In a week marked by significant movements across various financial sectors, the municipal bond market showed resilience, outperforming minor declines in U.S. Treasury yields. On a day when both the Dow Jones Industrial Average and the S&P 500 notched new all-time highs, the backdrop was shaped largely by the deliberations of the Federal Open Market Committee (FOMC). The FOMC meeting minutes underscored a cautious approach by the Federal Reserve towards monetary policy which, according to those discussions, indicates a slow transition to a more neutral policy stance might be on the horizon. BMO Senior Economist Priscilla Thiagamoorthy observed that the language from Chair Jerome Powell about the absence of an urgency to cut interest rates reinforces the Fed’s inclination for a careful approach.

This caution from the Federal Reserve aligns with the current economic sentiment, creating waves in both equity and fixed-income markets. With a broadly supportive consensus among policymakers for this conservative stance on rate cuts, the municipal market has capitalized on favorable conditions.

Municipal Bonds Outshining Treasuries

The recent performance of municipal bonds starkly contrasts the slight losses seen in U.S. Treasuries. Over the course of the preceding Tuesday, yields on triple-A municipal yield curves fell by as much as five basis points. In contrast, Treasury yields experienced declines up to four basis points. This shift indicates a growing investor confidence in municipal bonds, notably attributed to stronger demand from retail investors as they position themselves for year-end opportunities. As Matt Fabian from Municipal Market Analytics articulated, there has been a notable improvement in the distribution of municipals via separately managed accounts, further crystallizing market strength.

Despite the subdued trading activity in fixed income markets in the week prior, municipalities witnessed a notable uptick in interest, as investors capitalized on strength in liquid municipal names amid a less hectic holiday calendar.

Several intertwining factors appear to be fueling the current buoyancy in the municipal market. The posture of the Federal Reserve creates an environment conducive to municipal strength, effectively turning a blind eye to the broader fluctuations in U.S. Treasuries. The recent performance of USTs reveals a complex web of influences: potential inflationary pressures from tariffs and immigration policies, coupled with rising supply expectations amid looming deficits, have contributed to a tilt in favor of municipal bonds. If the downward trend among Treasuries persists into December, it is expected that munis may continue to maintain their competitive edge.

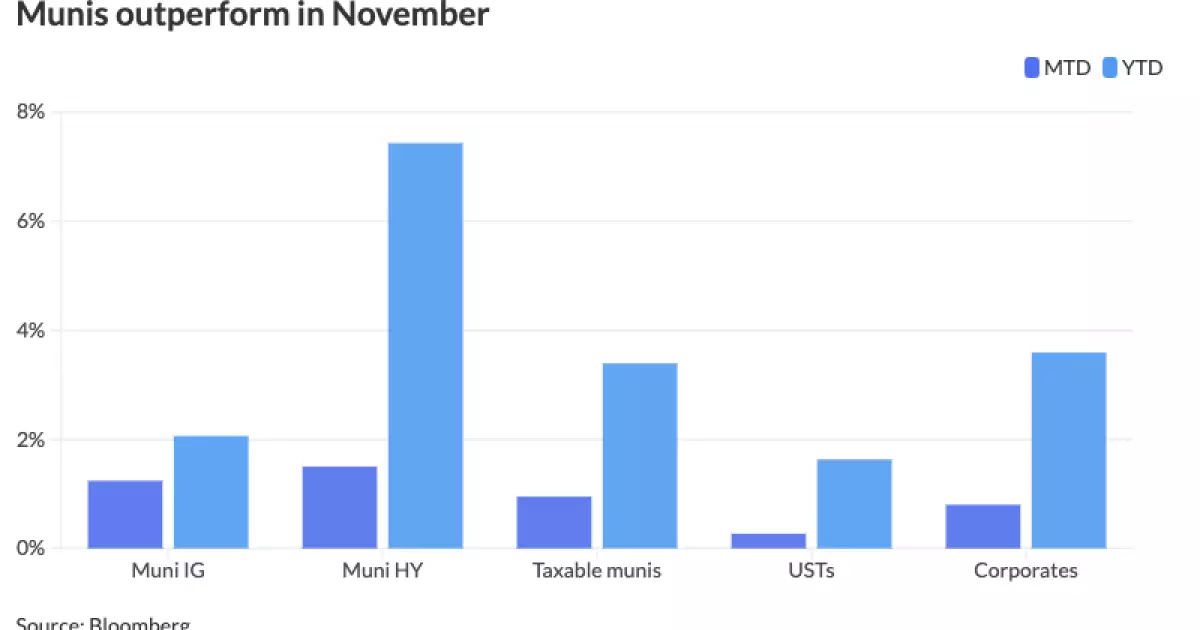

Performance metrics showcase that the Bloomberg Municipal Index recorded returns of 1.24% in November, emphasizing the accumulation of gains, particularly in high-yield municipal bonds which have realized 1.50% month-to-date. These positive figures are noteworthy when juxtaposed against the muted performance of USTs, which have posted 0.27% gains this month.

Even with a slightly declining issuance rate in November, where total issuance dipped around 34.6% year-on-year, investor appetite remains sturdy, especially with significant redemptions on the horizon. Pat Luby, a noted authority in municipal strategy at CreditSights, highlighted that December’s bond redemptions will amount to $37 billion—setting up a pivotal moment when investors eye new issuance. Such solid redemptions could potentially buoy the municipal market and offer robust support for forthcoming supply.

As the atmosphere swells with bullish sentiment, investors are advised to strategically assess their positions. With December’s historical returns being favorably moderate, expectations of returns similar to those of November remain plausible if the current traction in the municipal curve holds.

The current landscape reflects a cautiously optimistic municipal market bolstered by favorable economic indicators and investor dynamics. As issuances dip yet demand stays robust, the interplay between municipal bonds and other asset classes will continue to unfold. The Fed’s prudent navigation of monetary policy signals an anticipation for gradual adjustments, which, if managed effectively, could lead to increased volatility among Treasuries, further fueling municipal outperformance. As we approach year-end, a discerning focus on market behaviors and potential policy shifts will be crucial for investors looking to maximize their portfolios in this evolving landscape.