This year, the municipal bond landscape appears almost frenetic—a relentless influx of issuance underscores a broader narrative of both opportunism and fear. The market’s active borrowing spree signals a crucial shift in investor and issuer behavior driven by a mixture of strategic frontloading, economic uncertainties, and political anxieties. With issuance surpassing $280 billion by mid-2025 and expectations climbing toward $600 billion, the picture is one of bullish confidence tempered by underlying risks that many are quick to dismiss or overlook.

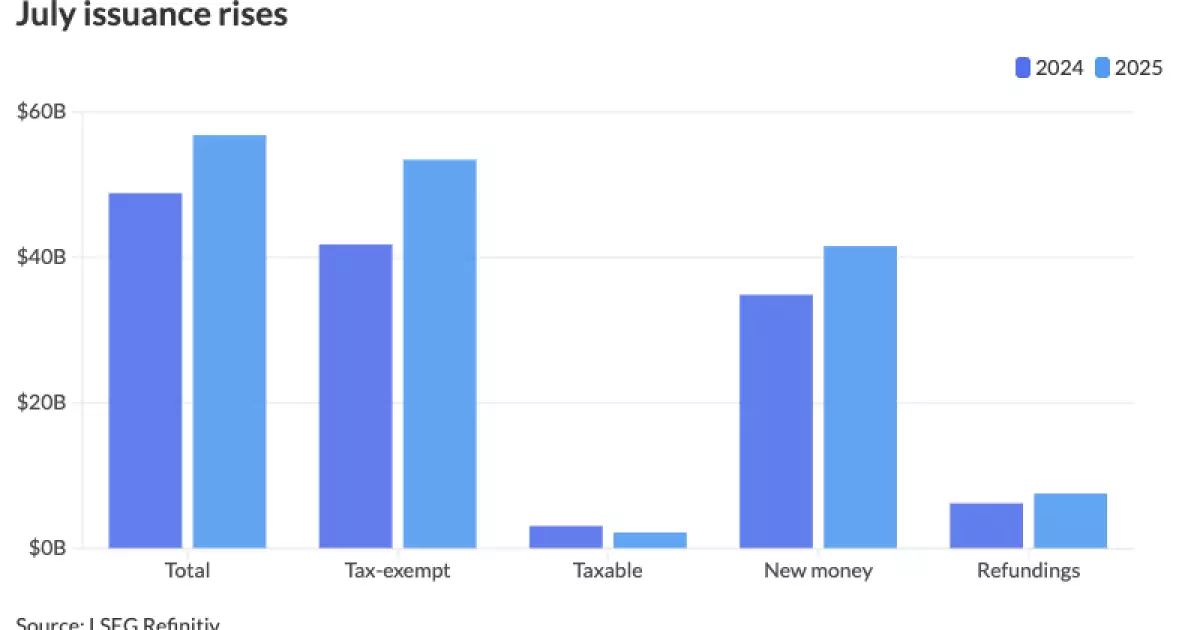

The first half of the year saw an unprecedented surge, with weekly issuance averaging between $10 billion and $12 billion, notably higher than previous years. Such surges, particularly during the months of June, reflect an aggressive push by issuers eager to capitalize on perceived market stability and sweeten deals before potential regulatory winds shift in their favor. This pattern reveals a climate where decisions on timing become almost reflexive—driven by a mix of market fundamentals and a desire to lock in favorable interest rates amid rising rates of around 30 to 40 basis points per month.

Yet, within this seemingly robust environment, there lurks a suspicion of overreach. Is this relentless issuance a sign of a resilient underlying economic health, or merely a speculative scramble to beat potential reforms or tax changes? The psychology of market participants suggests the latter, fueled by fears of policy reforms, particularly the risks to tax-exempt status that pop up repeatedly with every election cycle. While current legislative protections seem intact, the ongoing debate signals a fragile consensus, and a sudden policy shift could deflate this overheated bond market.

Policy Risks Masking Underlying Volatility

The political atmosphere fosters an environment of perpetual uncertainty, especially with respect to the tax exemption status of municipal bonds. Historically, such fears are cyclical—whenever a new presidential administration ascends, pundits question whether the longstanding tax benefits will endure. This recurring anxiety prompts issuers to accelerate their borrowing plans, often frontloading deals to shield themselves from future restrictions. In 2025, this behavior appears amplified, with the volume of issuance reaching new heights—not because of increased demand or improved fiscal health, but largely out of a defensive strategy to preempt legislative changes.

Interestingly, despite these fears, the exemptions for private activity bonds and issuers like universities and hospitals remain largely untouched—at least for now. The recent passage of a broad tax and spending package that preserves these benefits temporarily alleviates some anxieties, yet the underlying political tug-of-war remains unresolved. The market’s resilience here risks being illusory; it’s built on a foundation of optimism, which could be quickly shattered if legislative priorities shift or if lawmakers revisit the tax exemptions under different political circumstances.

Furthermore, the influx of new deals from elite universities aimed at compensating for cuts during the previous administration underscores the sector’s opportunistic stance. These institutions are leveraging their strong brand presence to borrow at attractive rates, often faster than the broader market, revealing a sector eager to shore up financial reserves amid uncertain federal support. Still, this pattern raises questions about whether such borrowing is sustainable long-term or merely a temporary response to budget pressures.

Market Dynamics: Volatility as a Double-Edged Sword

The year’s volatility—a consequence of geopolitical tensions, economic policy debates, and fluctuating interest rates—has conditioned issuers to act swiftly whenever conditions favor them. The strategy is simple: “Price a deal fast, and get it done,” as market veterans say. This reactive approach fuels the appearance of a market in perpetual motion, yet it also hints at a deeper fragility. When volatility dampens, and market sentiment shifts, these issuers may find themselves overextended or locked into unfavorable deals.

Observers, including industry analysts, are revising their earlier forecasts upward, indicating confidence that the issuance boom isn’t near its end. Predictions now range as high as $600 billion, signaling widespread market optimism—perhaps overconfidence. This deliberation warrants skepticism: markets built on a seemingly unstoppable wave of debt issuance risk overheating, especially if economic growth stalls or political storms intensify.

The enthusiasm isn’t solely grounded in fundamental fiscal health but driven by momentum and the fear of missing out. When multiple industry players, from J.P. Morgan to Barclays, lift their estimates, it suggests a collective belief that record-breaking levels are sustainable. But this narrative ignores the inherent risks of a market that has shown signs of nearing saturation. An overheated market often presages corrections, and the current environment, heavily reliant on continued political support and favorable legislative landscapes, remains precarious.

Concentrated Growth: California at the Forefront

On a geographic level, California’s dominance cannot be overlooked. Leading the charge this year with over $45 billion in issuance—an increase of nearly 26%—the state exemplifies the center-right approach of strategic borrowing for infrastructure, education, and public services. California’s financial behavior reflects a pragmatic acknowledgment that, despite systemic risks, debt remains a vital tool to meet ongoing fiscal demands.

Meanwhile, Texas and New York follow, illustrating diverse strategies across states. Texas, with its reduced issuance, might be facing its own fiscal recalibration, while New York’s slight uptick suggests a cautious confidence. Other states show mixed signals—some aggressively expanding, others holding back—highlighting a fragmented but overall bullish national trend.

However, such concentrated issuance doesn’t come without risks. Heavy reliance on debt to fund growth and infrastructure may strain future budgets if economic growth falters or if interest rates climb further. California’s example raises questions: Can these states sustain the current borrowing spree without risking future fiscal health? The danger lies in chasing short-term needs at the expense of long-term stability—an act that could backfire when market conditions shift or legislative support wanes.

—

This assessment of 2025’s municipal bond landscape reveals a market driven by a complex interplay of opportunism, political risk, and economic hopefulness. While the momentum appears unstoppable now, history warns that such aggressive borrowing can rapidly turn sour if underlying fundamentals weaken or if political winds shift in unanticipated ways. The prudent skepticism lies in recognizing that, for all its apparent strength, this surge may be a fleeting episode—one that could leave behind unresolved debt burdens and fragile expectations once the current tides recede.