The municipal bond market experienced a notable correction on Wednesday, characterized by a substantial rise in yields, particularly as it attempted to align itself with the movements observed in the U.S. Treasury market. This shift was primarily driven by the need to adjust ratios that had previously extended beyond reasonable levels due to the recent outperformance of munis. The adjustments had repercussions not just in terms of yields, but also in the structuring of primary market deals, which were repriced to reflect the changing landscape.

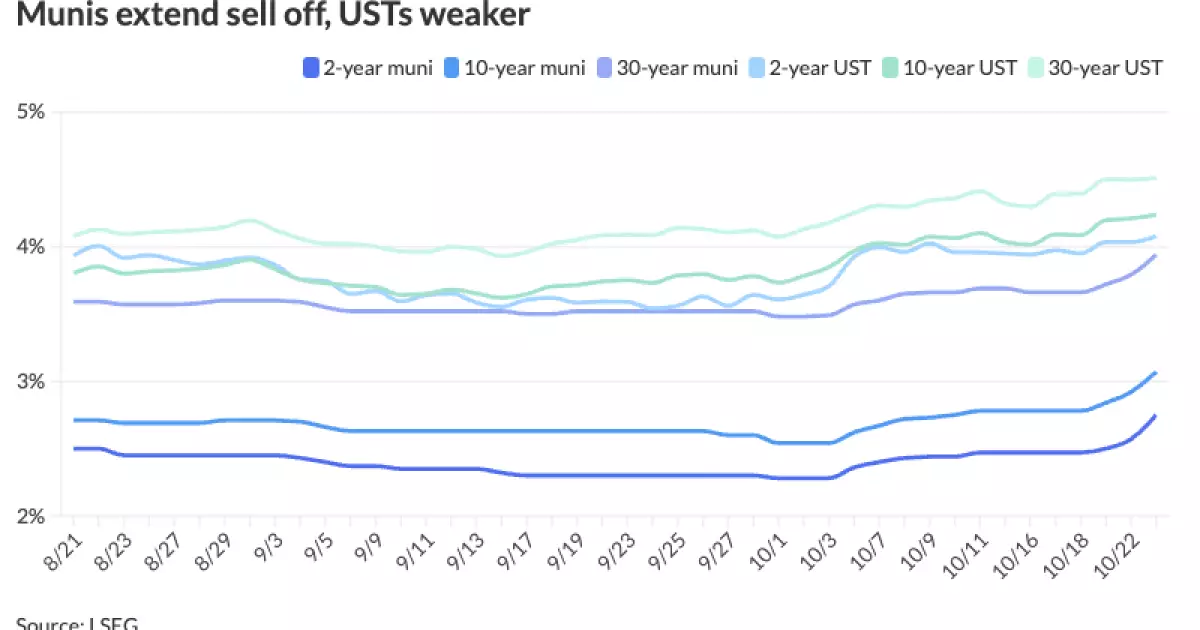

On Wednesday, municipal yields soared anywhere from five to eighteen basis points, culminating in the 10-year yield surpassing the 3% threshold for the first time since early July. Across the U.S. Treasury market, yields also increased, albeit by a smaller margin. The ratios between municipal and U.S. Treasury yields climbed, signaling a wider divergence. Specifically, according to data from Refinitiv Municipal Market Data, the two-year ratio stood at 67%, with further significant increases reflected across longer durations.

This revaluation of yields calls into question the stability of municipal bonds in an environment where U.S. Treasuries have been experiencing consistent yield growth. Kim Olsan from NewSquare Capital underscored the importance of seeing aligned trades that could stabilize trends rather than the sudden and pronounced double-digit yield cuts experienced on Wednesday.

A myriad of macroeconomic influences has exacerbated the volatility within the municipal bond market, creating a more challenging landscape for investors. The growing likelihood of a Republican electoral victory seems to have contributed to an increase in Treasury rates, raising concerns surrounding deficit spending and inflation. According to James Pruskowski from 16Rock Asset Management, these worries have instigated a broader sense of uncertainty, further dampening liquidity within the municipal sector.

As investors brace for potential policy shifts, issuers within the municipal space have accelerated their fundraising efforts, attempting to secure necessary funds amid this political ambiguity. Pruskowski pointed out that “coming off rich muni-Treasury ratios” has led to a swift repricing of the market, creating opportunities for new capital to enter, particularly as credit spreads have widened.

Data from the Investment Company Institute indicates a consistent inflow trend into municipal bond mutual funds, which have seen $1.524 billion of inflows during the week ending October 16, marking the eleventh consecutive week of inflows. This presents a contrasting picture against the background of rising yields, showing that investor demand for municipal bonds remains resilient despite the rising interest rates. Exchange-traded funds also reflected a healthy inflow, recovering from previous outflows.

These trends suggest that investors maintain a long-term view regarding the stability and attractiveness of municipal bonds, likely due to tax benefits and the relative safety compared to other asset classes.

In the primary market, several noteworthy transactions occurred that illustrate the adjusted yield environment. For instance, the New York City Transitional Finance Authority priced $1.5 billion in future tax-secured subordinate bonds but with noticeable yield increases compared to earlier pricing. Similarly, the Ohio Housing Finance Agency placed $275 million in residential mortgage non-AMT social revenue bonds, adjusting yields upward from previous transactions.

As different tranches across various sectors were repriced to reflect the current yield environment, a substantial uptick in costs for issuers became evident, indicating market sensitivity to changes in Treasury rates. The competition in the municipal market remained fierce, with larger issues seeing better attention but subsequently forced to adjust pricing in response to yield fluctuations.

Moving forward, the municipal bond market will need to navigate a complex landscape influenced by macroeconomic elements and shifting investor sentiment. With inquiries into future inversions in the yield curve and the potential for further corrections, care must be taken by both investors and issuers alike. Given the heavy supply anticipated in the coming weeks, market pressures likely will necessitate further adjustments, particularly against the backdrop of a changing political and economic climate.

As participants in the municipal market remain vigilant, a potential restructuring of expectations regarding yield ratios and credit performance may emerge, paving the way for more balanced trading behavior in light of the evolving economic environment. The resilience of municipal bonds will continue to be tested, yet the focus on long-term stability may present opportunities even amidst headwinds.