Recent events in the municipal bond market are signaling an unsettling trend that investors must pay attention to. Municipal bonds, which are usually seen as safe investments, have begun to exhibit a worrying weakness even as U.S. Treasury yields slip. As of late Thursday, key ratios suggested that the allure of these bonds is somewhat diminishing, with the two-year, five-year, and ten-year municipal-UST ratios hovering around the low 70% range. This offers little reassurance to investors who have long viewed munis as stable, secure options against the volatility displayed in the wider financial market.

The cause for concern extends beyond mere yield ratios. Dan Genter, CEO of Genter Capital Management, noted that the supposed rally since a tumultuous bout in April has been significantly undermined by risk factors including a downgrade of U.S. sovereign credit. Why should we be complacent knowing that even the most reputable credit rating agencies view our financial landscape with skepticism? This situation necessitates a closer examination of the forces at play, particularly those stateside.

The Deficit Dilemma

What stands out most glaringly is the glaring elephant in the room: the increasing U.S. budget deficit. Such financial irresponsibility is alarming, especially when many politicians appear unresponsive to curtailing spending. The recent downgrade by Moody’s Ratings was not unexpected; after all, S&P Global Ratings and Fitch encountered similar skepticism in the past. However, the apathy toward solutions accentuates public frustration about fiscal governance. Are we harsh in deeming citizens poorly represented by our elected officials, or are we merely expressing the justified anger of a populace confronted with economic mismanagement?

Peter Delahunt from StoneX emphasizes this disappointment. This lack of proactive measure is puzzling to many and has created a palpable sense of instability in the market. The message is clear: continuing to neglect fundamental financial principles will ultimately place even more strain on those institutions we rely upon. The long-term health of the municipal bond market hinges not only on stable yields but also on responsible fiscal governance.

A Market Fumbling for Direction

Jeff Timlin from Sage Advisory suggests that the market may navigate these turbulent waters if the right balance of good and bad news emerges. This idea represents a rather simplistic view of a complex issue. Are we truly prepared to ride the waves of uncertainty on whims of “mixed news,” or should we construct a more definitive course of action? The fragility of investor sentiment implies a growing discontent that echoes throughout the financial landscape.

While issuance in the municipal market appears to be picking up, the delayed projects from April’s volatility exemplify a lack of confidence in market stability. Coming into summer, this dynamic is concerning, as summer typically marks a slowdown in municipal issuance. Investors are itching to offload their deals, but this may merely be a Band-Aid on a much deeper issue. The long-term sustainability of the municipal bond market hinges on a genuine restoration of faith—both from investors and issuers alike.

Investors: A Double-Edged Sword

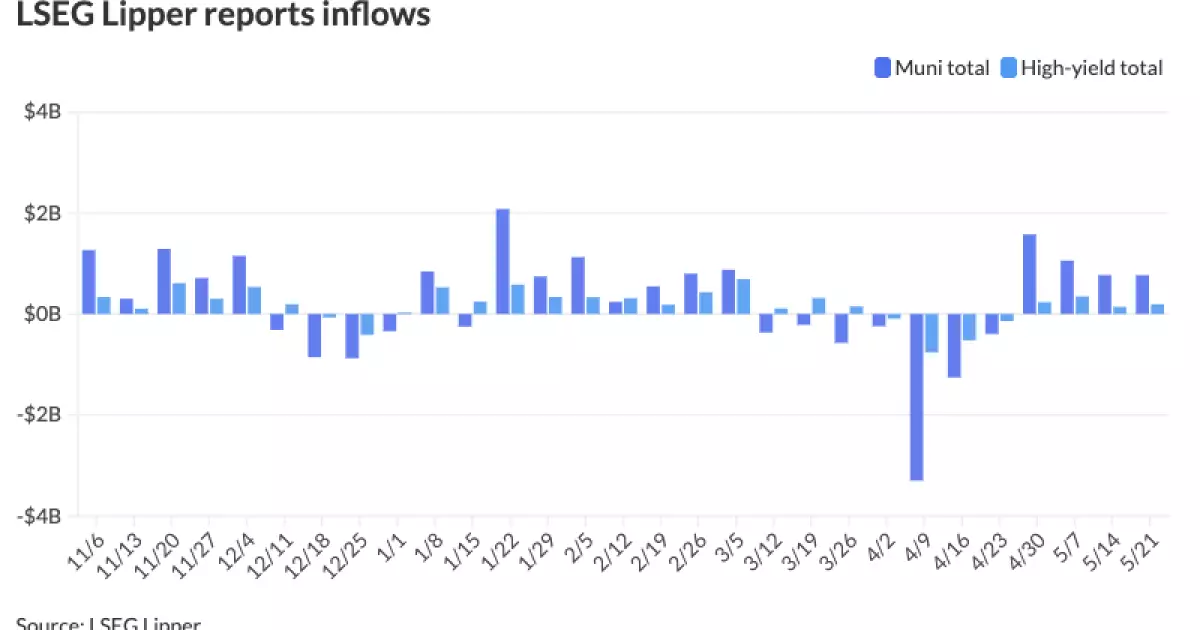

There’s a notable contradiction present in the current landscape. On the one hand, investor appetite for municipal bonds remains robust, with substantial inflows reported in mutual fund markets. In stark contrast, the burgeoning tax-exempt money market appears to be hemorrhaging assets. This dichotomy exposes underlying tensions within the investor community—highlighting disparities in confidence levels associated with different pockets of the market.

Genter mentions crossover buyers at play, ready to seize opportunities as spreads shift. In theory, this should enhance demand yet introduces a level of precariousness; market actors relying heavily on marginal spreads rather than fundamental value can exacerbate volatility. Investors need to be cognizant that short-term gains may yield long-term repercussions.

The Future: A Contradiction in Terms?

While optimistic rhetoric pervades discussions of market renewal, an unsustainable rally undercuts the necessary reforms needed to elevate municipal bonds back to their traditional stature. Existing trends suggest that the market could experience a decline as the year progresses. Moreover, the “anxiety of tax legislation potentially impacting municipal” may lessen, but it’s crucial to consider that reduced issuance won’t equate to balanced market health.

If history has taught us anything, it is that good intentions often fail when devoid of actionable commitments. Without tangible improvements to manage the fiscal health of our municipalities, we may be left with unreliable investments. We cannot afford to ignore the need for meticulous vigilance in the municipal bond market, lest we face harsh realities down the road.