The municipal bond market has exhibited notable resilience at the onset of this year, defying the previous December’s challenges. As investors navigate a fluctuating economic environment, key trends and developments within this asset class are essential for understanding potential implications for both investors and issuers.

Performance Trends in the Municipal Market

As the first week of January unfolds, the municipal bond market demonstrates a continued rally, having recorded a gain of 0.43%—an encouraging figure that pushes year-to-date gains to 0.94%. Analysts such as Jason Wong from AmeriVet Securities highlight that this rally underscores an optimistic turn of events following a disappointing December, which witnessed a decline of 1.46%. This sharp contrast between December’s poor performance and January’s positive trajectory hints at the underlying improvements in market sentiment, as participants seek value in municipal assets.

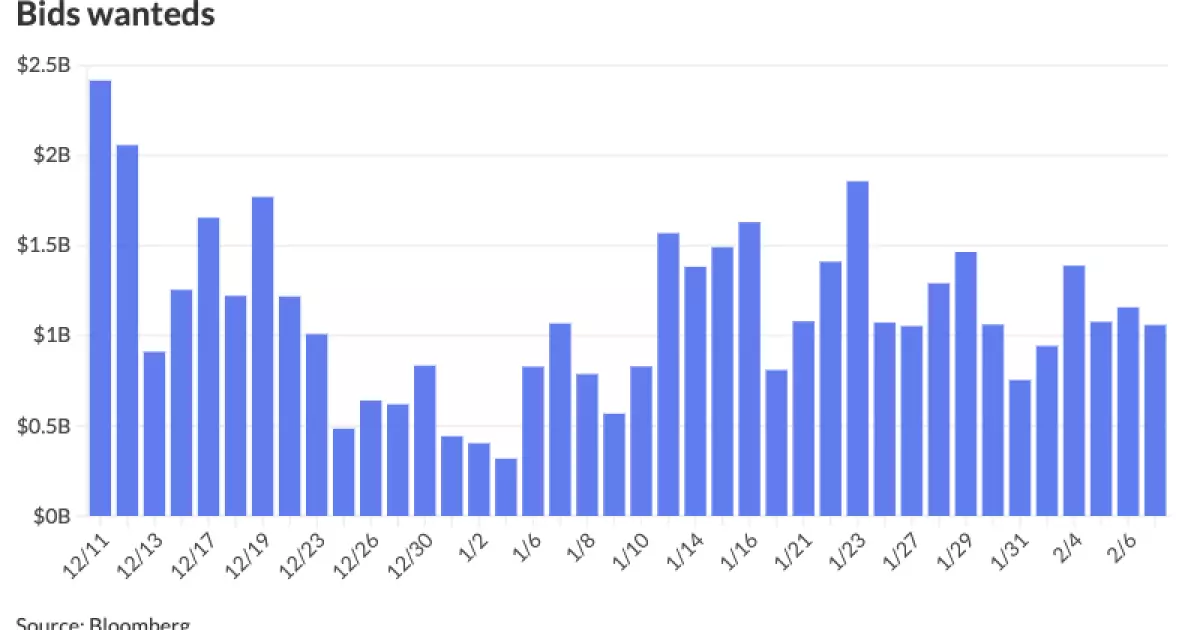

However, the cautious approach adopted by investors due to recent economic volatility indicates a market grappling with uncertainty. Birch Creek strategists emphasized the limited trading activity from institutional investors, a sentiment supported by J.P. Morgan data reflecting increased bid wanteds and dealer sales—up 26% and 20%, respectively. Investors’ return to the market is critical, as these numbers suggest growing confidence amidst previously inhibited trading activity.

Market Ratios and Their Implications

Examining the ratios between municipal bonds (munis) and U.S. Treasuries (USTs) reveals an interesting divergence in trends across different maturities. The two- to ten-year ratios have contracted by roughly 2 percentage points since the year’s beginning, suggesting that munis are becoming more appealing relative to USTs. Conversely, long-end munis have seen an interesting dynamic. With the 30-year municipal bonds widening compared to USTs—almost 4 percentage points since December—there’s a clear indication that investors are increasingly drawn to long-duration strategies. This phenomenon can be attributed to ongoing credit spread compression and the attractive yield curve steepness, particularly for those focusing on long-term investments.

According to Wong, the continued influx of capital—evident in the substantial $2.8 billion inflows into long-end muni mutual funds—signals robust demand. The combined flow of mutual funds and exchange-traded funds (ETFs) into this market has accumulated to an impressive $5.2 billion, with high-yield strategies claiming a significant share of investor interest. This trend not only reflects confidence in the market but also highlights the growing belief in the stability offered by munis against the backdrop of shifting interest rates.

As for yield scales across the AAA category, the Municipal Market Data (MMD) illustrates very little fluctuation, which might indicate a stabilization phase in the market. Despite minor adjustments in yields for different maturities—ranging from 2.58% in one-year notes to 3.93% in thirty-year notes—these yield levels reveal a correlated response to external economic conditions. More recently, Treasuries displayed a mixed performance, with fluctuations in yields across maturity ranging from 4.275% for two-year bonds to 4.719% for thirty-year bonds. This interplay highlights the wider narrative that investors are navigating in a complex financial landscape.

On the issuance front, a notable slate of upcoming bond offerings demonstrates the robustness of the municipal bond market. With entities like the New York City Transitional Finance Authority and the Hawaii state government poised to launch significant bond issues, the expected capital influx underscores investor appetite for municipals.

These forthcoming issuances are essential for financial stability across municipalities, offering a blend of new tax-exempt and taxable bonds that appeal to a diverse range of investors. The impending market activity not only accommodates institutional requirements but also suggests an upcoming wave of liquidity for those seeking to reinvest proceeds into higher-yielding options.

The municipal bond landscape is navigating through a transitional phase marked by renewed momentum and strategic adaptations by investors. With a backdrop of mixed economic signals and a continuous influx of capital, the market outlook appears cautiously optimistic. As January unfolds, participants in the municipal bond arena will need to keep a keen eye on evolving trends, ensuring their strategies align with the shifting dynamics of yield ratios, issuance calendars, and broader economic conditions. The potential for outperformance, particularly in the long-duration segment of the municipal market, provides an intriguing landscape for both seasoned and new investors as they chart the path forward.