The municipal bond market has recently exhibited a mix of firmness and volatility, as evidenced by a decrease in U.S. Treasury yields and mixed performances in equity markets. Understanding the dynamics at play in the municipal bond sector is crucial for investors looking to navigate this complex landscape effectively.

The shifting landscape of U.S. Treasury yields plays a significant role in shaping the municipal bond market. Recently, the two-year ratio of municipal bonds to U.S. Treasuries settled at 63%, with further variations observed over longer maturities—64% for five years, 68% for ten years, and 87% for thirty-year bonds. These figures, sourced from Municipal Market Data (MMD), reflect both the local and national economic trends affecting municipal bond pricing. Lower yields on Treasuries often prompt investors to seek higher returns in municipal bonds, typically considered a safer option due to their tax-exempt status.

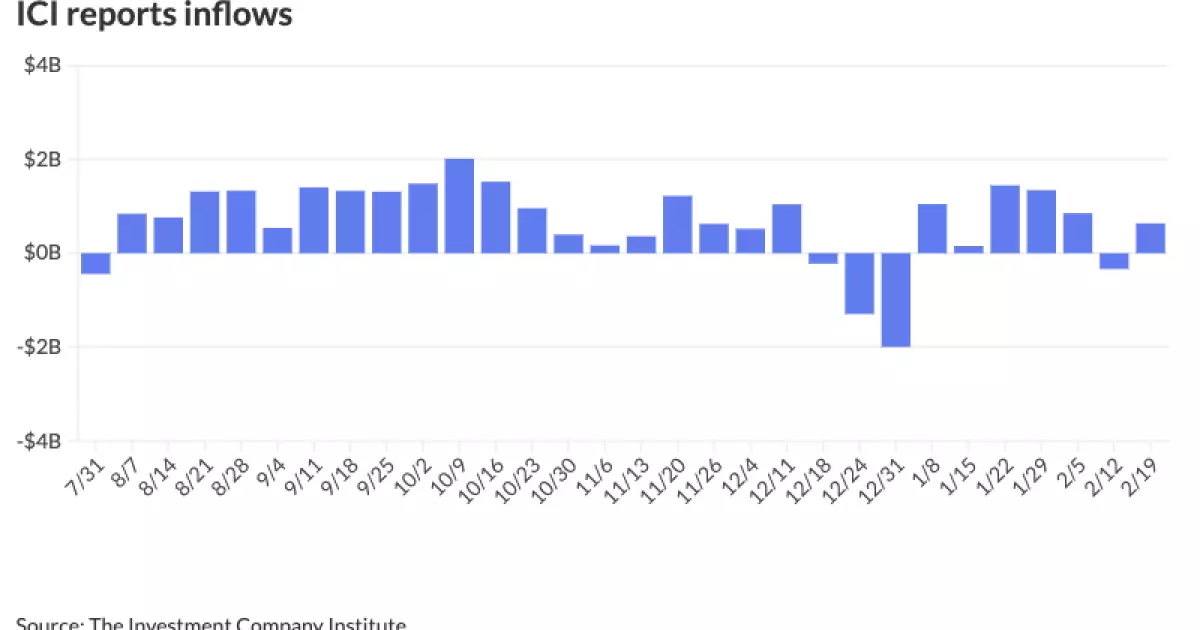

This relationship indicates a defensive stance among municipal investors as they react to ongoing economic uncertainties. The decline in Treasury yields beckons more substantial inflows into the municipal market, which was recently amplified by a reported $635 million in inflows for the week ending February 19, a rebound from previous outflows of $336 million. This fluctuation underscores the nature of capital flows as economic indicators evolve.

Despite a tepid start to the issuance of new bonds at the beginning of the year, there is a clear resurgence as issuers scramble to take advantage of favorable conditions. Jeff Devine, a municipal research analyst at GW&K, emphasizes that many issuers are motivated by the need to fund essential infrastructure projects, particularly in light of looming concerns regarding the potential full or partial elimination of tax exemptions associated with municipal bonds.

Given that construction costs continue to soar due to inflation, issuers are keen to access the market before conditions potentially worsen. Notably, mega-deals like the $1 billion issuance from the South Carolina Public Service Authority have injected significant capital into the market, suggesting a robust pipeline for future borrowings. As spring approaches, industry analysts suggest that the dynamics of supply and demand are expected to shift, potentially resulting in an imbalance that could affect liquidity.

The ongoing discourse surrounding tax exemptions for municipal bonds is particularly intense in the current political climate. Jeff Timlin, a managing partner at Sage Advisory, articulates that the potential elimination of these exemptions remains a contentious topic. Advocates argue about the cost to the federal government while weighing this against societal benefits. The looming prospect of increased borrowing costs for municipalities, resulting in higher taxes for residents, creates a scenario that could stifle consumption and economic growth on a state level.

Notably, many lawmakers have historically attempted to diminish such exemptions without ever completely abolishing them. While experts like Devine suggest the likelihood of total elimination remains low, their increased discourse indicates a rising concern for municipal issuers. Reports also indicate that legislative strategies could favor permanent extensions of tax exemptions, potentially alleviating some of the pressures expected from policymakers.

Recent data reveals a complex and evolving landscape for municipal bonds, with various issuers lining up to enter the market. Noteworthy recent issuances include BofA Securities pricing a substantial $950 million for the New York City Municipal Water Finance Authority. Furthermore, rigorous pricing associated with offerings from institutions such as Auburn University and the Humble Independent School District reflects an accommodating environment for municipal financing.

In the competitive market, other important transactions can be observed, such as the Springfield Board of Public Utilities raising significant capital. These activities illustrate that, despite broader economic uncertainties, municipal entities remain proactive in accessing capital markets to fund crucial projects.

While the current demand for municipal bonds remains robust, the anticipated drop in coupons and maturities during upcoming months presents challenges. S&P Global Market Intelligence’s latest curve adjustments indicate modest movement in yields across various maturities. As attention shifts towards March and April, market participants would be prudent to prepare for fluctuations that might arise from reduced issuance.

The municipal bond market currently reflects a unique blend of resilience and adaptation amidst economic challenges. With evolving dynamics around issuance, tax exemptions, and the interplay of Treasury yields, investors must remain vigilant and informed. The perspective on municipal finance is not merely a reflection of market conditions but also indicative of broader economic and policy environments yet to unfold in 2023.