As we navigate through the complexities of financial markets in 2024, one clear trend has emerged: a robust increase in the demand for bond insurance. The landscape has been shaped by various factors, including institutional investor appetites, geopolitical uncertainties, and the specific needs of infrastructure projects. This growth, evidenced by a notable 26.8% rise in insured municipal bonds, highlights the increasing reliance on bond insurers as a safeguard for investors and municipalities alike.

According to data from LSEG, municipal bond insurers wrapped an impressive $28.921 billion in debt during the first three quarters of 2024. This figure starkly contrasts with the $22.814 billion observed during the same period in 2023. The increase not only showcases a year-over-year positive growth trajectory but is also significant in the context of deal volume—1217 deals this year versus 995 from the previous year. The consistency in positive growth indicates a shift in investor strategy, with a pronounced move towards securing bond insurance as a form of financial protection against default risks.

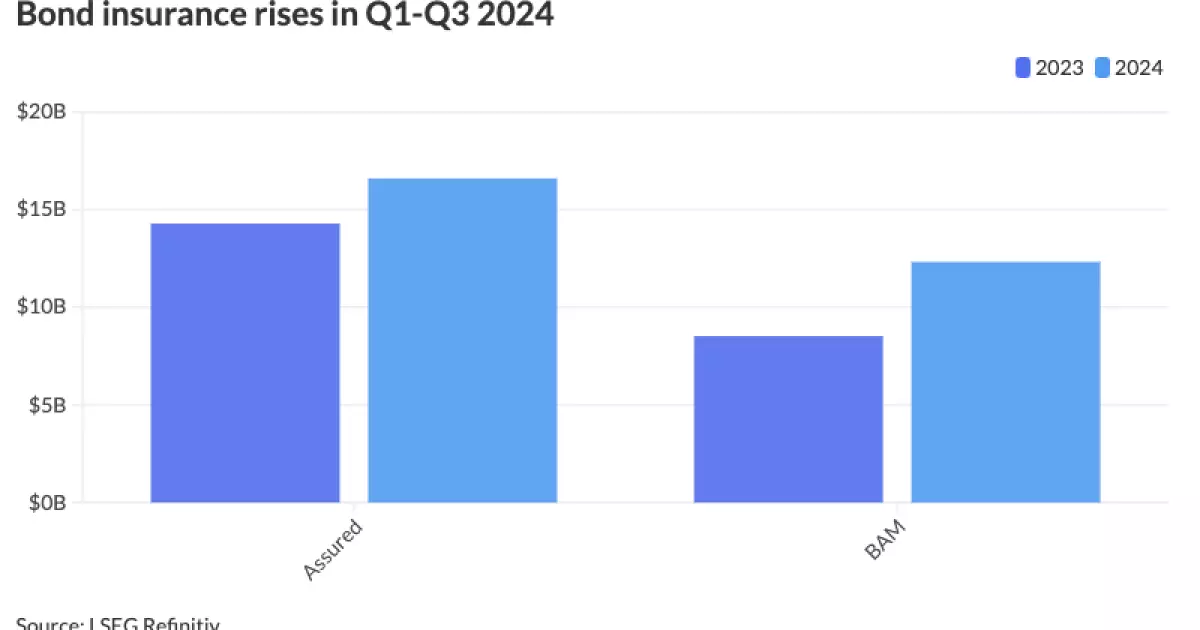

Two major players in the bond insurance sector, Assured Guaranty (AG) and Build America Mutual (BAM), have demonstrated exceptional performance in this burgeoning market. Notably, Assured Guaranty saw its insured debt jump from $14.289 billion in 2023 to $16.599 billion in 2024—an increase of 16.2%. This impressive feat allowed AG to capture approximately 57.4% of market share.

Conversely, BAM posted an even more remarkable growth rate of 44.5%, with its insured par amount climbing from $8.525 billion in 2023 to $12.322 billion in 2024, thus increasing its market share to 42.6%. This impressive uptick indicates a formidable and competitive market landscape where both firms are vying for dominance, propelled by strong investor demand.

The factors propelling this surge in insurance utilization are varied yet interlinked. For Assured Guaranty, significant transactions included insurance for high-profile projects such as the $1.1 billion Brightline Florida passenger rail endeavor and $800 million for the New Terminal One at John F. Kennedy Airport. These large-scale infrastructure projects have attracted substantial interest from institutional investors, further boosting the overall demand for bond insurance.

Similarly, BAM’s achievement of insuring 23 new-issue sales with a par of $100 million or more during the first three quarters underscores the growing trend toward larger deals. The utilization of partial insurance in these transactions reflects a strategic approach by underwriters seeking to attract diverse investor participation in a competitive environment.

The appetite from institutional investors is a major contributing factor to the thriving state of bond insurance in 2024. The large sums being maneuvered indicate that investors are increasingly willing to seek out protection in light of global uncertainties. As noted by representatives from both Assured Guaranty and BAM, stronger issuance and heightened demand from institutional entities have played pivotal roles in driving their respective successes.

Institutional investors are particularly drawn to the financial safety that bond insurance provides, which alleviates concerns related to geopolitical risks and fluctuating market conditions. As they navigate through unpredictable environments, the demand for insurance that offers not just financial protection but also cost savings becomes increasingly valuable.

Looking ahead, the bond insurance market appears primed for continued growth. The ongoing evolution in the types of projects being financed, coupled with sustained institutional investor interest, suggests a robust landscape for both Assured Guaranty and BAM. The competitive pricing and performance metrics within the bond insurance sector are likely to entice further participation from issuers eager to capitalize on the advantages that insurance brings to their financing endeavors.

The surge in bond insurance demand in 2024 reflects larger trends in the economy, investor behavior, and financial strategy. As bond insurers continue to adapt and innovate in response to market needs, they play an essential role in fortifying investor confidence and enabling critical infrastructure development across the nation.