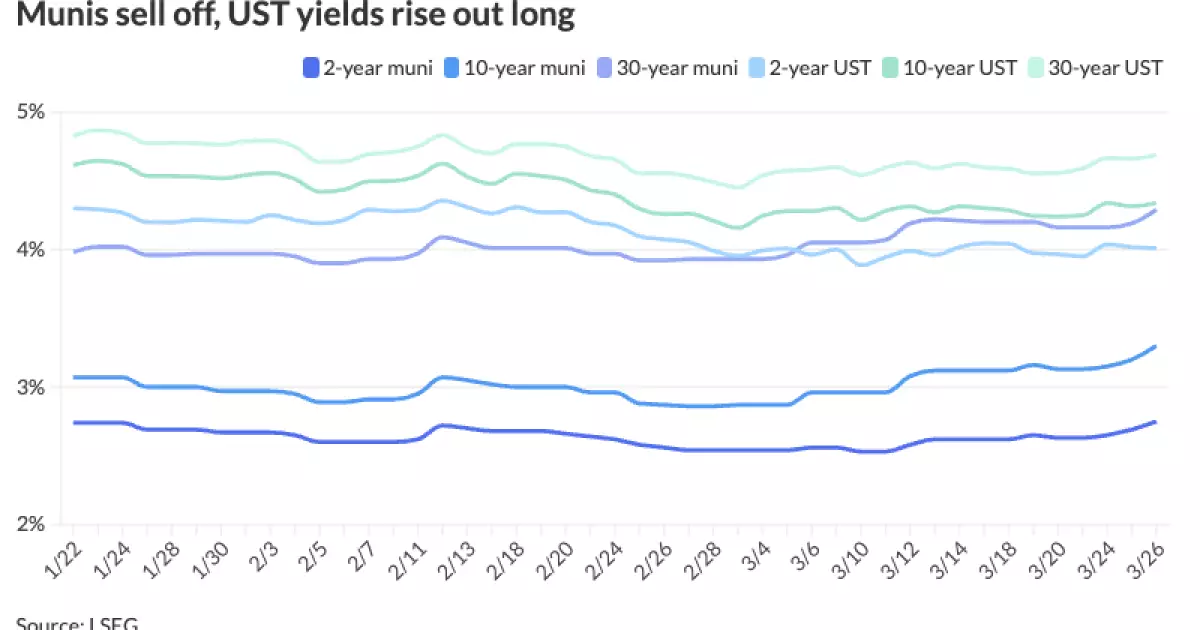

In a surprising display of market dynamics, municipal bonds faced significant selling pressure this Wednesday, reflecting broader trends in the financial landscape. The sell-off, marked by double-digit yield cuts for the second time this month, raises questions about the stability and future of the muni market amidst rising U.S. Treasury yields and overall economic uncertainty. Analysts have observed fluctuations across various maturities, highlighting a sharp divergence: while muni yields fell between 2 to 12 basis points, U.S. Treasury (UST) yields rose, demonstrating a clear shift in investor sentiment. Such disparities serve as a stark reminder of the challenges facing investors and fund managers navigating turbulent economic waters.

It is worth noting that the municipal-to-U.S. Treasury yield ratios, critical indicators of relative value, fluctuated bastante. As of Wednesday, the two-year ratio stood at 69%, indicating a widening spread that could be indicative of market apprehension. Investors are grappling with an ecosystem rife with macro risks—ranging from evolving tax policies to uncertainty surrounding cryptocurrency and broader market trends. These factors amalgamate into a scenario marked by cautiousness, prompting strategic reevaluations among institutional players.

Investor Sentiment and Market Dynamics

The Investment Company Institute shed light on recent inflows and outflows, revealing a complex picture of investor behavior within the muni market. While the report cited a modest $19 million of inflows for the week, contrasted with a substantial prior week’s inflow of $376 million, there is a clear trend indicating hesitation among investors. Notably, LSEG reported an even starker picture with $216.4 million in outflows from municipal mutual funds, reflecting a growing wariness among investors concerning market stability.

Market participants are wrestling with this dichotomy of inflows and outflows, leaving many to ponder whether confidence will return in this vital financing sector. James Pruskowski of 16Rock Asset Management highlighted a significant tension, noting the liquidity strain experienced by the market, a sentiment echoed by other industry insiders. With credit spreads beginning to widen, it appears that the market is at an inflection point, where strategic positioning will be vital in navigating potential pitfalls and capturing opportunities.

The Looming Opportunity Amidst Uncertainty

Composite dynamics are at play, and some analysts insist that this period of instability could also furnish unique opportunities for savvy investors. The market’s pronounced re-pricing seems to suggest that numerous mispriced assets are ripe for the picking. Historical patterns suggest that markets often overreact in periods of uncertainty, creating pathways for meaningful gains for those willing to adopt a patient and calculated approach.

Additionally, the allure of selectively investing in higher-rated bonds—such as the $378.7 million refunding bonds for the Board of Regents of the Texas A&M University System—highlights a prudent strategy. While the market grapples with macro risks, strategic investors should not overlook the crucial role of high-quality, stable municipal entities that can potentially provide solid returns amidst the turbulence.

Market Structure and Future Prospects

As the muni market stands poised at this crossroads, the broader implications for risk management and financing strategies loom large. Ron Banaszek of Blaylock Van echoed sentiments of precaution as he described the current trading environment as difficult yet orderly. The need for municipalities to source funds efficiently is paramount, particularly for iconic entities such as New York City’s Transitional Finance Authority, which grappled with bond pricing complexities last week.

The focus now shifts to the upcoming primary market activity, including the anticipated $1.534 billion Los Angeles International Airport bond deal. The outcome of such offerings will be instrumental in determining not only the price points for municipal bonds but also in shaping investor sentiment moving forward. The interplay of risk assessment and opportunity identification will dictate the market’s trajectory in the months to come, as the economic landscape remains dynamic and unpredictable.

Overall, the municipal bond sector is undeniably at a critical juncture, facing inherent risks while presenting avenues for strategic gain. Investors must adapt quickly, understanding that today’s tumult may transform into tomorrow’s opportunity as they navigate one of the most challenging financial environments in recent memory.