For years, municipal bonds have been portrayed as the safe harbor for conservative investors seeking tax-advantaged income. Yet, delving beneath the surface reveals a market riddled with inconsistencies, structural flaws, and vulnerabilities that are often ignored in favor of superficial stability. Recent market data paints a picture of a sector that is not only underperforming but also fraught with dangers that center-right skeptics should scrutinize more critically. Instead of blindly trusting municipal bonds as a resilient investment, it’s essential to confront their emerging fragility and question whether their apparent steadiness masks deeper problems.

One of the most obvious red flags is the divergence in performance between munis and other fixed-income assets. While treasuries, corporate bonds, and bank loans are trending upwards, munis stand out as the sole asset class recording year-to-date losses. This divergence is not an anomaly but a symptom of underlying issues, including supply dynamics and market sentiment shifts that threaten the muni sector’s long-term viability. The fact that long-duration munis have declined nearly 4% in value, despite general rate declines and inflows into other assets, indicates that the market’s foundation is more fragile than it appears.

Overexuberance or Structural Flaws? The Confusing Supply and Demand Dynamics

The recent surge in issuance—$280 billion in the first half of the year driven by fears over potential tax changes—initially created a sense of urgency that fueled the market. Issuers were rushing to frontload debt before the sunset of favorable tax treatment, an effort rooted in the myth that the tax shield was imminently threatened. However, with the passage of the “One Big Beautiful Bill,” that threat was vanquished, yet the market’s pain persists. This suggests that supply alone does not explain the muni market’s underperformance.

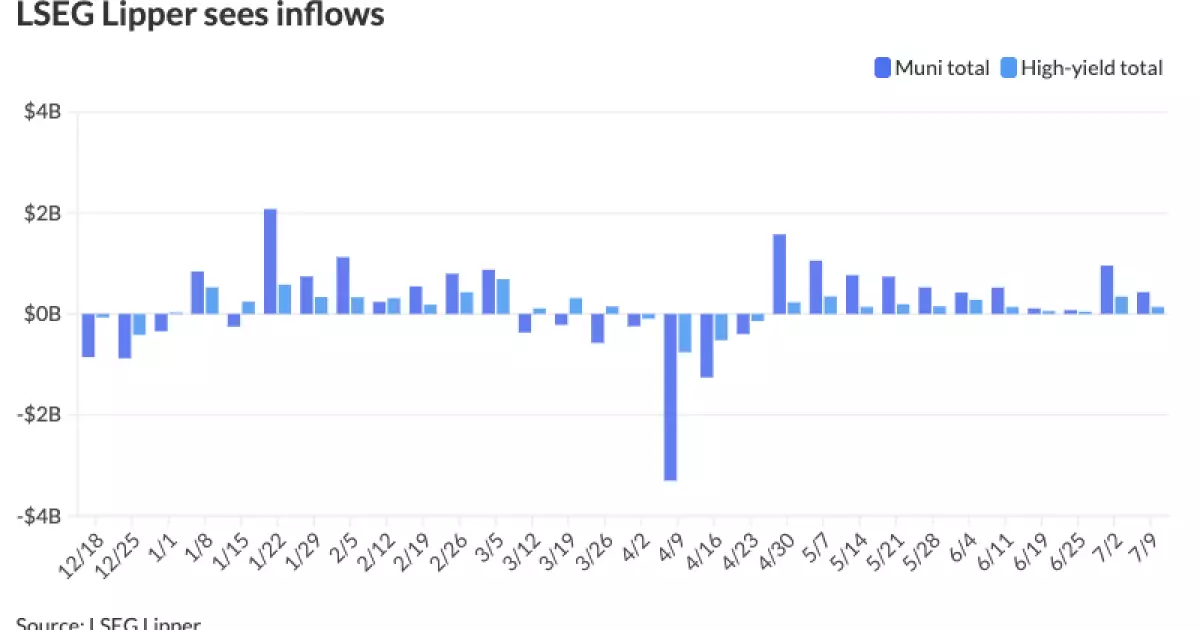

Beyond supply issues, the decline points towards structural shifts in investor preferences and fund flow behaviors. Large inflows into municipal mutual funds and tax-exempt money market funds signal continued demand, but the pattern of investment—favoring short to intermediate maturities—exposes long-term munis to significant valuation risks. The fact that long munis are less favored or even avoided by fund managers indicates an inherent structural weakness: an inclination among investors to avoid the longest maturities, which are traditionally the backbone of the muni market’s stability. This preference underscores a broader hesitancy that stems from underlying concerns about municipal issuers’ fiscal health, inflationary pressures, and potential policy shifts that could erode the tax advantages.

Moreover, the steepening yield curve and the widening spreads between munis and treasuries reflect market skepticism. A 200 basis point slope in the AAA muni curve signals an uneasy market — an environment where investors demand higher premiums for longer-term bonds. Such a steep curve suggests increased perception of risk on munis, contradicting their longstanding reputation for safety. If these trends continue, the disconnect between the market’s historical perception and the emerging reality could accelerate the muni market’s decline, making it a riskier proposition for conservative investors claiming to seek stability.

Is the Muni Crisis Just an Overreaction or Preventable Collapse?

In light of these troubling signals, one must ask whether recent underperformance is a temporary correction or the beginning of a fundamental breakdown. The answer hinges on the market’s structural resilience and the ability of policymakers and investors to adapt. Despite short-term inflows and seemingly stable primary market activity, the long-term outlook remains clouded. Local governments and educational institutions, often financially strained, face mounting costs due to inflation, pandemic-era aid reductions, and sluggish issuance activity once the initial frenzy subsides.

The recent market behavior suggests a misalignment of incentives and perceptions, with some stakeholders still clinging to the notion of munis as ultra-safe assets. Yet the data argues otherwise. The relative underperformance of the 22-plus-year muni index – trailing significantly behind the five-year segment – reveals a market wary of extending capital into long-duration bonds. This reluctance is influenced both by risk aversion and structural shifts in investor behavior, indicating a potential structural transformation rather than a mere cyclical fluctuation.

The critical question is whether the broader macroeconomic environment, especially if the Federal Reserve begins rate cuts, might reinflate the muni market or exacerbate its vulnerabilities. Skeptics should be cautious; rate cuts can attract inflows, but they can also mask deep-seated weaknesses in municipal credit quality or voting patterns that reflect fiscal indecisiveness and urban mismanagement. The risk of a bubble forming on the back of a false sense of stability remains real, and the cautious investor should be wary of prematurely jumping into munis solely based on favorable short-term signals.

The municipal bond sector, long considered fortresses of stability, is revealing cracks that demand a nuanced, skeptical approach. The illusion that munis can deliver safe returns in a changing economic landscape is just that—a carefully maintained myth. As the market confronts supply overhangs, shifting investor preferences, and widening yield spreads, it becomes increasingly clear that reliance on munis as a risk-free store of value is misplaced. Investors with a center-right, pro-market philosophy should advocate for a more disciplined, cautious stance—recognizing the signs of structural stress and avoiding complacency in a sector that, beneath its veneer, is far more vulnerable than it appears.