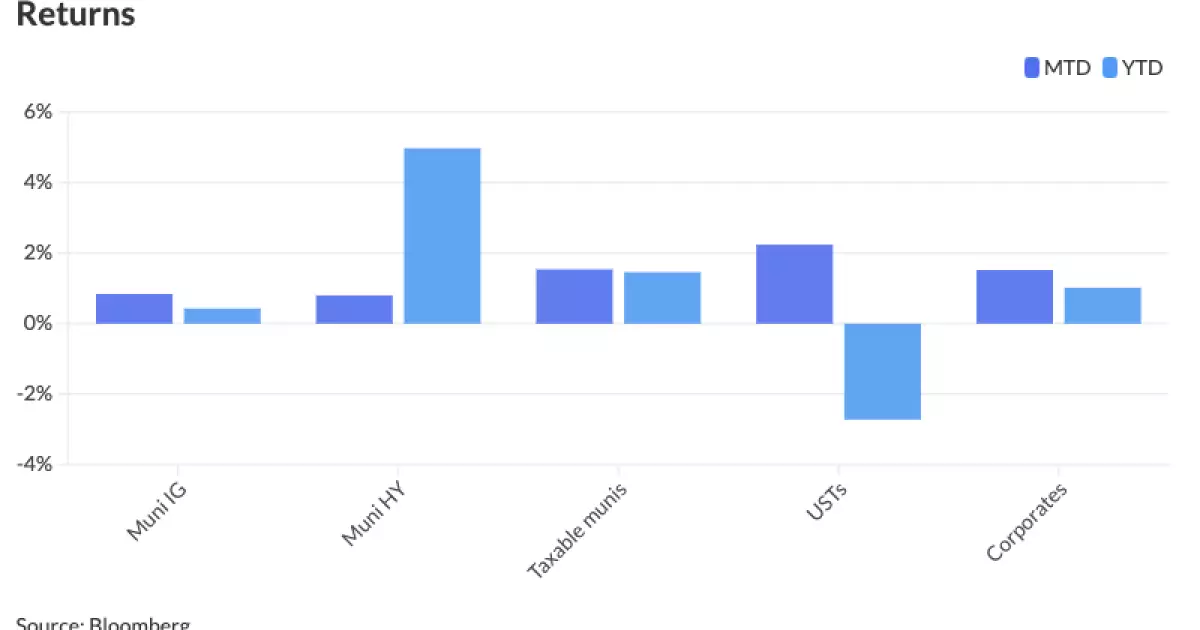

The municipal bond market has recently exhibited stability, showing little significant fluctuation as trading progressed on Monday. The backdrop of firmer U.S. Treasury yields and a mixed performance in the equity markets has contributed to a relatively calm atmosphere in the municipal sector. Jason Wong, the vice president of municipals at AmeriVet Securities, noted that yields in the municipal space have steadily declined this month, averaging a drop of approximately 15 basis points across the maturity curve. However, despite this short-term rally, the overall year-to-date yield levels remain elevated.

In more specific terms, the 10-year municipal bond yield experienced a small decrease, falling by 2.2 basis points to settle at 2.78% at the close of last week. Yet, this is still markedly higher than the beginning of the year when the yield for the same maturity stood at just 2.28%. This trend signifies that, while there is some positive movement in the short term, the long-term conditions for municipal bonds remain unyielding relative to earlier in the year.

One significant point raised by Wong was the comparative pricing of municipal bonds versus U.S. Treasuries. At the commencement of the year, the 10-year muni-to-Treasury ratio was recorded at 58.48%. By the current trading period, while municipal bonds are still viewed as relatively cheaper against Treasuries, they continue to exhibit richness when compared to their historical averages, which hover around 86.50%. As of the latest assessments, the ratio for the two-year muni to Treasury stood at 65%, with corresponding metrics for three-year, five-year, 10-year, and 30-year maturities indicating a general trend of solid but cautious demand across the board.

Wong’s insights signal that any forthcoming policy adjustments from the Federal Reserve could influence these ratios, especially if expectations for rate cuts materialize. With the Federal Open Market Committee’s upcoming meeting, market participants are closely watching for cues on potential rate changes, particularly those hinting toward a possible cut as early as September.

Last week’s macroeconomic data, perceived as “Fed-friendly,” suggests that inflation may be softening, prompting speculations regarding the Federal Reserve’s monetary policy direction. Should Fed Chair Jerome Powell signal a rate cut, it could trigger a resurgence of activity in the municipal bond market, encouraging issuers to return in greater numbers. Wong explains that a shift in rates could eventually normalize ratios to levels experienced earlier in the year, potentially restoring yields to those same January benchmarks.

The current market sentiment is also influenced by recent trends in municipal bond issuance and fund flows. Although a significant volume of new issuance has taken place in the preceding months, this week’s anticipated issuance is expected to diminish to about $6.6 billion, primarily influenced by the uncertainty surrounding the FOMC meeting. This decrease could set the stage for a more vibrant market environment in the days that follow.

In the primary bond market, noteworthy transactions took place, such as Wells Fargo’s recent offering of $1.106 billion in general obligation bonds for New York City. The significant first tranche included bonds with yields ranging from 3.01% up to 3.36%. Similarly, Goldman Sachs is in the process of pricing $638.745 million in gas project revenue bonds for the Black Belt Energy Gas District.

These large offerings indicate that despite the overall steadying of municipal yields, there remains a substantial demand for new debt instruments, particularly those that align with current yield opportunities. Birch Creek Capital strategists have noted that any shift in Federal Reserve language regarding rates could drive issuers back into the market, enhancing overall bond liquidity.

As we look toward the coming weeks, market analysts anticipate that any looseness in monetary policy could incite renewed interest in municipal bonds. The data as reported by LSEG Lipper highlighted an inflow of $866 million into long-term funds last week, creating a favorable backdrop. However, there has also been noted selling activity, reflecting a strategic repositioning among investors seeking more attractive new issues.

Overall, the municipal bond market is positioned on a precipice. Any potential shifts in interest rates, alongside current market trends, could significantly alter the landscape. As investors and issuers alike monitor the Federal Reserve’s next moves, the potential for both challenges and opportunities remains high. In a market often viewed as stable, the dynamics of interest rates and issuance levels could spark considerable activity, making the coming weeks critical for municipal bond stakeholders.