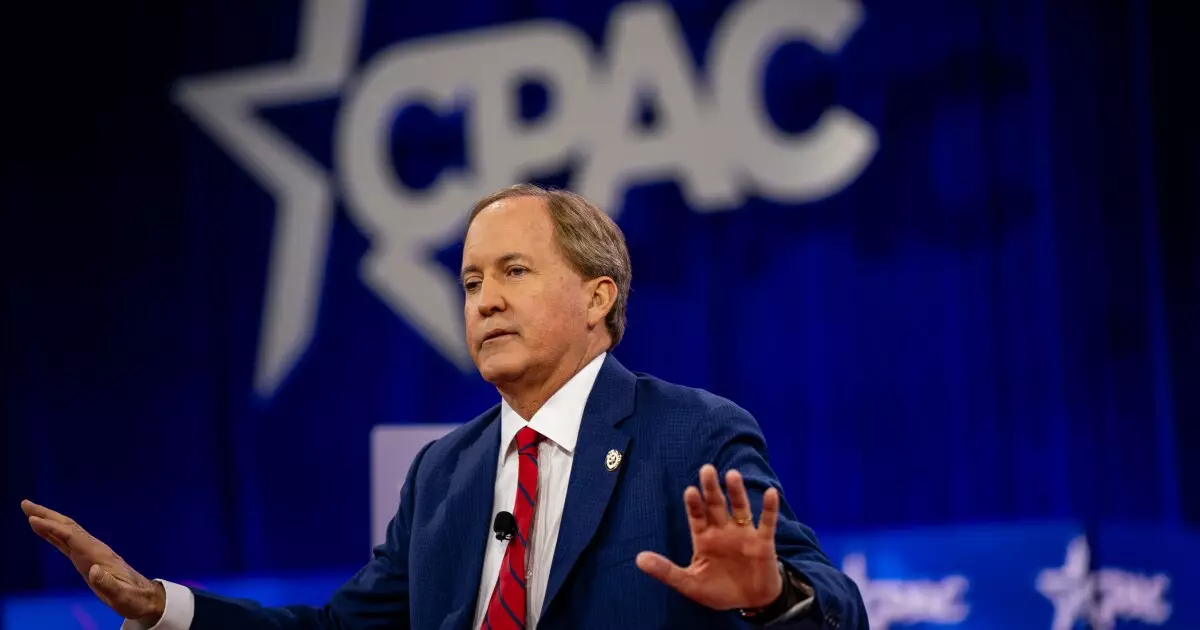

Recent developments in Texas politics reveal a significant shift in the relationship between state authorities and major financial institutions. Texas Attorney General Ken Paxton’s recent commendations towards Bank of America, Morgan Stanley, and JP Morgan for their withdrawal from the Net-Zero Banking Alliance (NZBA) highlight the state’s firm stance against perceived anti-fossil fuel agendas. This article delves into the implications of these moves, the legal framework that supports them, and the broader impact on the financial landscape in Texas.

The Net-Zero Banking Alliance was formed as a response to growing concerns about climate change, with an ambitious target of achieving net-zero greenhouse gas emissions by 2050. Nevertheless, for some state officials in Texas, the initiative has been labeled as a form of economic sanction against traditional energy sectors, particularly oil and gas. Paxton’s assertion that these banks could be classified as energy boycotters under Texas’ 2021 legislation—which bars contracts exceeding $100,000 with companies that boycott fossil fuels—illustrates the tension between environmental objectives and state economic interests.

The 2021 Texas law, aimed at protecting the state’s energy sector, has paved the way for heightened scrutiny of financial institutions engaged in environmental advocacy, particularly those that align with progressive climate policies. Paxton’s announcement in late 2023 that he would conclude reviews of these banks signals a proactive approach to mitigating what’s perceived as economic discrimination against critical industries. By embracing banks that distance themselves from NZBA, the Texas government not only fosters a more favorable business environment for fossil fuel enterprises but also sends a message about its prioritization of local interests over global climate initiatives.

As some banks have distanced themselves from the NZBA, others like RBC Capital Markets remain under scrutiny. Their participation in municipal bond underwriting in Texas is contingent upon compliance with the state’s legal framework, particularly concerning Senate Bill 19, which targets perceived discrimination against the firearm industry. This complicates the financial landscape in Texas, as banks are compelled to continuously affirm their compliance with multiple state mandates while navigating the complexities of environmental commitments. Leslie Brock, who heads the public finance division in Paxton’s office, has indicated that ongoing reviews are essential to ensure accountability among banks in their dealings with the state.

Interestingly, while some banks have exited the NZBA, they still express commitment to sustainable practices. For instance, JP Morgan emphasized its focus on “pragmatic solutions” for low-carbon technologies, arguing that exiting the alliance does not equate to abandoning sustainability efforts. Morgan Stanley echoed similar sentiments, reinforcing their dedication to achieving net-zero emissions despite their withdrawal. This juxtaposition raises critical questions: how can financial institutions balance their commitment to sustainability with the regulatory and economic pressures imposed by states like Texas?

The legal landscape surrounding the fossil fuel boycott law is not settled, as evidenced by ongoing litigation involving Paxton and Texas Comptroller Glenn Hegar. A business group has challenged the constitutionality of the law, asserting that it infringes upon the rights of companies to engage in socially responsible investing. This legal battle underscores the complexities involved where environmental policies intersect with commercial regulations, potentially setting precedents that could impact similar laws in other states.

The recent actions taken by financial institutions in Texas reflect a delicate balancing act between supporting climate initiatives and safeguarding local interests. Ken Paxton’s endorsement of banks withdrawing from the NZBA serves as a clarion call for those who prioritize the fossil fuel industry while simultaneously navigating the intricate landscape of environmental responsibility. As the legal challenges unfold, observers are left to ponder: how will this influence the future of the banking industry in Texas and beyond? What lies ahead is not only a critical intersection of policy and finance but also a litmus test for how states and businesses engage on the pressing issue of climate change.