Thursday marked a notable turnaround for the municipal bond market, breaking a streak of rising yields that had persisted for four consecutive days. Municipal bonds experienced a noticeable uptick as their yields decreased by up to seven basis points, a positive shift for investors. This downward trend in yields was mirrored in the U.S. Treasury market, where yields also fell between one to five basis points. As municipal bond yields softened, the ratios comparing municipal to Treasury yields showed a slight decline, indicating a re-evaluation of risk and return dynamics in this sector.

According to data from Refinitiv Municipal Market Data, key ratios for various maturities demonstrated shifts—most prominently, the two-year ratio was recorded at 66%, indicating particularly favorable conditions for short-term investors. Such metrics reflect the prevailing sentiment in the market that may influence investment decisions moving forward.

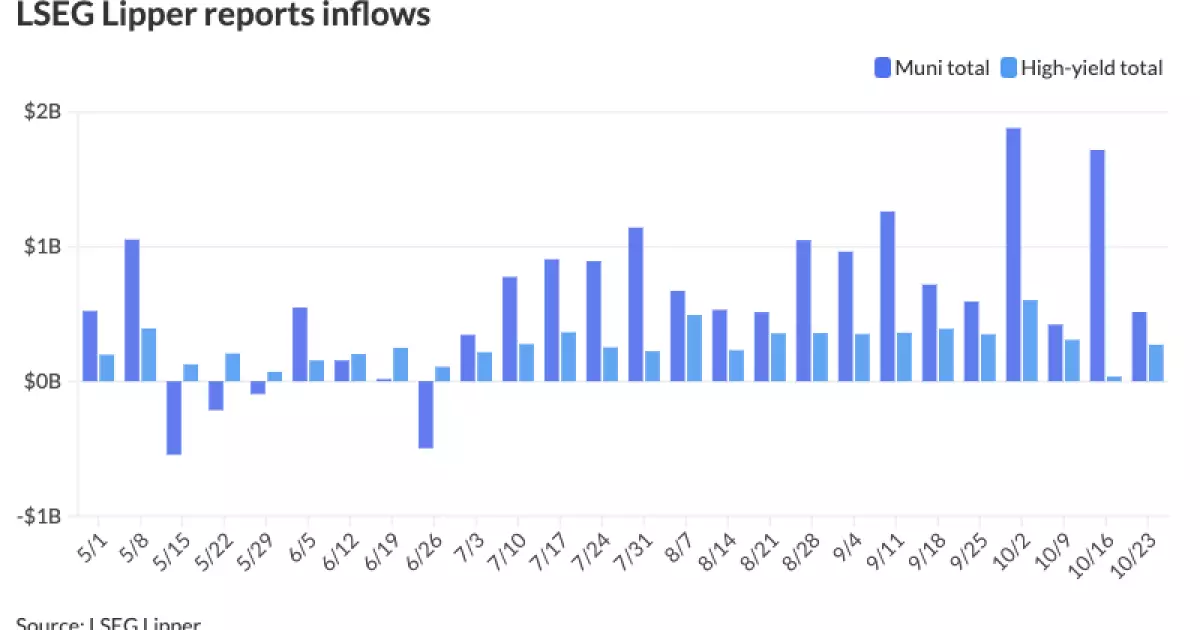

Investor interest in municipal bonds remains robust, as evidenced by the recent LSEG Lipper report, which indicated a significant inflow of $514.7 million into municipal bond mutual funds. This marks the 17th consecutive week of inflows, highlighting a consistent trend despite a slowdown in the previous week when $1.718 billion was recorded. High-yield funds captured a particularly large share of this new investment, receiving $271.8 million compared to just $36.2 million the previous week.

A crucial factor for this trend is the attractive returns that municipal bonds provided in the summer and early fall, which drew in participants seeking positive yields. Although October has shown declines with losses of approximately 1.88% month-to-date, the year-to-date performance still sits at a modest return of 0.37%. Sheila May, director of municipal bond research at GW&K Investment Management, noted that the economic landscape has shifted following robust employment and spending reports—a development that has tempered expectations for further Federal Reserve rate cuts. This evolving interest rate environment significantly impacts demand for municipal bonds.

Year-to-date issuance in the municipal market has surged to $418.451 billion, reflecting a remarkable 41.1% increase compared to prior periods. The combination of cooling inflation, declining interest rates, and diminished federal assistance has urged states and local municipalities to actively participate in bond issuance. This influx is not viewed as merely an opportunistic move in the lead-up to elections but rather as necessary to address a significant backlog in infrastructure maintenance, estimated at around $1.2 trillion for water utilities and $1 trillion for higher education.

Matt Fabian, a partner at Municipal Market Analytics, emphasizes that sectors such as infrastructure and healthcare are catalyzing growth in issuance. With states and municipalities recognizing urgent needs, market dynamics suggest the current pace of issuance may be sustained, potentially leading to record-high issuance figures.

Despite the abundance of supply in the market, interest remains high. Analysts from Principal Asset Management have observed that large deals tend to attract significant investor appetite, especially those which provide competitive income spreads. This sustained demand has been buttressed by several weeks of new issuances exceeding $10 billion, creating a conducive environment for investors seeking opportunities.

Looking ahead, the upcoming weeks may experience a continued flow of large deals, particularly as issuers look to capitalize on favorable conditions before major holidays such as Thanksgiving and Christmas. This strategy highlights a keen awareness of timing in a market often sensitive to seasonal variations.

On Thursday, several key bond deals were completed, including a pricing by Goldman Sachs for the Intermountain Power Agency and a subsequent issue by BofA Securities for the Maryland Health and Higher Educational Facilities Authority. Both these issues reflect ongoing confidence in the municipal market, with various maturities offering competitive yields that cater to a range of investment strategies.

In the realm of money markets, tax-exempt municipal money market funds also witnessed inflows totaling $1.58 billion, contributing to an overall asset pool of $1.231 trillion. The average yield for these funds has noticeably increased, indicating a positive response to the current market dynamics.

The municipal bond market is navigating through a complex landscape characterized by recent shifts in yields, strong investor inflows, and substantial issuance. While challenges persist, the fundamentals supporting municipal bonds remain solid, driven by ongoing infrastructure needs and sound local credit conditions. As market participants position themselves for the future, the unfolding trends will continue to shape the attractiveness of municipal investments in a changing economic environment.