Amid the ever-fluctuating landscape of U.S. public finance, municipal bonds show signs of resilience as they end the year. This article explores recent trends in the municipal bond market, the pressures from U.S. Treasury yields, and the outlook for 2025, revealing the complexities and challenges ahead.

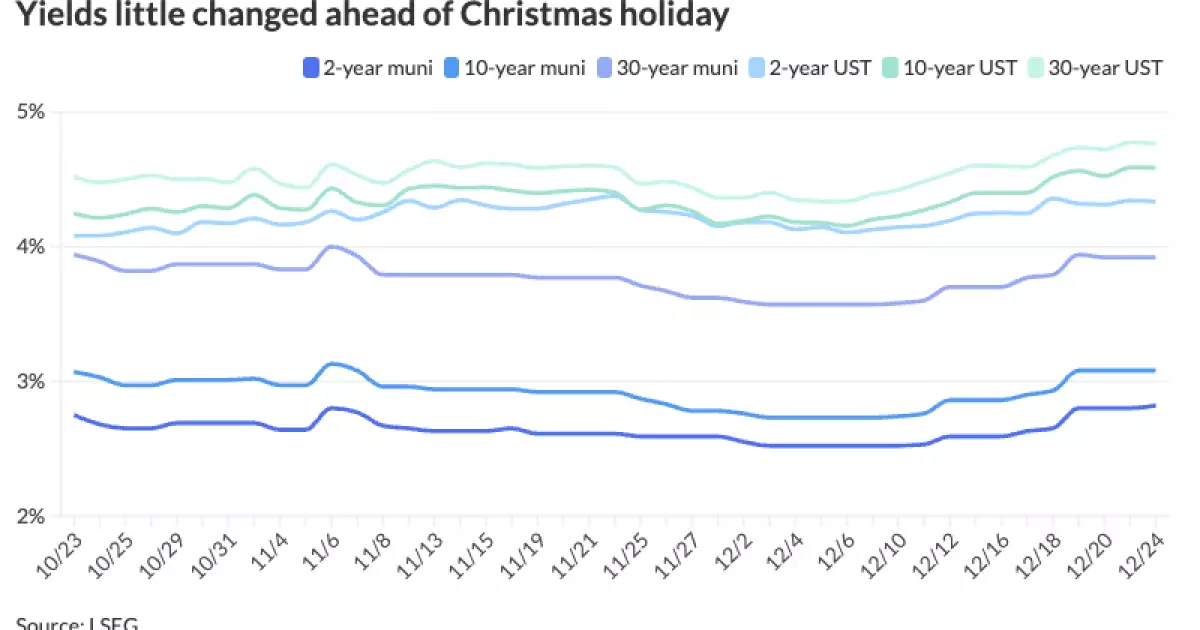

As we approach year-end, the municipal bond market has been relatively stable, even as U.S. Treasury rates declined slightly. Recently, yields on Triple-A rated municipal bonds rose by one or two basis points, paralleling a minor strengthening in Treasury rates by 1 to 2 basis points. This situation results in a somewhat stagnant state for municipal bonds, as the two-year municipal-to-U.S. Treasury ratio stands at 65%, illustrating a consistent landscape where municipalities face less volatility compared to their Treasury counterparts.

While the stability is notable, Kim Olsan from NewSquare Capital emphasizes that the overall environment for municipal bonds remains influenced by numerous factors. She attests that municipal bonds have attracted a “supportive bidside,” partly due to the intense pressures on taxable rates. Despite this modest upward trajectory in yields, the overall health of the municipal market suggests investors continue to find value, signaling a cautious optimism.

One prominent trend influencing the municipal market is the change in cash flows. Olsan notes a decrease in assets within the tax-exempt money market sector, with the Investment Company Institute reporting a decline from $137 billion to $132 billion in a matter of weeks. This suggests a reallocation of resources as municipal bond investors seek more attractive returns in other markets. Moreover, rising weekly floater rates, which are nearly 3.75% now, indicate that investors are looking for longer-duration investments in response to increasing yields.

Interestingly, the recent trading activity reveals a shift in focus. Olsan states that the last five sessions witnessed approximately 67% of all secondary trades concentrated in maturities beyond 2030. This trends toward extended maturities, especially given the encouragement from a steepening curve in the intermediate range, signifies that investors may be trying to lock in yields before potential rate increases in the future.

The Economic Climate and its Implications

Looking forward, several economic factors will shape the dynamics of the municipal bond market in 2025. Analysts from UBS have pointed to an anticipated surplus of tax-exempt bond issuance exceeding $450 billion due to longstanding infrastructure financing needs. However, the potential political climate surrounding fiscal policies and election year uncertainties may further complicate these trends. The risk of certain municipal bonds losing their tax-exempt status remains a topic of discussion among analysts, though they largely agree that existing bonds will likely retain their value—a sentiment that could bolster confidence among current holders.

Moreover, inflationary pressures arising from tariffs and expanding fiscal deficits pose additional risks to the municipal market. Although fiscal aid has diminished for many issuers, some municipalities might find it challenging to maintain their financial footing once one-time federal support disappears. As Cooper Howard from Charles Schwab notes, the supply of fiscal resources due to the American Rescue Plan Act will dwindle, necessitating careful planning by municipalities to avoid future financial shortfalls.

With the potential outlook for municipal bonds in 2025 still uncertain, several analysts assert that credit spreads will remain relatively tight due to a strong economy. However, market participants might witness tightening ratios between municipal bond yields and Treasury returns. UBS strategists believe that despite the current environment reflecting richer muni-UST ratios, these may stabilize over the coming year.

While the immediate future appears somewhat stable, challenges remain in terms of credit worthiness and the need for municipalities to project their financial health with diminishing external aid. The transition from one-time federal funding to sustainable revenue streams presents a notable hurdle for many entities navigating debt repayment.

As municipal bonds prepare to close out the year amidst varying economic pressures and the shifting financial landscape, investors find themselves cautiously optimistic. The interplay of Treasury rates, shifting demand, and looming challenges from dwindling fiscal aid all intertwine to create a complex backdrop leading into 2025.

While analysts predict continued stability in the near term, the intricacies of municipal bond valuation and inherent risks associated with fiscal policies warrant close attention in the coming year. Stakeholders in the municipal bond market would do well to prepare and adapt to these evolving conditions, ensuring robust strategies in a changing financial environment.