The municipal bond market has demonstrated a curious resilience in the face of fluctuating supply and cautious investor sentiment, characterized recently by limited trading activity. As we approach the Thanksgiving holidays and a shorter trading week, market dynamics suggest a notable trend: relative stability exists in the realm of Triple-A municipal yields. These yields have remained remarkably unchanged for nine consecutive sessions, indicating a steady state amidst minor fluctuations in U.S. Treasury yields.

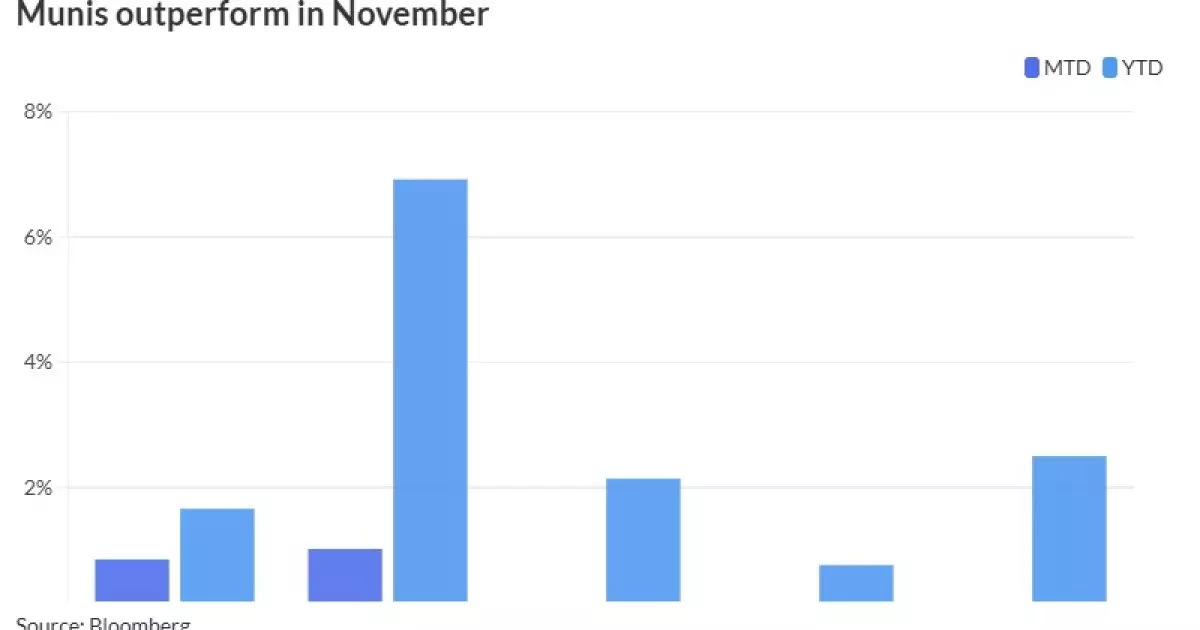

The month of November has proven beneficial for municipal bonds, with technical conditions leading to their outperformance against U.S. Treasuries and corporate bonds. Analysts believe that this November’s supply has decreased significantly, allowing market participants to reevaluate their positions without feeling pressed by escalating inventory levels. The confluence of a drop in supply combined with retail investors’ persistent demand for tax-exempt securities paints a picture of an evolving market landscape.

Mikhail Foux, a managing director at Barclays, observed that investor behavior has shown resilience in response to rate volatility, lower tax environments, and potential threats to tax exemptions. This resilience is crucial as it underscores a fundamental shift in how retail investors perceive and engage with the municipal market amid external pressures. The tax-exempt ratios have leveled out to a more neutral stance compared to corporate offerings, shedding light on a recalibration of value assessments in the wake of market changes.

As we analyze the interrelations of municipal and Treasury yields, it becomes evident that recent ratios signify a strategic positioning by investors. The two-year municipal to UST ratio is at 60%, while the ratios for five-year, 10-year, and 30-year bonds hover between 62% and 82%. Such metrics indicate a cautious approach to investment, as many market participants have begun exercising discretion rather than pursuing aggressive performance chasing.

Looking ahead, the new-issue calendar for the upcoming week is projected to exceed $1.4 billion. This provides a unique opportunity for investors to further assess the month’s newly issued bonds against a backdrop of diminishing supply and market readiness. The Bond Buyer’s 30-day visible supply sits at $6.91 billion, down from previous peaks, indicating a tightening market that could bode well for bond prices.

Speculations about December’s performance are also firmly rooted in historical contexts. Historically, municipals have displayed robust gains in December. Notably, high-grade municipales have retained their value, which could be reassuring to hesitant investors. Foux suggests that although recent performances in high-yield municipals emerged sporadically, the last decade has favored a positive average return in December.

Macroeconomic indicators and fundamental economic health play a pivotal role in shaping market expectations. Recent observations of the U.S. economy, particularly the performance of the core PCE index, will inform future Federal Open Market Committee meetings, providing essential data on the prevailing economic climate. With the third-quarter GDP forecasted at a solid 2.8%, the chances of a significant economic downturn appear weak, reinforcing a more optimistic investor outlook.

Despite a hopeful macroeconomic narrative, caution persists among analysts and market participants alike. While the bullish sentiment surrounding the municipal market looms large, Foux remains prudent about potential challenges heading into 2025. The focus now is to closely monitor market rates and assess performance trends as the new year begins.

The municipal bond market has showcased remarkable performance stability amid shifting supply dynamics, yielding a rich ground for analysis and strategic investment planning. Strong technical achievements and consistent demand from retail investors underscore a resilient market atmosphere. The established historical patterns during December present a unique backdrop for anticipated gains, albeit layered with caution as uncertainties linger in broader economic conditions.

December is poised to serve as a litmus test for the forthcoming year, prompting active investors to remain vigilant while balancing their portfolios with an eye toward anticipated opportunities. Ultimately, a disciplined approach in navigating the complexities of the municipal bond market will be crucial for capitalizing on both potential rewards and inherent risks.