Tampa International Airport (TPA) is set to take a significant financial leap with its planned issuance of $484 million in alternate minimum tax eligible senior bonds. This crucial funding strategy comes on the heels of a recent upgrade in the airport’s subordinate debt rating by Fitch Ratings, which has further showcased the resilience and growth potential of this vital gateway to the Tampa Bay Area.

The recent upgrade from Fitch, which raised the airport’s subordinate bonds to an AA-minus rating from A-plus, is a strong indicator of the airport’s financial health and attractiveness as an investment opportunity. With ratings from reputable agencies such as Moody’s (Aa3) and Kroll Bond Rating Agency (AA), the bond offering is presented under favorable conditions. Fitch’s upgrade reflects the sustained growth trajectory that TPA has experienced, with a notable influx of passenger traffic in recent years. This positive outlook culminates in what industry experts describe as a robust credit profile—a newfound assurance for potential investors.

Ken Cushine, principal of the advising firm Frasca & Associates, points out that the recent ratings upgrade has spurred “really good interest” in the upcoming bond issuance. This interest is not just from traditional bond investors, but also from insurance companies and banks—indicating a well-rounded appeal across various financial institutions. As the airport stands poised to facilitate an anticipated increase in passenger traffic, these bonds are more than just a financial maneuver; they represent a strategic move to ensure that TPA can continue to handle increased demand efficiently.

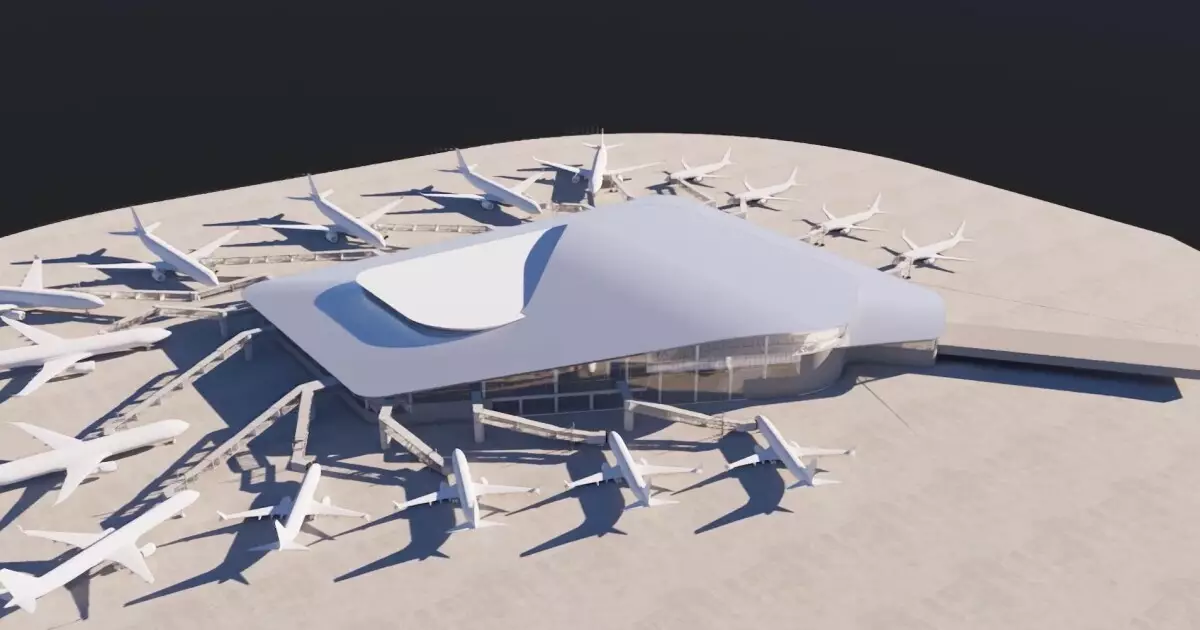

The proceeds from the bond sale are earmarked for critical developments at Tampa International Airport, particularly the construction of a new passenger facility known as Airside D. This facility will expand the airport’s operational capabilities by introducing 16 new swing-gates dedicated to both domestic and international travelers. The total cost of this ambitious project is projected to be around $1.5 billion, with roughly $896 million being financed through the issuance of these new bonds.

Further enhancing connectivity, an automatic people mover system will also link Airside D with TPA’s main terminal complex. The addition of these facilities represents an essential phase in a larger $3.5 billion capital improvement program aimed at elevating the airport’s infrastructure over the coming years. The completion timeline for this ambitious initiative is set for September 2028, making it critical for the airport to gather the necessary financial support promptly.

Air Travel Demand and Economic Growth

The timing of this bond issuance aligns perfectly with a general resurgence in air travel demand across the United States. July marked a record high, with the Transportation Security Administration screening 84 million passengers—underscoring an increasing trend towards domestic and international travel. As a result, TPA stands to benefit significantly from this uptick in airline passenger numbers, particularly as the airport enjoys a dominant position in the Tampa Bay area.

Fitch’s analysis points out that TPA’s favorable cost recovery framework further enhances its credit appeal. The airport has seen its operational revenues grow in tandem with rising passenger numbers, illustrating a healthy economic environment for future investments. Additionally, TPA has recently expanded its operational capacities to include a greater number of destinations—demonstrating its commitment to serving a broad demographic of travelers.

Despite the promising developments, the Tampa International Airport faces challenges that come along with its burgeoning growth strategy. With a projected capital program totaling $3.5 billion from fiscal years 2025 to 2030, financial stewardship will be vital to avoid excessive debt levels that could jeopardize future operations. Although Moody’s reports indicate a continuous decrease in total adjusted debt to net revenue ratios, the increasing debt load requires careful monitoring to maintain TPA’s competitive position in the aviation sector.

Furthermore, natural disasters, particularly hurricanes, pose a notable risk to operational stability and can cause fluctuations in enplanement numbers. Recent weather events, including a near-miss from Hurricane Debby, have already presented challenges. Strategic planning for such contingencies is essential for mitigating risks that may impede the airport’s growth trajectory.

As Tampa International Airport embarks on this ambitious expansion and seeks to capitalize on strong financial indicators, the upcoming bond offering represents not just a financial arrangement but a roadmap to future resilience. With a well-supported credit rating portfolio and a clear strategy for long-term growth, TPA is not just preparing for its next chapter, but ensuring that it remains a vital player in the ever-evolving landscape of air travel into the future. The airport’s commitment to improvement positions it favorably in both the short and long run, making it a key asset for the Tampa Bay region and beyond.