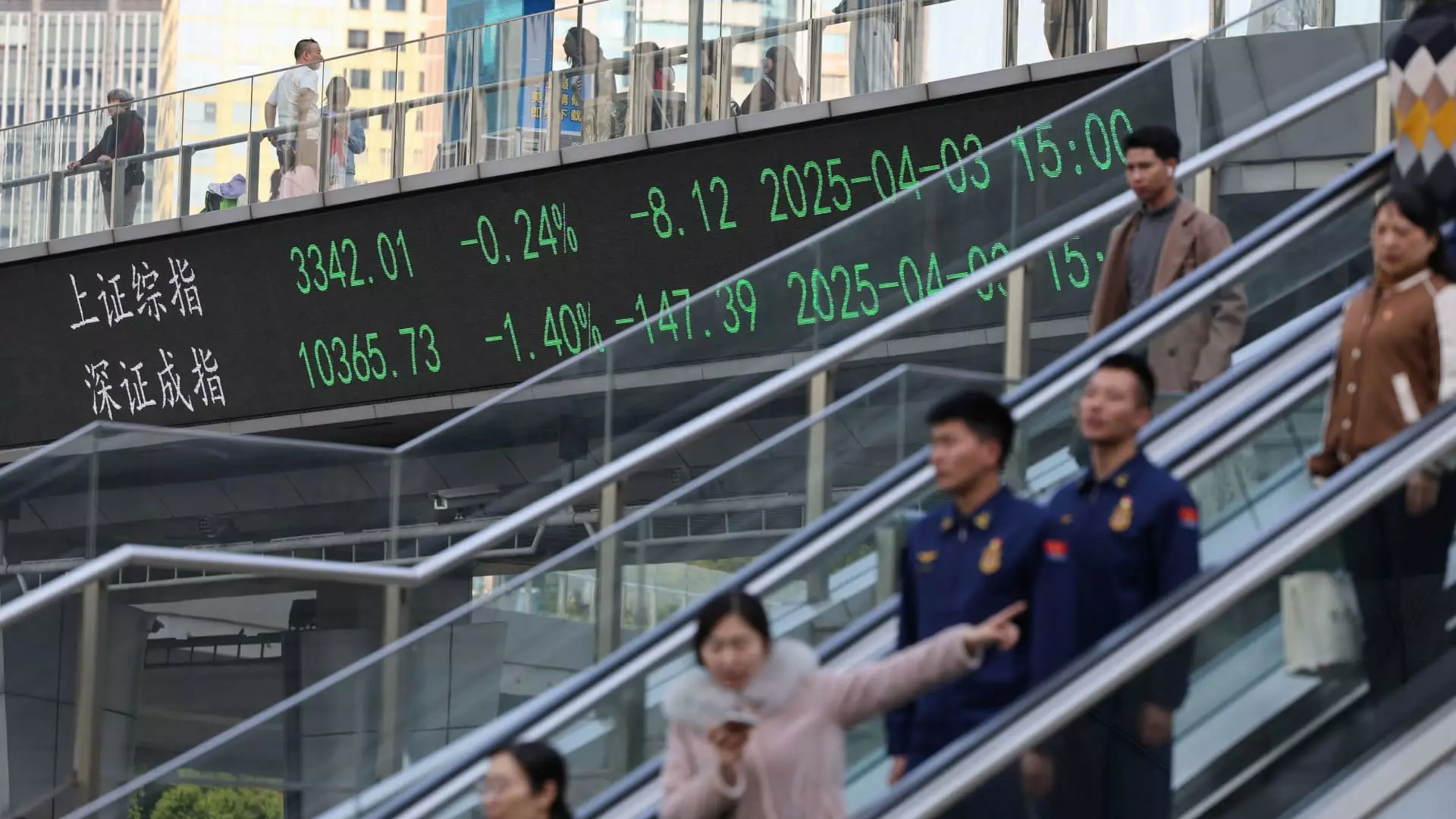

In an era marked by escalating tariffs and tightening geopolitical tensions, one might expect a significant decline in global investment interest towards China, particularly in its burgeoning technology sector. Contrary to these fears, analysts are observing an intriguing trend: the Chinese tech industry is poised to thrive amid rising domestic and international pressures. While it is true that the freshly imposed tariffs from the United States have initially sent shockwaves through Chinese stock markets, the overall sentiment reflects a cautious optimism. This nuance reveals an unexpected resilience that could redefine investor strategies for years to come.

The recent fluctuations in market performance paint a vivid picture, as major Chinese stocks experienced a temporary decline but managed to recover significantly by the end of trading hours. Analysts like Kai Wang from Morningstar have noted that many leading tech and consumer companies possess limited exposure to the U.S. market. This mitigates the direct impact of tariffs, suggesting that investor overreactions may not accurately reflect the underlying stability of the sector.

Fiscal Policies and Market Predictions

Chinese policymakers are taking proactive steps in the wake of these developments, hinting at potential fiscal policy interventions. With the National People’s Congress soon convening, there is speculation surrounding measures that could stabilize and invigorate the economy amidst turbulence. Historically, China has demonstrated an ability to pivot quickly in response to economic pressures, adapting its policies to sustain growth. The imminent meeting of policymakers is likely to underscore these intentions, presenting a broader framework through which investors can navigate the complexities of the current landscape.

It’s essential to consider that the valuations of Chinese tech stocks remain appealing, especially when juxtaposed with their American counterparts. Reports indicate that the average price-to-earnings ratio of select Chinese tech stocks stands at a staggering 52% lower than that of the so-called “Magnificent Seven” of U.S. tech giants. This discrepancy signals an intriguing investment opportunity, particularly for those with a center-right wing liberal outlook who may emphasize the importance of capitalizing on value-driven assets in turbulent times.

Investment Trends: Shifting Preferences

An evolving sentiment is observed among international investors, as nearly 25% have expressed a more positive outlook on Chinese tech companies in recent months. This shift can be attributed to a growing understanding of the fundamental strengths within the sector, which boasts significant advancements in generative artificial intelligence. Chinese startups, exemplified by DeepSeek’s claims of superior AI performance compared to OpenAI’s ChatGPT, demonstrate a commitment to innovation that cannot be overlooked.

Moreover, the focus among investors is shifting toward domestic consumption and technology services rather than export-driven goods. This strategic pivot indicates a maturity within the sector, with growth potential emerging from smart investments in modernization and digital infrastructure. Analysts at Citi have spotlighted sectors such as internet services, transportation, and technology, positioning themselves on growth stocks that exhibit an inherent resilience to external shocks, including tariffs.

Health Care: A Sanctuary Amidst Tariff Turbulence

Interestingly, another area that has remained relatively insulated from the tariff storm is the Chinese health care sector. Pharmaceuticals were notably exempt from the latest round of tariffs, creating a cushion for biotech firms that often collaborate with U.S. companies. This unique relationship allows Chinese businesses to maintain a foothold in the lucrative American market, thus continuing to drive innovation and profitability.

Investment analysts such as those from Jefferies note that even if further tariff barriers were to arise, many Chinese biotech companies are not perceived as direct exporters. This strategic advantage positions them well in the marketplace, enabling them to operate effectively amidst regulatory challenges. The sentiment surrounding companies like Wuxi Biologics, which anticipates accelerated growth in upcoming years, highlights a burgeoning sector that remains less vulnerable to external pressures.

China’s ability to adapt to global challenges while simultaneously fostering internal growth presents a significant opportunity for investors. However, as indicated by Morningstar’s analysis, ongoing vigilance is required. The possibility that tariffs could indirectly hamper GDP and invoke market volatility must not be ignored, bringing a level of realism to the otherwise optimistic outlook on Chinese tech.

The resilience demonstrated by China’s technology sector amidst tariff uncertainties not only challenges preconceived notions about economic vulnerability but also underscores the complex interplay between domestic policies and international market dynamics. The evolution of investor sentiment and strategic reorientation points towards a landscape rich with opportunities for those willing to engage deeply with these emerging trends.