Bond insurance is increasingly becoming an indispensable tool for issuers aiming to enhance their market appeal and secure favorable financing terms. As we delve into the first half of 2024, it’s evident that bond insurance has not only prevailed but thrived in a challenging economic climate, marked by heightened investor interest and growing transaction volumes.

The bond insurance sector has demonstrated significant resilience, witnessing a remarkable 19.5% year-over-year increase in the debt it has insured during the first half of 2024. Specifically, municipal bond insurers wrapped a total of $18.592 billion in debt, a substantial rise from $15.561 billion during the same timeframe in 2023. LSEG data indicates that this uptick in insured debt was achieved through 762 transactions, an increase from 622 deals in the previous year. Such growth not only signifies a healthy appetite among both retail and institutional investors but also underscores the pivotal role that bond insurance plays in facilitating capital access for issuers.

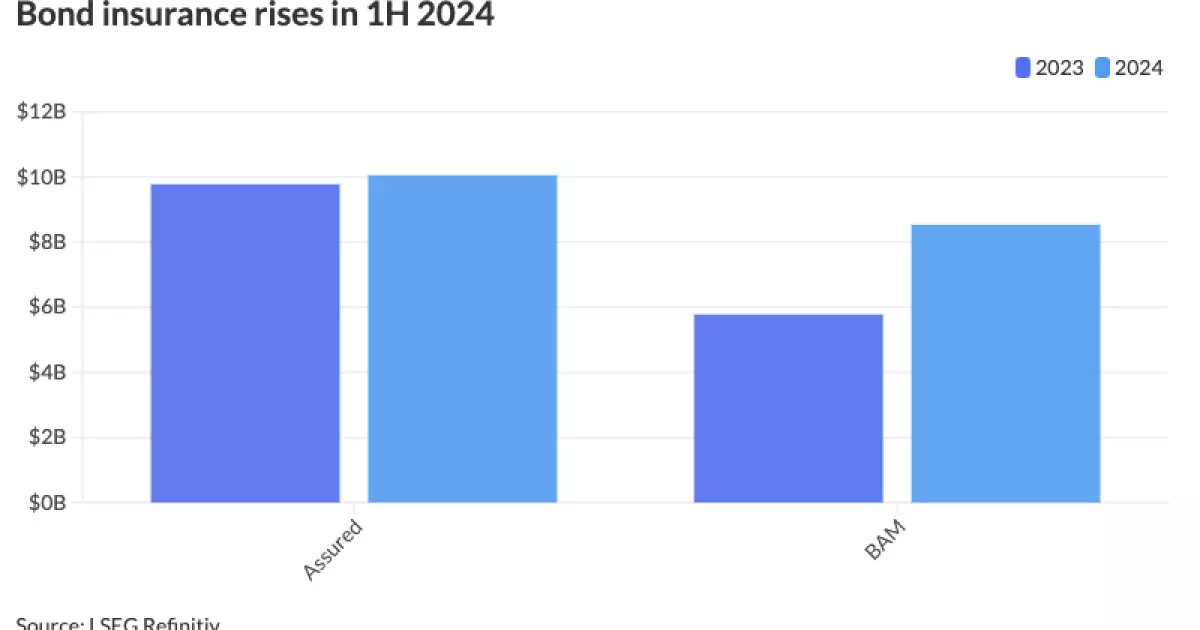

In the competitive landscape of bond insurance, Assured Guaranty and Build America Mutual (BAM) have emerged as key players, each commanding significant market shares. Assured Guaranty led the market with a total insured amount of $10.055 billion across 327 transactions, representing a 54.1% market share, albeit a decrease from 62.8% in 2023. BAM, on the other hand, experienced a dramatic growth spurt, insuring $8.537 billion—a staggering 47.6% increase from the prior year—and capturing 45.9% of the market share.

This divergence in market dynamics raises intriguing questions about the shifting preferences of bond issuers and investors alike. Assured Guaranty’s notable presence remained stable, likely due to its established reputation and comprehensive risk mitigation strategies. In contrast, BAM’s impressive growth could be attributed to its tailored offerings that resonate deeply with smaller issuers seeking to stand out in a crowded market.

The uptick in bond insurance usage can be attributed to several pivotal factors. Robert Tucker, senior managing director at Assured Guaranty, noted that investors are increasingly recognizing the dual benefits of bond insurance: enhanced security and the potential for price stability. In a volatile market, such assurances become invaluable for both issuers and investors, as they reduce financing costs and provide greater certainty during execution.

Moreover, the evolving landscape of investor preferences showcases a distinct shift towards insured bonds. Mike Stanton from BAM highlighted that retail buyers, both directly and through managed accounts, are leaning more heavily toward insured bonds. This trend is complemented by the ongoing demand from institutional investors, indicating that both retail and institutional segments coalesce to foster a robust bond insurance market.

Notably, Assured Guaranty has identified significant opportunities in larger, high-margin transactions. In the first half of 2024, a notable 21 transactions each exceeded $100 million, reflecting a burgeoning demand for insurance on substantial deals, particularly among institutional investors. The importance of insuring large-scale projects cannot be overstated; it allows issuers to attract deeper pools of capital, ultimately leading to better financing terms.

Deals such as the $1.13 billion Brightline Florida passenger rail project and the $800 million New Terminal One at John F. Kennedy Airport exemplify the high-caliber projects that are being positively impacted by bond insurance, positioning both Assured Guaranty and BAM as essential enablers of major infrastructural investments.

The implication of these trends suggests that bond insurance is set to continue its upward trajectory into the latter half of 2024. Both Assured Guaranty and BAM remain optimistic about the future, aligning with the rising interest from municipal issuers seeking insured bonds to diversify credit risk and enhance liquidity. Furthermore, with an upsurge in utilization from revenue bond issuers, insurance adoption has broadened beyond traditional markets.

In closing, the bond insurance landscape in 2024 showcases resilience and adaptability amidst shifting economic conditions. As issuers increasingly leverage the protective benefits of bond insurance, the sector will likely continue to grow, supported by a diverse array of investors eager for stability and security in their holdings. This evolution shapes not only the bond market but also the greater economic landscape, ensuring that bond insurance remains a cornerstone of financial strategy for issuers and investors alike.