The municipal bond market, currently valued at an astonishing $4 trillion, has been characterized by its longstanding tradition of self-regulation. This market is unique, as local governments and municipalities have benefited from certain exemptions that have shielded them from direct oversight. However, as economic conditions evolve and defaults become more frequent—exemplified by the recent fiscal crises in cities like Detroit and Puerto Rico—there is a growing call for fundamental regulatory changes. This article explores a provocative proposition suggesting direct federal oversight in the municipal bond market, dissecting its implications and the perspectives it garners from various stakeholders within this complex financial ecosystem.

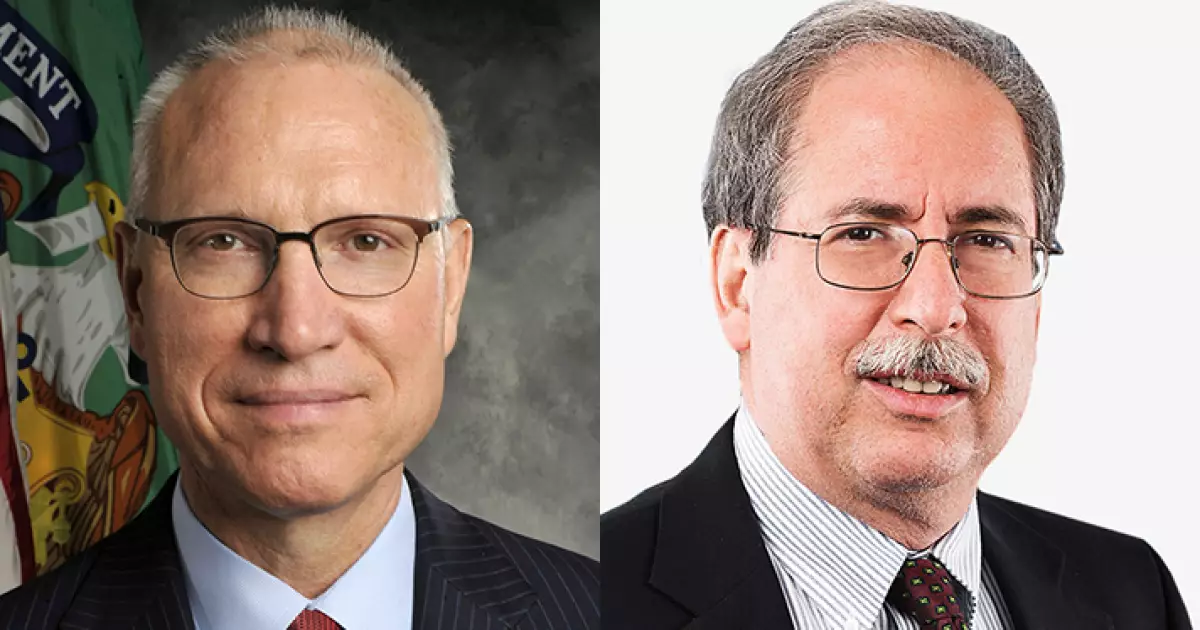

For decades, the municipal bond market has been largely self-regulated, a model rooted in systems put in place during the New Deal era. The Securities and Exchange Commission (SEC), created in response to the market crash of 1929, has had limited jurisdiction over municipal bonds due to the Tower Amendment of 1975, which established a level of immunity from federal oversight. This exemption was initially intended to empower local issuers to raise capital without the burdens of stringent federal regulations. However, as highlighted by seasoned public finance experts David Dubrow and Kent Hiteshew, this exemption has now come under scrutiny.

The near-default of New York City in 1974 and subsequent events, such as the Washington Public Power Supply System’s catastrophic bankruptcy in the 1980s, prompted slight regulatory reforms. These changes established the Municipal Securities Rulemaking Board (MSRB) and incorporated indirect oversight through underwriters. Still, these measures have been deemed insufficient in light of the evolving complexities within the municipal bond sector.

Advocates for increased oversight argue that a fundamental transformation is required to ensure that municipal disclosures are consistent, transparent, and adequately safeguard investors. Dubrow and Hiteshew urge that the SEC should exercise its authority to establish explicit disclosure mandates for issuers. One of the pivotal arguments is the introduction of more standardized guidelines, which would modernize risk assessments and enhance audit reports—essentially bringing municipal bond disclosures into alignment with corporate-grade standards.

With one-third of the current municipal bond market comprising private activity bonds, the authors posit that existing disclosure frameworks are inadequate. These entities, often resembling private corporations in functionality, should adhere to rigorous standards akin to the corporate sector. The argument speaks to a broader necessity: elevating the overall quality and accessibility of information available to bondholders, thus fostering a healthier investment landscape.

Not surprisingly, the push for increased federal regulation has garnered significant pushback from those within the municipal finance community. Local governments and bond counsel maintain that the existing self-regulatory framework is effective and should evolve organically rather than through federal imposition. Jason Akers from the National Association of Bond Lawyers contends that calls for repeal of the Tower Amendment represent an overreach of federal authority that could destabilize a well-functioning market.

These stakeholders argue for a collaborative approach—an inclusive dialogue among industry participants that focuses on enhancing transparency and communication around disclosures without dismantling the existing regulatory paradigms. Emily Brock of the Government Finance Officers Association emphasizes the ongoing voluntary measures being implemented by municipalities to increase transparency, arguing that these efforts are often overlooked by federal advocates.

In light of these contrasting viewpoints, it’s crucial to evaluate how the landscape of the municipal bond market might evolve in the coming years. The failures of disclosure have highlighted critical vulnerabilities; therefore, the push for modern, robust guidelines should not be viewed solely through the lens of regulation versus self-regulation. Instead, a hybrid model could emerge, combining structured federal oversight with the autonomy of local issuers.

This proposed model may foster innovations in disclosure practices that uphold the fundamental principles of local governance while ensuring robust protection for investors. Moreover, conducting periodic reviews of disclosure practices could keep pace with the rapidly changing financial landscape, addressing the timely matters of auditing and compliance.

Ultimately, as the discussion surrounding municipal bond disclosures evolves, stakeholders must weigh the benefits of federal oversight against the principles of local self-governance. As economic conditions fluctuate and the stakes rise, the necessity for enhanced transparency becomes clearer. As this conversation unfolds, the challenge lies in crafting a regulatory framework that not only enhances trust and accessibility but also respects the unique character of the municipal bond market. The time may indeed be ripe for a cooperative yet cautiously regulated approach that paves the way for a more resilient financial ecosystem.