Municipal bonds, commonly known as munis, represent an important segment of the fixed-income market that often garners attention from both institutional and retail investors due to their tax advantages. Recently, the municipal bond market displayed notable stability, even in the face of a fluctuating Treasury market. As the week unfolded, the dynamics of supply, demand, and investor sentiment became increasingly fascinating amidst a backdrop of significant inflows into municipal bond mutual funds.

On Thursday, the municipal bond market appeared notably steadfast despite the mixed performance seen in U.S. Treasury securities, where yields fluctuated. The last significant deals of the week presented an opportunity for investors to engage in the space while also reflecting an inherent resilience within the municipal sector. The two-year municipal bond’s yield was reported at a ratio of 64% compared to its Treasury counterpart, with successive maturities showing similar trends.

What this ratio indicates is a sustained interest in munis, particularly from investors seeking to offset the tax implications of their income. This could signal a budding trend as more individuals and institutions recognize the enduring value of municipal bonds, especially as competitors, such as U.S. Treasuries, are grappling with their own challenges amid economic uncertainties.

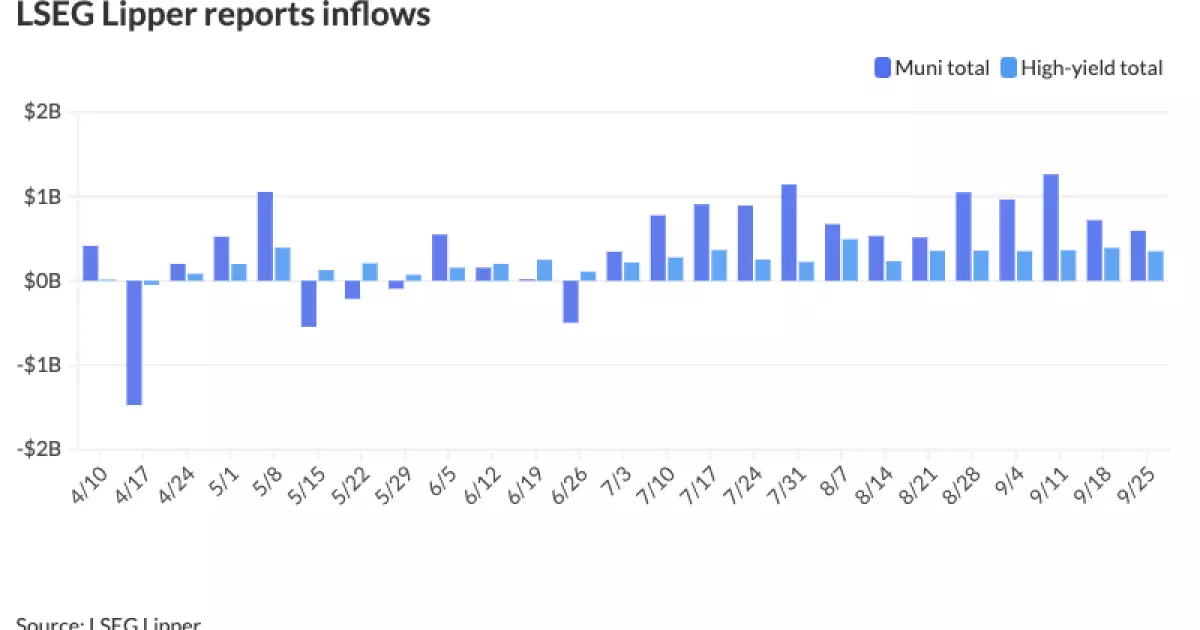

The inflow of capital into municipal bond mutual funds has reached an impressive 13 consecutive weeks, which is a strong indicator of positive sentiment among investors. High-yield municipals have been at the forefront of these inflows with $349.2 million recorded in the latest week alone. Comparatively, this surge in high-yield issuance (an increase from $7.6 billion to approximately $20 billion year-to-date) corroborates the theory that investor appetite for yield-oriented investments remains robust.

This trend is especially notable considering that high-yield securities typically present higher risk profiles compared to investment-grade munis. However, as interest rates have stabilized and economic conditions become increasingly complex, the risk-return balance has worked in favor of certain high-yield offerings. The favorable interest in municipal high-yield offerings can be attributed to the favorable tax-equivalent yields they provide compared to corporate bonds, giving them a distinct edge in attracting income-focused investors.

Another crucial aspect of the municipal bond market’s current state is the role of the secondary market. The liquidity in this space is often dictated by both supply and demand dynamics that change based on investor sentiment and broader economic indicators. In recent weeks, secondary market trading volumes have shown relative calm, which can be beneficial in helping stabilize bond prices.

With September historically being a month where many portfolio managers reassess their positions and either deploy sidelined cash or take profits, the municipal space could witness a slight departure from typical market patterns. Analysts note that the influx of cash into munis could lead to unexpected upward pressure on yields, but this transition is expected to be gradual rather than abrupt, allowing investors time to strategize accordingly.

Looking ahead, the prospect of increased issuance following the upcoming election could create significant market activity. The anticipated ‘outsized’ supply may lead to short-term adjustments in the yield landscape as market participants recalibrate their expectations. However, fixed-income experts remain optimistic about the underlying strengths of municipal bonds, especially given the recent evidence of healthy flows and investor appetite.

Investment opportunities continue to abound in this space, particularly for high-net-worth individuals seeking tax-advantaged options. Intermediate AA-rated bonds offering yields around 2.75% present attractive taxable equivalent yields that cater to wealthy investors keen on maximizing their income. Bureau of Economic Analysis reports also suggest that, as economic planning becomes increasingly vital in an unpredictable environment, municipalities focusing on infrastructure and public essential projects could see enhanced demand, further supporting pricing.

Moreover, the consistency of the municipal bond market amidst external pressures reinforces its reputation as a reliable segment within the overall fixed-income landscape. The trends suggest a promising trajectory as municipal bonds adapt to the evolving economic framework, rewarding investors with potential yield opportunities and relative safety.

In a landscape characterized by volatility, the municipal bond market exhibits a remarkable adaptability. The sustained inflows into municipal bond mutual funds over the past weeks are indicative of a larger trend where investors are seeking refuge in these tax-efficient securities. As supply increases and market dynamics shift, the resilience of this sector will be tested, but the current sentiment offers a solid foundation for investors navigating the complexities of today’s economy. With the right information and strategies, the municipal bond market remains a viable avenue for prudent investment.