The landscape of the municipal bond market has been fraught with fluctuations in recent weeks, reflecting a complex interplay between interest rates, investor sentiment, and economic indicators. As we analyze the current state of the market, it becomes evident that various factors are influencing movements in yields, issuance levels, and investor behavior.

Over the past week, there has been a notable downturn in municipal bond values, marked by significant reductions in triple-A yield curves. This downward trend culminated last Thursday with cuts in municipal yields ranging from two to ten basis points. In contrast, U.S. Treasury yields saw a rise of four to seven basis points. Such dynamics suggest an ongoing challenge for the municipal bond sector, largely tied to fluctuations in the U.S. Treasury market.

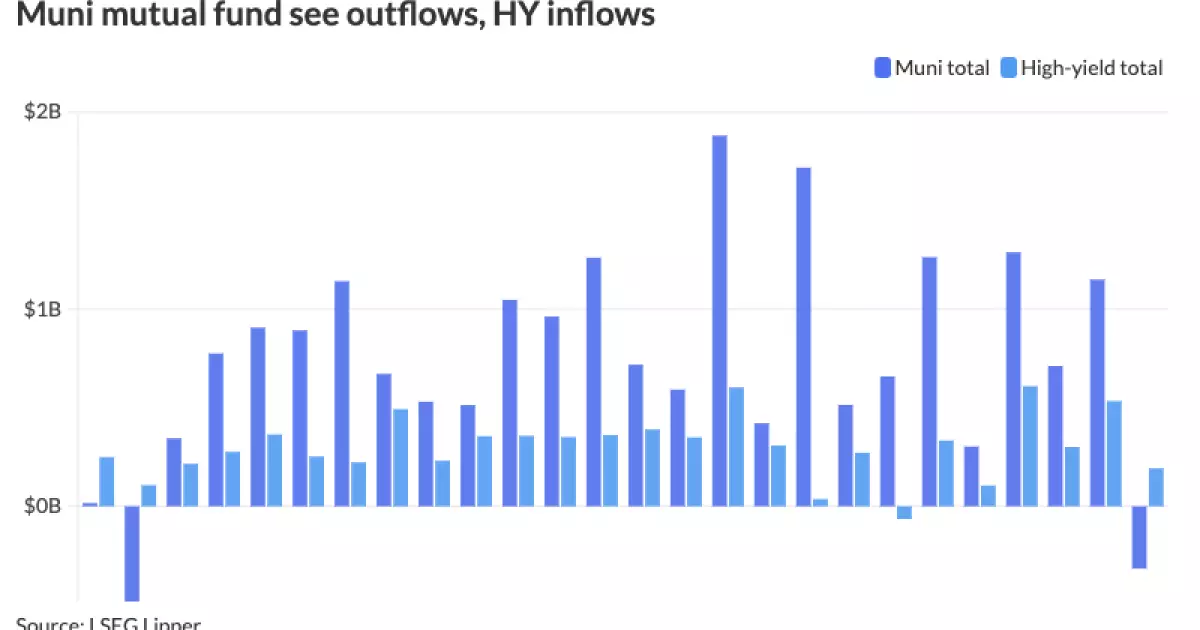

Investors appear to be reassessing their positions, as evidenced by recent outflows from municipal mutual funds. The LSEG Lipper reported an outflow of $316.2 million for the week ending December 11, breaking a streak of 23 consecutive weeks of inflows. In stark contrast, high-yield municipal bond funds recorded inflows of $192.3 million, indicating a possible shift in investor preference towards riskier assets in the current climate.

Mark Paris, chief investment officer at Invesco, emphasized that the current volatility in the muni market is heavily influenced by the Federal Reserve’s actions regarding interest rates. Despite the Fed’s recent moves to cut rates, the municipal bond market is still sensitive to movements in Treasury yields. This correlation indicates that even minor fluctuations can lead to notable adjustments in municipal pricing.

Furthermore, Paris posited that the duration of negative trends in Treasury yields can exacerbate cuts in the municipal market. This volatile interaction between municipal and Treasury yields raises important questions about the sustainability of current yield ratios, especially as the market heads into the new year.

Adding to the complexity are the changing trends in money markets. Recent reports indicate a volatility in money market yields, with tax-exempt municipal money market funds experiencing a withdrawal of $1.25 billion for the week ending December 9. The average yield for such funds fell to 1.83%, a clear indicator of the broad challenges facing tax-exempt instruments amid shifting investor strategies.

Conversely, taxable money market funds have seen a surge, gaining $6.94 billion in assets. With yields hovering around 4.28%, taxable options could become increasingly attractive for investors seeking better returns. The contrasting flows into taxable versus tax-exempt funds underscores a bifurcation in investor sentiment, shaping the broader market landscape.

Looking ahead to 2024, experts anticipate record levels of issuance in the municipal bond market. Despite a slowdown in issuance rates towards the end of this year, there are indications that upcoming deals, like the anticipated $1.5 billion in tax-exempt subordinate bonds from the New York City Transitional Finance Authority on December 17, could rejuvenate the market. Many analysts see this as a pivotal moment for the municipal sector as it battles challenges posed by interest rates and investor confidence.

Moreover, analysts expect a robust bond volume in 2025, with estimates suggesting issuance may approach $500 billion. Nevertheless, some believe that the market could see even higher values if issuers increase their activity in anticipation of potential changes to tax exemptions. This speculation could embolden issuers to accelerate their bond offerings to capitalize on favorable conditions while they last.

The current municipal bond market is navigating a challenging environment characterized by declining yields, changing investor preferences, and the overarching influence of Federal Reserve policies. The interplay between the municipal and Treasury markets will remain a focal point for investors as they seek to understand the implications for future investments.

Investors and market participants must remain prudent and informed as they face uncertainty in the coming months. Balancing the risks between municipal and taxable assets, along with anticipating the effects of potential legislative changes regarding taxes, will be crucial for effective capital allocation in this evolving landscape. As we venture into 2024, strong issuance levels coupled with cautious optimism may help stabilize a market that has seen considerable turbulence in recent times.