The municipal bond market has experienced a flurry of activity recently, characterized by nuanced shifts that suggest both opportunities and challenges for investors. As of Wednesday, trades remained relatively stable as U.S. Treasury securities exhibited some strength, and stock markets posted mixed results. This interplay notably sets the context for the ongoing evolution within the municipal bond market. Ratios comparing two-year municipal bonds to U.S. Treasuries stood at 63%—a figure consistent across several timeframes, highlighting a balanced yet cautious investor sentiment.

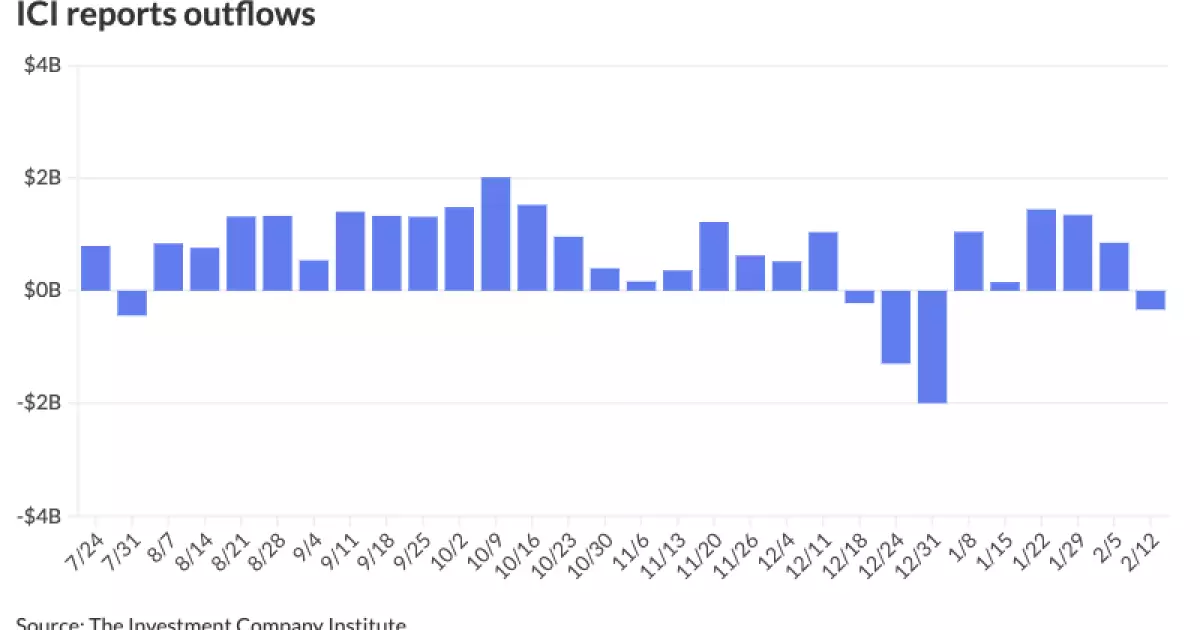

A noteworthy aspect of the current market dynamics is the contrasting reports from different financial data institutions. While the Investment Company Institute (ICI) indicated a net outflow of $336 million in the week ending February 12 after a previous week of substantial inflows amounting to $852 million, LSEG Lipper provided a more optimistic outlook, reporting inflows of $238.5 million within the same timeframe. Such discrepancies underscore the volatility and varied perspectives that can arise in municipal bond assessments.

Looking ahead, the supply within the municipal bond market is anticipated to exceed $500 billion in 2024. However, market analysts, including Nick Venditti from Allspring, emphasize that the direction of interest rates has played a far more influential role in shaping market responses than supply figures themselves. Venditti noted that past years allowed issuers some leeway through delayed issuance, but circumstances are changing rapidly. As projects long shelved due to COVID-19 are reignited, municipalities are increasingly compelled to access capital markets.

In the previous week, issuance reached its fifth-highest level in the last year, a trend mirrored by a robust institutional buying interest that appears to provide some buoyancy to the market. Yet, despite the influx of capital, industry analysts such as Matt Fabian of Municipal Market Analytics caution that a continuous ‘strong buying push’ from institutional accounts may not be guaranteed. The marginal buyers, typically managed accounts with specific investment goals, could face hurdles if nominal rates deteriorate beyond acceptable levels.

A pivotal question looms over the market: Will demand rise to match the increasing issuance? This issue is particularly pressing as the industry heads into the spring, where expectations for demand are high but remain uncertain. Investors are left scrutinizing how various factors might steer the market, especially given that demand and supply can often become misaligned. Venditti notes that there is a potential for 2024 to see market movements dictated significantly by technical trading dynamics, leading to considerable impacts if supply surpasses demand significantly.

The primary market remains lively, evident in recent notable transactions. For instance, BofA Securities facilitated a notable pricing of $500 million in taxable Economic Development Revenue bonds for the Pennsylvania Economic Development Financing Authority. This transaction exemplifies not just individual issuer dynamics but also the broader fabric of how expectations around economic development and infrastructure drive municipal financing.

As the landscape evolves, the focus also falls on tax-exempt bonds, which continue to attract a segment of investors wary of the potential impacts of rising rates on their investment portfolios. With a focus on maintaining tax-exempt standing, municipalities find themselves under pressure, particularly in the wake of potential federal tax reforms that could reshape investor preferences.

As this week unfolds, issuance in the municipal bond market is expected to reach an estimated $5.5 billion, a figure dampened by the recent holiday. Experts posited that such “undersized” offerings might allow for investors to balance out their portfolios more effectively, so long as their appetite for new issues remains robust. Analysts remain cautiously optimistic about upcoming months, with expectations of increased issuance linked to the return of numerous delayed initiatives.

The current state of the municipal bond market is characterized by a delicate interplay between supply and demand, evolving investor sentiments, and the ongoing influence of external economic factors. While challenges remain, a cautious optimism around rising demand could help solidify the market’s trajectory as issuers attempt to navigate a complex financial landscape. As we progress throughout the year, the need for vigilance and strategic foresight in municipal bond investment remains as crucial as ever.